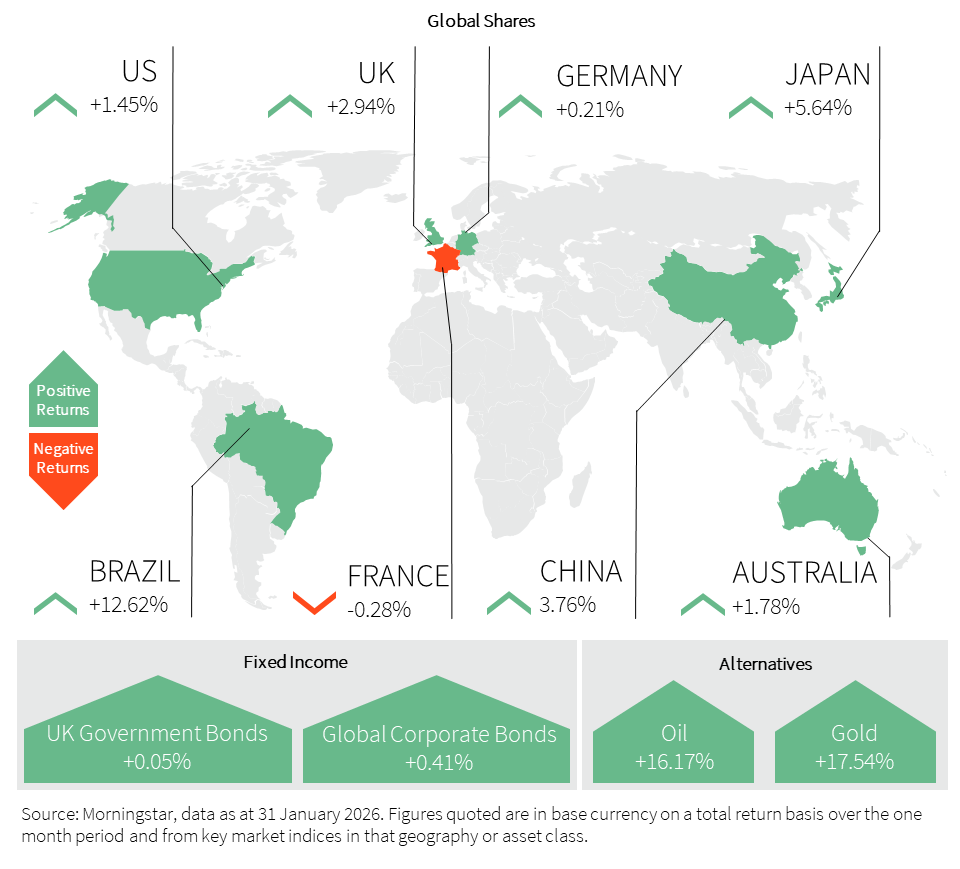

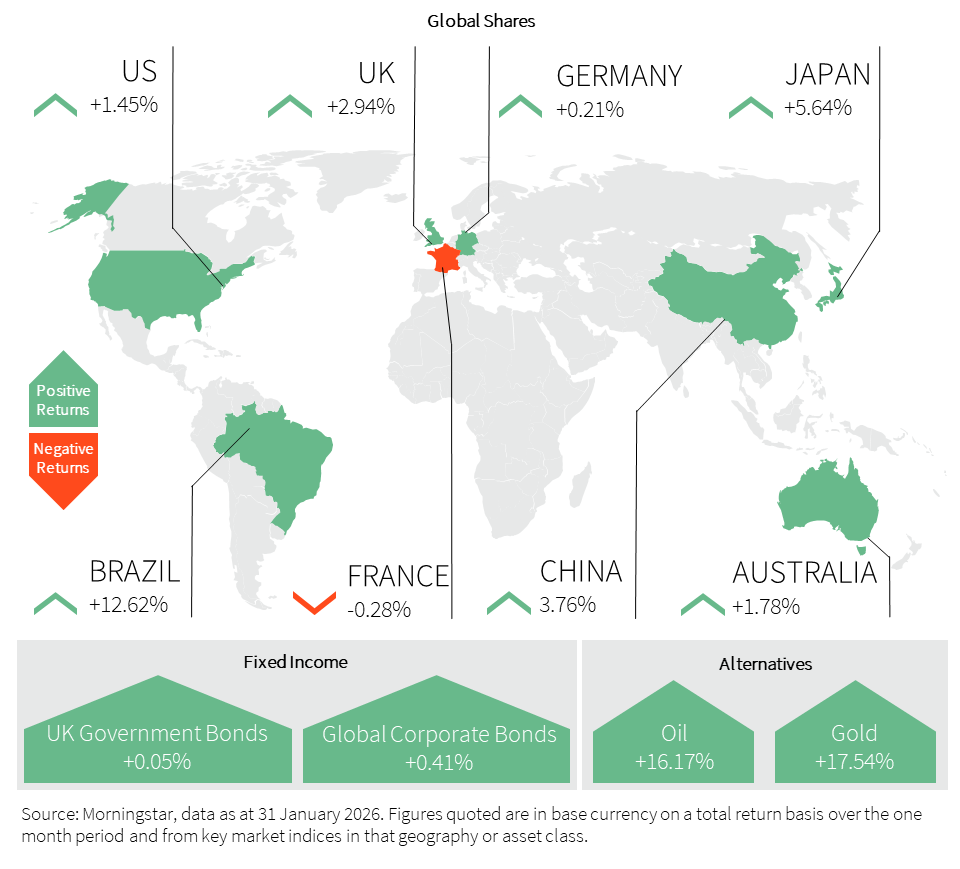

Global Market Insights – January 2026

World Market Summary Commodities had a bumper year in 2025, but have seemingly found another gear, taking no time to put the pedal to the metal in 2026. Global equities…

Read more ›Have I got enough money to live comfortably after I retire? It’s a question we all ask ourselves.

We all want to enjoy life to the full in retirement, which is why having a financial plan in place to provide you with the right amount of income – both for your plans, and to ensure it lasts as long as it needs to – is essential.

It is important to consider other needs which may arise in the future too – such as long term care, or passing on your money to loved ones. We can help you to prioritise these areas.

Understanding tax, government allowances, and the advantages of saving into a tax-efficient pension is crucial. We also offer advice relating to the Lifetime Allowance and any potential tax charges which may apply.

We can work alongside your tax advisers to ensure you aren’t paying more tax than you need to, by making the most of all available tax allowances, as well as ensuring you avoid potential penalties from exceeding these allowances.

As you come closer to retirement, it is important that you review where your money is invested, and to consider factors such as reducing investment risk & adjusting the strategy.

We can review the pensions you are currently invested in to ensure they match your retirement plans, the investment choices are suitable, and that they are working as hard as they can for you.

Whilst the introduction of pension freedoms led to positive change for retirees, making a choice can be daunting and confusing.

Getting good advice is critical, and we can advise on the best options for you, whether that be an annuity, choosing a drawdown, or a mixture of these options.

In the recent Aon client satisfaction benchmark survey for 2020, we came first for Financial Planning satisfaction alongside 11 competitors.

82% of our clients are overall satisfied with the service they are receiving from us.

World Market Summary Commodities had a bumper year in 2025, but have seemingly found another gear, taking no time to put the pedal to the metal in 2026. Global equities…

Read more ›

Macro As in the previous quarter, economic data was mixed in Q4, and the picture was made murkier by the longest US government shutdown in history, which limited data availability.…

Read more ›

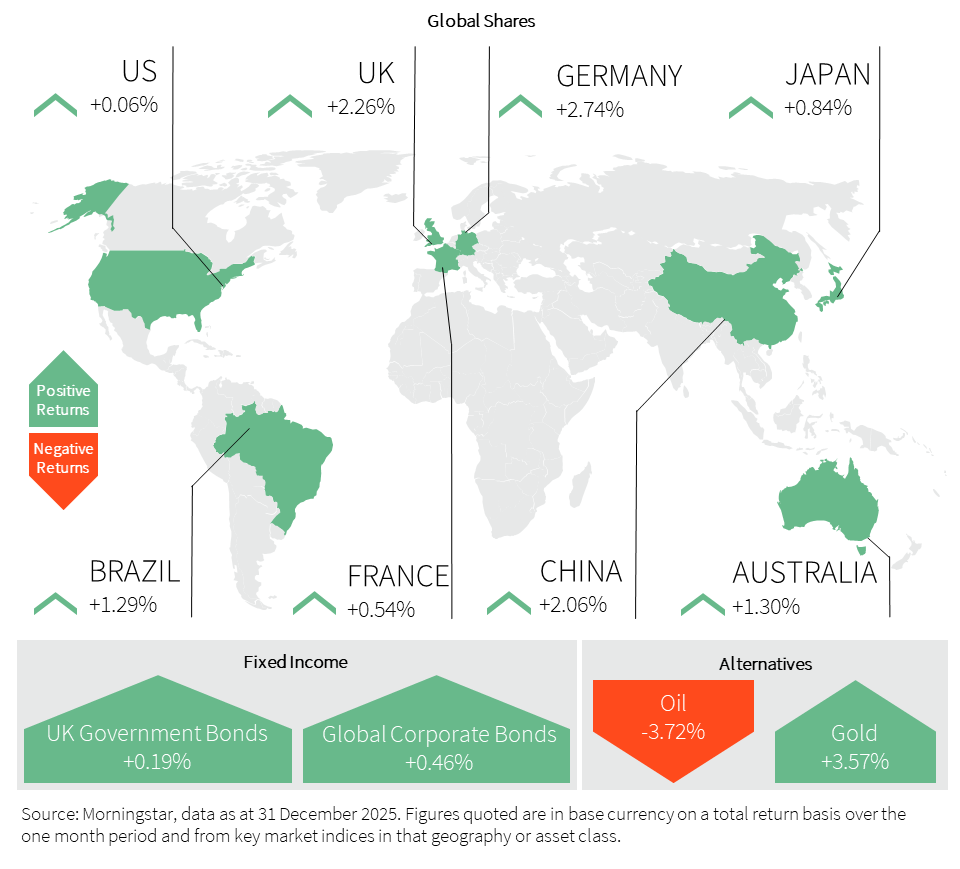

World Market Summary December was characterised by growing geopolitical tensions alongside regional divergence in economic growth trends and market performance. Europe led with a 2.7% gain, while the FTSE 100…

Read more ›