Overview

Wimbledon set the tone for markets in July, with champagne corks continuing to fly as the S&P 500 registered another ten record highs over the month. However, Europe was in no mood for celebration come month end, as the French prime minister labelled the US tariff deal a ‘submission’ and a ‘dark day’ for Europe.

Japanese equities took the 15% tariff deal in their stride, but European equities experienced a small sell-off on the day, with member states and investors viewing the deal as much more favourable for the US. Positively, the deal does provide a greater level of certainty for corporations, which have been in wait-and-see mode and the International Monetary Fund (IMF) upgraded global growth as they expect a less substantial drag on global growth from tariffs. However, China, Mexico, Canada, South Korea, India and Brazil all remain at the negotiation table with Trump’s deadline for a deal fast approaching.

Markets remained remarkably calm in July, and both bond and equity market volatility moved lower, with the VIX Index nearing a 12-month nadir. Credit spreads continued to tighten, and the S&P 500 was not the only record breaker on the month, as Nvidia and the crypto sector both hit a record $4 trillion valuation.

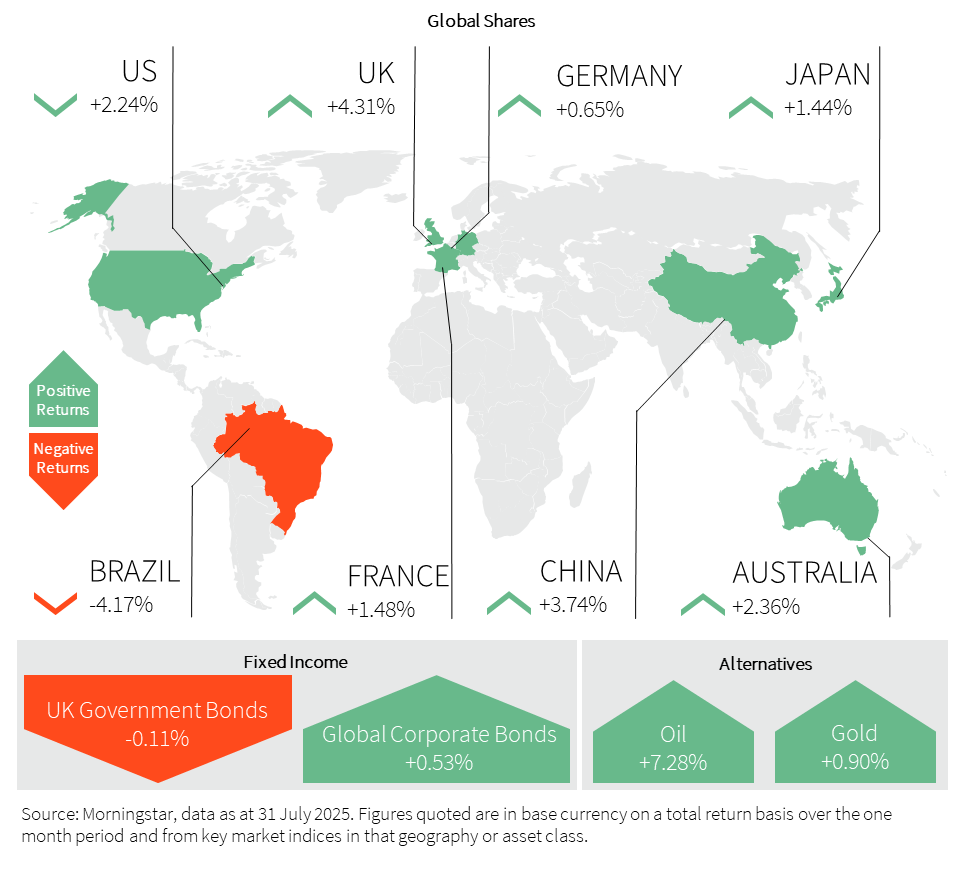

Despite the fully valued US markets pushing higher, the month’s strongest performers were the lowly valued Chinese and UK markets. Within the US, the Magnificent 7 continued their dominance, having surged over 40% since the ‘Liberation Day’ low.

Economic data continued to be distorted by the front-loading of tariffs in Q1, and this was most evidenced by the Q2 US Gross Domestic Product (GDP) figure, in which net exports had their most substantial impact on economic growth on record, as companies drew down on inventories to counterbalance the Q1 orders. GDP growth also held up better than expected in the Eurozone. Inflation came in hotter across major economies, leading to a sell-off in government bonds amidst persistent fiscal credibility concerns. Both the European Central Bank (ECB) and the Federal Reserve (Fed) consequently opted to keep rates on hold. The Fed remains unwilling to cut rates, given the noise in the data, as well as the potential for tariffs and the ‘One Big Beautiful Bill’ to generate a resurgence in inflation. Meanwhile, the Bank of England (BoE) is expected to look through the pick-up in inflation and cut in their August meeting.

After the worst first half to a year in more than 50 years, the dollar found some reprieve, climbing close to 2% over the month. This came despite Trump continuing to flirt with the idea of firing Fed Chair Powell, which continued to be supportive for gold, which saw a more muted gain. ‘Black gold’ gained a little over 7%, after improved China demand and rising tensions between the US and Russia.

Our in-depth views on:

Our weightings are based on sterling as a base currency.

United Kingdom (UK)

UK equities rose in July, supported by tentative signs of economic stabilisation. The FTSE 100 led the way over the month up 4.31% lifted by strength in energy and financials amid firming commodity prices and easing global rate expectations. The FTSE 250 climbed 1.82%, underpinned by steady services activity, improved retail sentiment, and continued fiscal support.

Mid-month, the government unveiled its draft National Productivity Strategy, outlining reforms to boost long-term growth. Markets welcomed the announcement as a sign of policy continuity.

Headline Consumer Price Index (CPI) rose 0.3% in June, slightly above expectations, while core inflation accelerated to 3.7%, driven by services and wages. The economy contracted by -0.1% in May after a 0.3% decline in April, raising the risk of a technical recession in Q2. Manufacturing remained weak, though the Purchasing Managers Index (PMI) edged up to 48.2 in July. New import orders declined for the tenth consecutive month as cost pressures persisted. Meanwhile, house prices rebounded according to Nationwide and affordability improved. Retail sales rebounded 0.9% in June, though still below expectations and consumer confidence dipped in July, weighed down by inflation concerns and expected tax hikes in the Autumn Budget. Labour market conditions softened with continued weakening of payrolls and unemployment picked up to 4.7%, the highest since 2021.

United States (US)

It was another positive month for US equities with the S&P 500 and NASDAQ continuing to set record highs, gaining 2.41% and 2.24% respectively. The month saw trade agreements struck with Japan and the EU, along with the passing of Trump’s One Big Beautiful Bill Act, which improved sentiment and provided further clarity to markets. Earnings also acted as a tailwind as 80% of companies that have so far reported for Q2 have beaten estimates. The DOW lagged, gaining just 0.16% as performance from healthcare and industrial stocks subdued the Index.

“Cloud and AI is the driving force of business transformation across every industry and sector”, detailed Microsoft CEO Satya Nadella as the company delivered another set of blowout results, propelling them to the second company with a valuation above the $4 trillion mark. Meta’s CEO, Mark Zuckerberg, detailed that technology more powerful than the human brain was now within sight as Meta’s share price surged after beating estimates. The AI excitement remains backed up by the numbers as the revenue and earnings growth of the Magnificent 7 companies continue to outshine the rest of the market. Many commentators now believe AI will drive a ‘fourth industrial revolution’ of which we are in the very early stages.

At the moment, the US economy has remained resilient despite the tariffs and trade uncertainty. The latest GDP reading showed growth of 3% for the second quarter, easily exceeding the 2.4% forecast. Flash PMIs showed US business accelerated in July, rising to a seven-month high and driven entirely by the strength in the services sector. Manufacturing remained muted, dropping to its lowest figure since December 2024. Retail sales came in nicely above consensus and consumer sentiment moved to a five-month high. Whilst house sales slipped, house prices rose again.

Much to Trump’s annoyance, the Fed opted to hold rates steady again for the fifth consecutive meeting in the 4.25-4.5% range, but there was some dissent as for the first time in 30 years two members voted for a cut. Headline inflation came in as expected, rising 0.3% in June, whilst core inflation rose less than forecast. The coming months will paint a picture as to whether Trump’s tariffs prove inflationary or not, as he claims.

Europe

The controversial tariff deal cemented a more muted month of performance for European markets. However, the peripheral nations continued to provide strong performance with Italian and Spanish equities up 3.79% and 3.91% respectively. Meanwhile, the broader European index contracted -0.01%, weighed down by weaker performance in France and Germany as well as the Danish weight-loss drug maker, Novo Nordisk, which has now shed $400 billion in market capitalisation. Having recently been the largest company in Europe, it now no longer sits in the top five.

Adding to the negative sentiment from the tariff deal, the ECB struck a more hawkish tone in its meeting, deciding to keep interest rates on hold at 2% as it nears the end of its cutting cycle. This resulted from economic data largely coming in ahead of expectations and inflation ticking up to 2%. Notably, GDP came in ahead of expectations at 1.4% for Q2. Meanwhile, economic sentiment and PMIs improved. German PMI joined the broader Euro area back in expansion, helped by an improvement in both services and manufacturing activity. European Retail sales dropped off a little but industrial production came in well ahead of expectations.

Fixed Income

Global fixed income markets saw heightened volatility in July, with 10-year government bond yields rising across developed markets. Resilient economic data and persistent inflation challenged rate-cut expectations and drove a cautious market tone. In contrast, credit markets outperformed, supported by solid corporate earnings and tighter credit spreads. Amid ongoing concerns about fiscal deficits and inflation, investors remained underweight government bonds and favoured short-duration, high-quality credit.

In the US, the Federal Reserve left rates unchanged. While markets initially pared back expectations for 2025 cuts following the July Federal Open Market Committee (FOMC) meeting, softer payroll data revived some optimism. Tariff-driven inflation remains a key uncertainty, though inflation impacts have been modest so far, as companies have delayed passing on higher costs and continue to draw down inventories.

Eurozone government bond yields also drifted higher alongside improving growth momentum, as July’s flash PMI rose and inflation remained steady. The ECB held rates unchanged, adopting a wait-and-see approach amid fiscal loosening and trade-related uncertainties.

In the UK, gilt yields rose sharply after a surprise uptick in June inflation, with headline CPI climbing to 3.6% year-over-year. The UK’s heavy reliance on inflation-linked debt and worsening fiscal outlook further pressured bond sentiment.

Japan was the weakest-performing major government bond market in July. The Bank of Japan kept policy rates unchanged despite persistent inflation, which contributed to renewed yen weakness. Political uncertainty following the ruling party’s loss in the upper house election further weighed on sentiment. Against this backdrop, 10-year Japanese Government Bond (JGB) yields climbed to the highest level since 2008.

Asia and Emerging Markets (EM)

Emerging markets underperformed in July, weighed down by negative returns in India, Mexico, and Brazil. In contrast, China and Japan posted positive returns, supported by easing trade tensions with the US and some positive domestic dynamics.

China surprised to the upside on several macro indicators. GDP growth beat expectations, supported by strong industrial output and a rebound in exports following the US-China tariff truce, which is now likely to be extended by 90 days. However, domestic demand remained fragile, retail sales underwhelmed, and property investment continued to decline. Policymakers have turned their focus to addressing industrial overcapacity, introducing supply-side reforms aimed at ending predatory price competition and restoring pricing power across key sectors.

Japan’s equity market rallied on the back of a trade deal with the US, which imposed a modest 15% tariff on most Japanese exports, including autos. Record wage hikes agreed from the annual Shunto wage negotiations supported household incomes, while the Tankan survey showed improving business sentiment, particularly among manufacturers. Rising real wages are expected to sustain moderate inflation and gradually restore consumer confidence.

Elsewhere, India, Mexico, and Brazil came under pressure from deteriorating trade relations with the US. India faced 25% tariffs and penalties linked to Russian arms and energy purchases although India’s direct export exposure to the US is limited. Brazil was hit with 50% tariffs on select exports for political reasons, while its economy continues to struggle under restrictive real rates. Mexico secured a 90-day extension and avoided immediate tariff hikes, but stalled progress and a 35% tariff imposed on Canada have cast a shadow for the North America region.

Alternatives

July saw prices trade higher over the month, albeit in a tighter range, compared to June’s wild swings (when Brent spiked above $78 and plunged back to mid-$60s). Of the two, Brent outperformed, reflecting slightly tighter fundamentals and strong Asian demand as evidenced by China’s crude imports hitting 12.14 million barrels per day in June, the highest since 2023. West Texas Intermediate (WTI) lagged behind, weighed in part by swelling US product inventories and the contract’s expiry dynamics mid-month. Still, both benchmarks spent most of July well above the lows seen in May and early June, signalling a recovery in market sentiment. Overall, July saw an early rally, a mid-month pullback on tariff fears, and a late-month rebound with news on Organization of the Petroleum Exporting Countries (OPEC+) supply, geopolitical risks, and global trade policy driving the day-to-day volatility.

After surging to an all-time high of over $3,500 per ounce in April, the gold price entered a period of consolidation in July. The price fluctuated throughout the month, with a notable mid-month high before correcting slightly. The precious metal closed the month up 0.90%, continuing its uptrend. Silver showed remarkable strength and outperformed gold over the month as the price neared $40 per ounce, a level not seen in over a decade. This strong rally was driven by a combination of factors, including its industrial use and the ‘safe-haven’ status it shares with gold. However, the price gains were not sustained and were cut short by the end of the month, with silver closing with a modest gain of 1.7% for July. The gold-to-silver ratio, which tracks how many ounces of silver it takes to buy one ounce of gold, compressed from a high of 105:1 earlier in the year, indicating silver’s relative outperformance. Of particular note was the performance of the Copper price which plummeted after Trump announced that refined copper would be exempt from the planned 50% tariff on US imports.

Property

The UK property market in July presented a complex and often contradictory picture. While some indices reported a rebound in-house prices, others highlighted the sharpest monthly decline in asking prices in over two decades. The Nationwide House Price Index rose 2.4% year-on-year in July 2025, above expectations and June’s 2.1% rise. On a monthly basis, prices increased 0.6%, rebounding from a 0.9% drop in June and exceeding forecasts of a 0.3% gain.

The overarching theme was a shift in market dynamics towards a more balanced ’buyer’s market’, with a significant increase in housing supply and a greater emphasis on realistic pricing from sellers. This was supported by a resilient level of buyer activity, driven by improving mortgage affordability and a positive long-term outlook.

This increase in supply was a significant factor, with some reports indicating the highest level of stock in a decade. This gave buyers more choice and leverage, forcing sellers to price their properties more competitively. The increased competition among sellers was a direct cause of the steep drop in average asking prices.

Of note, the UK house price to earnings ratio reached its lowest level in over a decade, sitting at approximately 5.75, compared to a record high of 6.9 in 2022, according to Nationwide’s chief economist, and rental demand remained strong, with average UK rents up 6.5% year-on-year, according to Zoopla’s latest Rental Market Report.

Knight Frank’s assessment painted a picture of a UK property market navigating a period of adjustment but showing signs of stability and potential for modest growth in the latter half of the year, particularly outside of Prime Central London. The potential for further Bank Rate cuts, alongside improving market confidence, provided some optimism, but uncertainty around the upcoming Budget and other economic factors remained a consideration.

Learn more…

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 30 June 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.