Overview

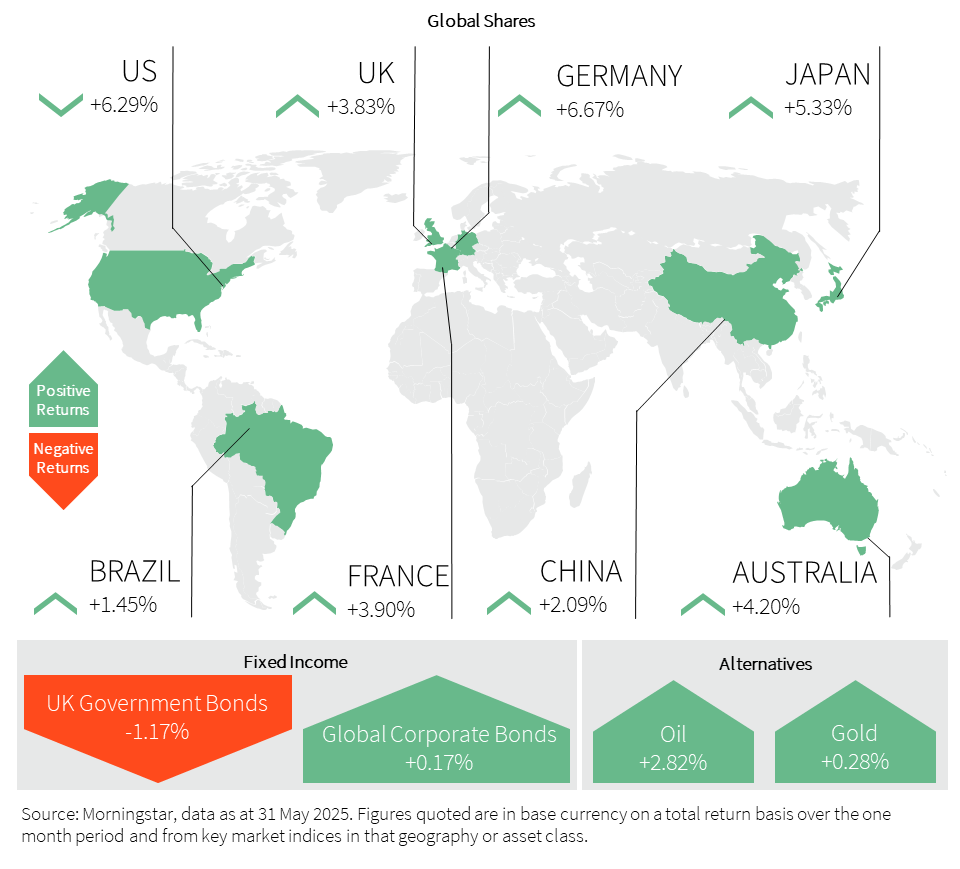

Tariffs continued to provide the main focus for markets in May, but as the recently coined ‘Trump always chickens out’ (TACO) narrative emerged, US markets extended their recovery from the ‘Liberation Day’ dip. The average tariff rate has materially eased since the start of the month, with the tariff rate on China being temporarily reduced from 145% to 30%. There is also the potential for further reductions as the US Court of International Trade ruled that the Trump administration lacked the legal authority to impose many of its announced tariffs. The US market strength was also helped by another strong set of earnings in Q1, which was capped off by impressive results from the world’s second largest company, Nvidia. The equity market volatility gauge (VIX) finished the month below its long term average despite elevated uncertainty and news flow, which is indicative of a market assuming Trump will continue to ‘chicken out’ and resilient earnings will persist.

The Federal Reserve (Fed) kept interest rates unchanged despite inflation easing to a four-year low, as policymakers “continued to view the risks around the inflation forecast as skewed to the upside.” This appears prudent given the uncertain impacts from tariffs and that Trump’s administration will likely find an alternative route should their appeal with the courts fail to keep the tariffs in place. Walmart’s announcement that it will hike prices due to tariffs could just be the start of a broader inflationary impulse and the relatively weak Q1 consumer spending data provided evidence that the weak consumer confidence is starting to feed into their spending patterns. The current market rally could also be challenged by the weak seasonality in the summer months, but importantly, the ‘Sell in May’ strategy misses out on a period that has still averaged positive performance for investors.

It was a different story for bonds, which sold off as yields rose across the globe. This was most notable in the US, where debt concerns mounted amidst a credit rating downgrade and the passage of Trump’s ‘One Big Beautiful Bill’ by the House. Elsewhere, Japan and UK yields also rose as inflation came in ahead of expectations.

Growth trajectories have at least momentarily shifted, with the US and Japan entering a contraction and leaving the UK as the fastest growing economy in the G7. In emerging markets, an impressive 7.4% GDP growth reading from India saw the world’s most populous nation surpass Japan to become the world’s fourth largest economy by Gross Domestic Product (GDP).

Our in-depth views on:

Our weightings are based on sterling as a base currency.

United Kingdom

They say the best things come in threes, and May saw the UK significantly strengthen its international trade relationships through the signing of deals with the US, the Eurozone and India. Along with these deals and a wider easing of ‘Liberation Day’ tariff threats, the UK market enjoyed a positive May, with the FTSE 100 leaping 3.83% and the FTSE 250 surging 6.14%. This came despite higher-than-expected inflation, unemployment edging up, and government borrowing higher than consensus in April.

Defying the often-gloomy forecasts, the UK economy grew 0.7% in the first quarter, slightly better than the 0.6% forecast and marking the highest growth of any G7 country. Whilst the second quarter may be more mixed as tariff effects show, in a boost to Rachel Reeves, the International Monetary Fund (IMF) upgraded growth forecasts for 2025 to 1.2% and praised the government’s, planning reforms and infrastructure investments which, if implemented properly, could further bolster growth. The flash services Purchasing Managers Index (PMI) moved back into expansionary territory and slightly better than forecast, with optimism improving as financial markets stabilised after ‘Liberation Day’.

As expected, The Bank of England slashed interest rates by a further 0.25%, bringing the headline level down to 4.25%, the lowest level since May 2023. The committee were divided, with two members favouring no cut and two favouring a more aggressive ‘0.5% cut’. Policymakers continue to adopt a cautious narrative on further reductions, with markets expecting one or two more for this year. Fuelling rate cut uncertainty, inflation moved further away from its target, increasing sharply to 3.5% in April, higher than the consensus, as utilities and house prices pushed the figure higher.

Despite the Stamp Duty holiday ending, house prices edged up in May, indicating resilience in the sector. Sales agreed hit a four-year high, with mortgage approvals holding up well amidst a backdrop of rising wages and solid household balance sheets. UK retail sales continued to remain strong, with a further 1.2% month-on-month growth in April as food store spending picked up.

United States

US markets put in a ‘big beautiful’ performance in May, with all three major indices posting significant gains. Boosted by easing trade tensions and with Chinese tariffs being suspended for 90 days, the DOW surged to a 4.16% gain and the S&P 500 ended the month up 6.29%. As the ‘Magnificent 7’ reasserted market leadership, the NASDAQ stole the show, having its biggest monthly increase since November 2023 gaining 9.6%. The AI gold rush showed little signs of easing as Nvidia once again sparkled despite headwinds in China.

Revised data showed that the US economy contracted by 0.2% in the first quarter, slightly better than the previously forecast 0.3% contraction. The numbers were heavily skewed by businesses stockpiling inventories prior to Liberation Day. Imports soared nearly 43% through the quarter. As confidence was hit, consumer spending slowed to its weakest pace since late 2023, but fixed investment rose at its fastest pace since Q2 2023. There was, however, better news with the latest PMI data showing services and manufacturing jumping in May and beating forecasts. Consumer confidence also rebounded sharply in May.

It was not just equity markets that were causing excitement as Donald Trump was beginning to experience his own ‘Liz Truss’ moment in the bond market, with the US 30-year treasury yield surpassing 5%. His ‘One Big Beautiful Bill’ narrowly passed through the House stoking fears that additional tax cuts could further worsen the US’ fiscal trajectory. The month also saw credit rating’s agency, Moody’s, downgrading the US over concerns of the federal debt picture. Yields edged back below 5% to end the month but the bond market remains jittery.

There was better news on the inflation side as it came in below expectation at 2.3% and at its lowest level since early 2021. Pleasingly for Trump, egg prices saw their biggest decline since 1984 falling nearly 13% over the month. In addition, the Fed’s preferred measure, The Producer Price Index (PPI), unexpectedly fell in April as the cost of services declined the most since 2009.

Europe

European markets continue to lead performance for the year, but they provided slightly more muted gains than the US in May, gaining 5% on the month. German and Italian markets led the way, up 6.67% and 8.16% respectively, with the former up nearly 20% already this year. The French CAC was up a more modest 3.90% in May.

Inflation expectations rose to their highest level in a year, increasing from 2.9% to 3.1%, but the market is still pricing in near certainty for another interest rate cut from the European Central Bank (ECB) in June.

Flash PMI data presented a mixed picture as services activity unexpectedly moved into contractionary territory, whilst the contraction in manufacturing was the weakest in three years. Industrial production was also the strongest since September 2022 and economic sentiment rebounded sharply from a weak reading in April.

The European Commission reduced its forecast for economic growth in 2025 to 0.9% from the 1.3% projected in late 2024, largely due to the tariff impact. However, the German economy expanded in the first quarter by 0.4%, double the initial estimate and a rebound from the 0.2% contraction it registered in the final three months of last year.

Asia & Emerging Markets

Emerging markets (EM) and Asia posted solid gains in May, with the FTSE EM index up 3.95%, slightly trailing global equities, while Asia ex-Japan performed in line with the FTSE World. Japan’s Nikkei led regional gains, surging 5.3%, supported by resilient corporate earnings and yen weakness. In contrast, China’s Shanghai Stock Exchange lagged slightly, rising 2.09%. India and Brazil also trailed, each up around 1.5%, though Brazil remains one of the strongest performers year-to-date, up 14%.

Broader sentiment was lifted by a sharp de-escalation in US-China tariffs, a softer US dollar, and a steadier macro backdrop in the US. These factors have together created a more supportive environment for emerging market assets to potentially outperform in the months ahead.

In China, the People’s Bank of China announced a surprise lending rate cut alongside a further loosening of monetary policy, injecting over 1 trillion yuan in long-term liquidity. However, the scale of the stimulus appears insufficient relative to the challenges. Producer prices have been in deflation for 31 consecutive months, and consumer demand remains weak. While factory output beat expectations, retail sales underwhelmed and exports to the US plunged 21%.

Across the rest emerging markets, India stood out with GDP growth of 7.4% year-on-year in Q1. Domestic momentum is holding firm, supported by recent rate and tax cuts, and the economy remains largely insulated from tariff-driven volatility. In Latin America, Mexico cut rates by 0.50% amid weakening global demand, while Brazil continues to defy expectations with resilient growth.

Finally, inflation in Japan is becoming more entrenched, with core Consumer Price Index (CPI) hitting a two-year high. The case for rate hikes is growing, but normalisation is expected to proceed cautiously to avoid unsettling bond markets again.

Fixed Income

May 2025 was marked by heightened volatility in fixed income markets, driven by evolving fiscal dynamics and continued geopolitical uncertainty. Global bond yields rose, led by the US 10-year treasury yield climbing 0.25% to close at 4.4%. In response, many countries shortened the maturity profile of new debt, reducing the supply of bonds with longer maturities to stabilise markets. As a result, bond duration remained under pressure as greater supply and mounting fiscal concerns weighed on sentiment across developed markets. Despite these pressures, credit spreads remained stable, supported by resilient equities and a waning recession narrative.

Turning to monetary policy, the Fed maintained its holding pattern, citing stagflation risks and concerns about second-order effects of tariffs. Meanwhile, fiscal risks intensified following Moody’s credit downgrade and the House passage of Trump’s ‘One Big Beautiful Bill’, which raises the debt ceiling by $4 trillion and proposes tax retaliation on foreign investors. This development has raised the prospect of outflows and increased demand pressure on domestic buyers. The 4.6% yield level has emerged as a key technical threshold; surpassing this yield could reignite bond vigilante activity and broader risk-off moves.

Across the Atlantic, the Bank of England delivered a hawkish cut, while Europe faced yield pressure from higher spending and signs of fiscal slippage. In Japan, 30-year yields spiked above 3.2% after weak demand, prompting the Ministry of Finance to pare long-dated issuance.

Against this backdrop of shifting policy and market volatility, the US dollar ended the month weaker. Although a 90-day tariff reduction on China initially buoyed risk sentiment, the dollar’s softness is likely to persist as ongoing tariff threats and fiscal uncertainty prompt global investors to reconsider their allocations to US dollar assets.

Alternatives

Gold has ended the month largely where it started, but the volatility within this period has seen it swing from $3,133 to $3,432 per ounce. Similarly, the silver price was marginally ahead by month-end, continuing an upward trend which has been in place for the last 12 months. This has been driven in the most part by ongoing risk-on and off sentiment swings caused by Trump’s tariff wars as investors seek any safe haven in light of this, the underperformance of more traditional equity hedges such as US Treasuries and the decline of the US dollar. The hawkish tone from the Fed will, however, have helped to rein prices back in. Gold remains a favoured safe haven if investors’ fears of a US recession grow and some forecasts see the precious metal climbing to as much as $3880 per ounce.

Oil prices rose slightly over the month as a whole, despite a brief dip at the start as eight OPEC+ countries that have been withholding production decided to bundle three monthly increases in output in the May production levels to bring rise to an increase of 410,000 barrels a day. However, a de-escalation in trade tensions increased global demand hopes as May progressed. Broader geopolitical tensions still pose a potential risk to production disruption and will likely cause ongoing price volatility.

Property

After the passing of the Stamp Duty deadline on April 1, the market naturally experienced some demand softening and some price falls. However, given the reduction in UK Base Rate in May to 4.25%, the market bounced back with some 6% more agreed sales when compared to the same time last year and the UK Nationwide House Price Index rose by 0.5% from a month earlier in May, rebounding from a 0.6% decline in April and exceeding forecasts of a 0.1% gain. The annual rate of house price growth increased marginally in May to 3.5%, compared to 3.4% in April. The April figures were a significant drop from the 3.9% growth seen in March. The average house price now stands at £273,427, according to Nationwide. Robert Gardner, Nationwide’s chief economist, said, “Owner occupier house purchase completions were around twice as high as usual and the highest since June 2021, which was also impacted by stamp duty changes.”

Consensus is that price growth, whilst evident, will likely remain muted through Q2. Knight Frank has raised its UK house price growth forecast to 3.5% for 2025 amid further rate cut optimism but cut its near-term growth outlook for prime central London on the back of political uncertainty.

Learn more…

Credit spread: The compensation investors receive for taking on credit risk.

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 31 May 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.