Macro

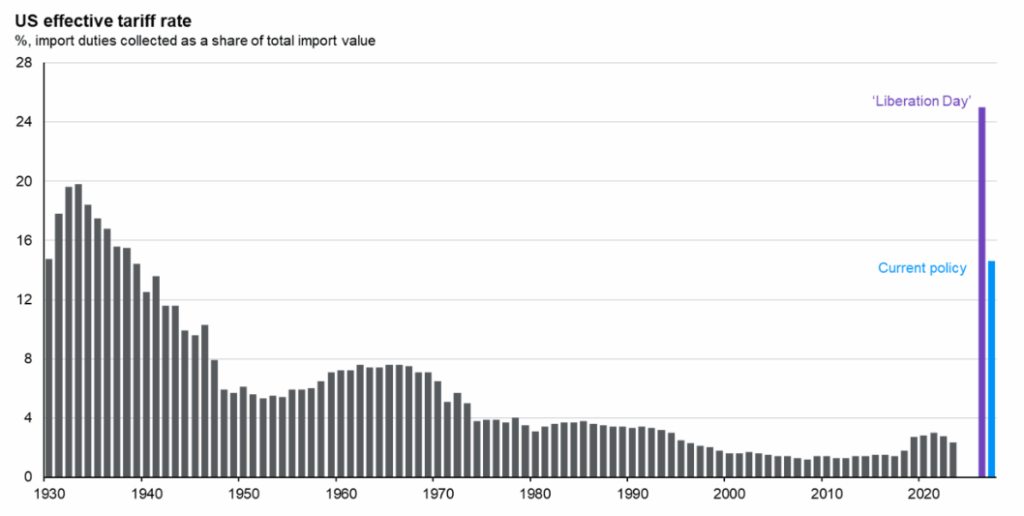

Q2 continued to be dominated by tariff news flow, with global recession fears mounting amidst Trump’s self-proclaimed ‘Liberation Day’ announcement. As trade deals have been reached, most recently with China, the effective or average tariff rate has been reined in, but still remains at century highs.

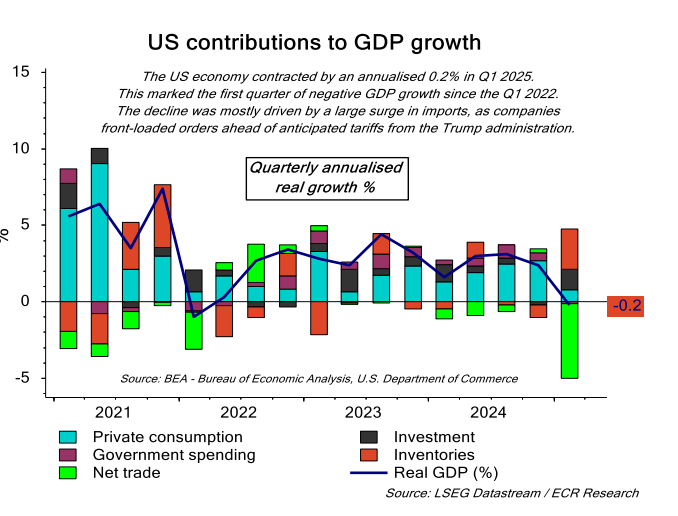

Soft (subjective) data is most sensitive and consequently deteriorated markedly before recovering as trade agreements brought down the effective tariff rate. Most recently, US consumer confidence jumped by the greatest margin on record. Meanwhile, hard (objective) data has been slower to adjust and is gradually deteriorating to the levels where soft data has corrected to. This was exemplified by retail sales data, which had remained very strong before falling from 5% to 3.3% in May on a yearly basis. Market consensus now appears to be closer to a mid-cycle slowdown, rather than a recession. This is further supported by Gross Domestic Product (GDP) data which is likely to recover strongly from the small contraction in Q1. As displayed on the graph below in neon green, the Q1 figure was likely skewed by the front-loading of orders ahead of tariffs. The Q2 figure, which the Atlanta Federal Reserve (Fed) tracker expects to be 2.9%, is likely to be overstated as these orders are unwound. Once the trade abnormality is discounted for, the figure is likely to be closer to the Fed’s projection of 1.4%. This is sub-trend and indicative of a slowdown rather than a recession.

In the unlikely event of a recession you would likely see a material spike in unemployment. The recession tail risk could materialise if there is a material spike in unemployment. Continuing benefit claims hitting their highest since November 2021 is potentially an ominous sign of labour market weakness ahead, but as of yet payroll figures have remained relatively robust. Should this remain the case and the impact of tariffs on inflation remain ambiguous, the Fed will likely keep interest rates steady.

Elsewhere, relatively robust data has enabled other developed nations to somewhat bridge the growth gap to the US, with the UK being the fastest-growing G7 economy in Q1. However, the US was likely still slightly ahead when accounting for the front-loading. UK and European consumers remain in good shape relative to the US. The UK savings ratio dropping alongside a 5% growth in retail sales in April is indicative of the improved consumer confidence translating into spending. European retail sales have also been improving alongside confidence. Continued cuts from the European Central Bank (ECB) have provided a particularly positive impulse for the region.

In Asia, China’s consumer confidence remains in the doldrums, but there is a sign that consumers are starting to spend again, with May’s retail sales figure the strongest since December 2023. However, the property sector remains a drag and tensions with the US have resulted in a material drop in exports, which will slow the economic recovery. Japan’s GDP contracted, but encouragingly, inflation looks increasingly sustainable. Finally, India’s disinflationary trend enabled the central bank to conduct further interest rate cuts and an impressive 7.4% GDP growth reading saw the world’s most populous nation surpass Japan to become the world’s fourth-largest economy by GDP.

Markets

Markets unsurprisingly sold off at the start of the quarter and equity market volatility spiked to the highest level since the pandemic as President Trump unveiled broad-based tariffs. As the quarter progressed, the market grew more tolerant of the seemingly constant news flow. This led to the ‘Trump Always Chickens Out’ (TACO) trade emerging with investors most notably buying the dip ahead of Trump placing a 90-day pause on ‘reciprocal’ tariffs. Despite average tariff rates remaining at the highest level in a century, the pause helped investors shrug off tariff concerns and markets quickly recovered the losses from the ‘Liberation Day’ sell-off.

Meanwhile, concerns over the fiscal trajectory of the US government were sparked by a credit rating downgrade and the passage of Trump’s ‘One Big Beautiful Bill’ by the House of Representatives. However, bond yields subsided soon after a relatively brief spike. Towards the end of the quarter, conflict in the Middle East escalated as the US joined Israel in attacking Iran’s nuclear facilities. Despite this significant escalation, the market exuded calm, with a muted response across global markets, and equity market volatility was soon back below its long-term average. After surging more than 20% from May lows, oil prices subsided to finish the quarter below where they started.

Whilst the market has continued to shrug off the seemingly constant news flow out of the White House, there has been a more lasting impact on the dollar. The greenback has had its worst first half of a year since 1973, shedding 10.8%. This has meant that the S&P 500’s impressive 10.94% gain in Q2 has translated into a 4.50% gain for sterling-based investors. Investors following the old market adage of ‘Sell in May and go away’ would also have missed out on some strong performance outside of the US as well. Japanese equities, UK mid-caps and Spanish equities also exhibited double-digit gains.

Positioning and outlook

The improving market breadth witnessed in Q1 came to a halt after the ‘Liberation Day’ low, with the Magnificent 7 providing 45% of the gains. As the valuation of the Magnificent 7 corrected substantially, we took the opportunity to increase our technology exposure, and the instrument we utilised has gained over 30% since. We expect this to be a short-term phenomenon as the previous valuation premium to the rest of the market has now been restored and performance has started to broaden again in June, with nine of the 11 sectors delivering positive returns.

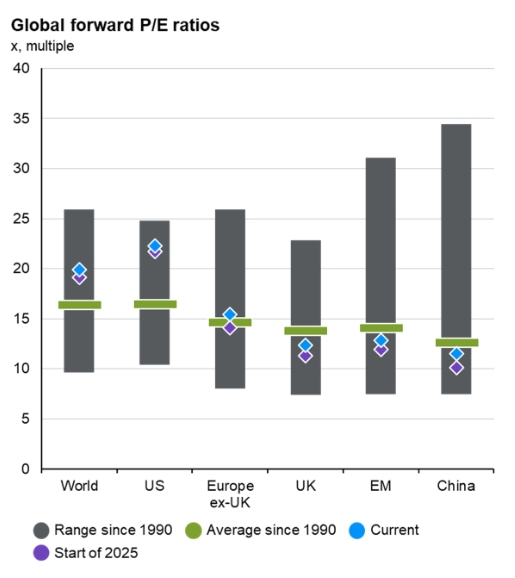

Whilst earnings expectations have been reined in, the market has continued to move higher, which has led to valuations across the globe sitting higher than they did at the start of the year. Given the multitude of geopolitical risks and historically weak seasonality, we are very comfortable with the defensive exposure that our UK overweight provides.

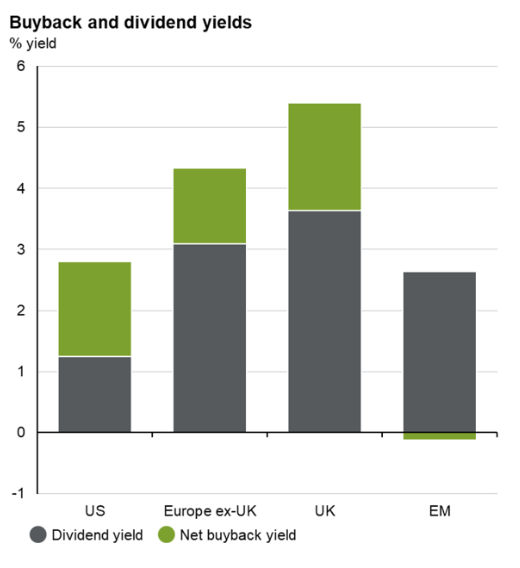

The UK’s strong relationship with the US and service-centric economy makes it well shielded from geopolitical noise and tariff concerns. The buyback yield now exceeds the US and that is in addition to a very attractive dividend yield. The cheap valuations, attractive distributions and improving fundamentals provide optimism that this year’s strong performance will continue going forward.

As some of the heat came out of the European rally and the US performed strongly, we took the opportunity to take profits and recycle them into Europe, where the region is benefiting from monetary and fiscal stimulus.

We also exited a position in an overly complex fixed income fund to add exposure to global equities through a team with an exceptional track record and at a discounted fee. We also reduced exposure to a poor performing US mid-cap fund and utilised the proceeds to access a passive instrument to fees.

In the sustainable models, we took profits in a fund that decided to close and recycled the proceeds into a water and waste fund that continues to perform well and provide a good ballast to the portfolio.

As ever, and as long-term investors, we welcome periods of volatility and will use them to add to areas where we have the most conviction.

Kind Regards,

Robert Matthews, Head of Research and Chartered Wealth Manager

Important Information:

For more industry terms and definitions, visit our glossary here.

All Index data figures are sourced by Morningstar and correct as at 30 June 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.