Macro

To pivot or not to pivot? That was the question on investor’s lips throughout the third quarter of 2022. It (pivoting) refers to the policy actions of the US Federal Reserve (Fed), specifically whether or not they would begin to take a less aggressive stance on inflation.

Unfortunately for almost all market participants, no pivot has arrived. The Fed have continued on their bruising rate hiking path, with little shying away from the hard truth that an economic slowdown is to be an inevitable consequence of their efforts to rein in inflation.

Ramifications of higher interest rates are beginning to show up in data releases. Be it early signs of weakness in the labour market[1], commodities and used car prices falling sharply[2], or a slowdown in the housing market[3], it is becoming increasingly evident amongst many leading economic indicators that inflation has peaked and is beginning to decline (displayed below).

Chart 1. Headline Inflation (3-month annualised) has started to decline

Source; MFS Asset Management, Haver Analytics as of 31 August 2022. Shaded areas are US recessions.

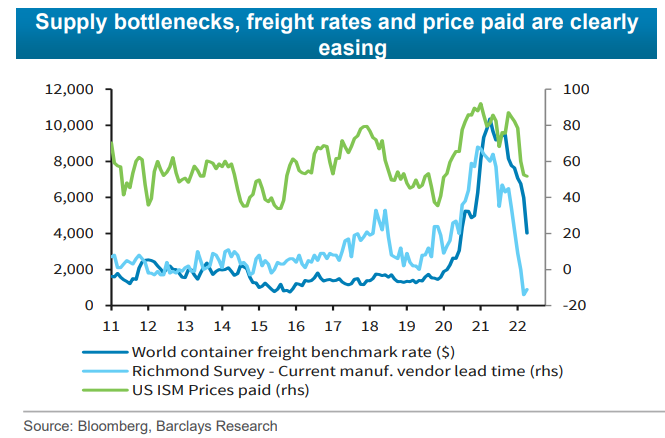

Additionally, anecdotal evidence from companies in the manufacturing sector is beginning to imply that supply chain issues are past their worst. For example, in the latest US ISM Manufacturing Index[4] (reflecting September Activity) the prices paid index fell for the sixth consecutive month whilst the supplier delivery times component fell to its lowest level since 2019. Eventually this should lead to some abatement of inflationary pressures.

Chart 2. Supply chains are clearly easing, highlighted by supply bottlenecks, freight rates and prices paid for manufacturing goods

Source; Bloomberg, Barclays Research. 5th October 2022

Despite an easing of pricing pressures becoming increasingly apparent in the economic data (Chart 1), it has yet to be reflected in US central bank rhetoric. One-by-one Fed governors have continued to reiterate their hawkish stance and thus rebut market cries for a dovish pivot.

Table 1. Recent comments from all Federal Open Market Committee (FOMC) members have been hawkish

Source; Federal Reserve, JP Morgan. 30th September 2022

The Fed and Bank of England each used both of their meetings[5] in the quarter to hike rates and both are now holding interest rates at the highest level since 2008[6]. Likewise, the European Central Bank followed a 50 basis point hike in July with an unprecedented 75 basis point hike in September. All three have implied further increases are still to come. However, as it becomes increasingly apparent that inflationary pressures have peaked, the rhetoric from western central bankers should begin to ease. This could be seen as the pivot the market has been hoping for, and would be well-received by investors.

In Asia and Oceania it is a somewhat different story. Whilst several regions have continued on their rate hiking paths (such as in South Korea, Taiwan and Australia), increases have been smaller in magnitude given the relatively muted inflationary pressures compared to the west. Bucking the trend, the Bank of Japan has thus far resisted temptation to ease its policy of yield curve control and China has ramped up targeted stimulus measures to stabilise the property market and address this year’s growth slowdown.

Finally, on the political front there was little for markets to cheer in the third quarter. US-China tensions have continued to boil away and may well be set to ramp up around the US mid-term elections. The war in Ukraine continues to wage on and raises the question of Putin’s endgame should he continue to be squeezed by the Ukrainian army. In Italy, the election of a right-wing coalition at the very least decreases European stability and in the worst case (albeit not our base case) threatens to shatter it. Elsewhere, former Japanese Prime Minister Shinzo Abe, still an influential politician, was shot dead. And in the UK, the less said about the recent “mini-budget”, the better.

Markets

As inferred above, it was another turbulent period for financial assets in which performance of both equities and bonds fell for the third consecutive quarter. This very unusual occurrence was driven by a sea change in perception about the magnitude of required interest rate increases and consequent adverse effect on economic activity.

Table 2. Performance table of asset classes and regions in Q3 2022

| Index or Asset Class | Change in value | Currency and Bond yields | Change in value |

| FTSE 100 | -2.72% | (EUR) €:£ (GBP) | +2.18% |

| S&P 500 | -4.88% | (EUR) €:$ (USD) | -6.62% |

| CAC | -2.46% | (JPY) ¥:£ (GBP) | +2.58% |

| DAX | -5.24% | (USD) $:£ (GBP) | +9.43% |

| Hang Seng | -21.21% | UK 10 Year Gilt Yield | + 191 basis points |

| Nikkei | -0.83% | US 10 Year Treasury yield | + 82 basis points |

| Brent Oil | -23.39% |

Source; Morningstar, FE Analytics, MarketWatch. 4th October 2022. All figures are in base currency.

An unhealthily strong dollar, ongoing zero-Covid policy in China, the attritional nature of the war in Ukraine, potential gas shortages in Europe and the UK budget debacle all added to the turmoil which investors had to navigate. Even the commodity complex saw its star billing fade as there was a more or less across the board sell-off amongst precious metals, industrial metals, gold and oil.

Bonds have continued their malaise, with yields climbing demonstrably again in the third quarter. It is little surprise that bonds have had their worst year-to-date performance since at least 1926 when one considers that UK and US 2 year government bond yields have risen by 324 and 355 basis points respectively this year alone (bond yields and bond prices have an inverse relationship).

In Europe and the UK markets initially welcomed the measures governments were taking to ease the ‘cost of living crises’ for households and businesses. This benign view didn’t last as the bear market mentality set in and the view now is that any move which makes the economy better simply means interest rates need to rise by even more, thus hurting housing and other interest rate sensitive sectors.

Equities have now given back all of their gains since the November 2020 ‘vaccine day’ with very few places to hide this year.

Chart 3. The MSCI World index (a global stock market index) is now back to its pre-Covid crisis level

Source; Bloomberg, Barclays Research. 4th October 2022.

Nonetheless, there are more reasons to be optimistic about the future than the past. The US new orders to inventory ratio indicates the health of the US manufacturing sector. The combination of a slowing manufacturing sector and elevated inventories have led the ratio down to a level only ever recorded 10 times in the past[7]. In 9 of the 10 ensuing 12-month periods markets have risen, with an average increase of 17%.

Other supportive technicals show that market sentiment is extremely low, bonds are oversold and equities are underowned. All of which tend to be positive indicators of future market performance so, when coupled with positive seasonality in the fourth quarter and a tendency for markets to perform strongly following mid-term elections (in the US), we are cautiously optimistic on the outlook for markets in the short and medium term.

Positioning

As such, we have begun to gradually put cash to work in both equities and bonds.

We entered the period underweight fixed interest and the fixed interest we did own was in aggregate far less vulnerable to a rise in interest rates than our benchmark. As rates have risen significantly, we have moved to take advantage of the better risk/reward and started adding to positions, albeit not in the most aggressive manner possible.

In many cases credit has actually fallen more than equities this year. Yields and spreads (difference between corporate bonds and US 10 year government bond) have blown out leaving many parts of the bond market far more favourably priced.

We have begun to take advantage of such falls and during the third quarter added to an existing holding in the high yield market, as well as taking our first foray into Emerging Market Debt at yields north of 12%!

We have also steered clear of UK Gilts. They tend to be long-dated and as we have seen recently vulnerable to high (and rising) levels of UK debt. Corporates, on the other hand, are in much better financial shape than in previous crises and offer a more attractive risk/return.

Our preference has continued to be towards bond funds that are less exposed to rises in interest rates – which may mean that we participate in, but lag, a strong rally. However, we see little need to take on the extra interest rate risk in this volatile environment given the historical compensation from these starting levels (see Chart 4 below).

Chart 4. Historically, when investing at current yields, longer term returns have been strong

Average 5-year forward returns (p.a, lhs) from today’s starting yields (shown in the grey below)

Source; Capital Group, Bloomberg. Data goes back to 2000 for all sectors except for emerging markets debt, which goes back to 2003 as inception date of the local currency index used in the blend referenced. Based on average monthly returns for each sector when in a +/- 0.30% range of yield to worst. Sector yields above include Bloomberg Global Aggregate Index, Bloomberg Global Aggregate Corporate Index, Bloomberg Global High Yield Index and 50% JPMorgan EMBI Global Diversified Index / 50% JPMorgan GBI-EM Global Diversified Index blend. Yields and returns as at 30 September 2022 in USD terms. Note: Yield to worst is a measure of the lowest possible yield that can be received on a bond with an early retirement provision.

Similarly in equities, valuations have continued to decline leaving areas such as the UK and Europe at several standard deviation lows when compared to US stocks. These phenomenon are rare and do not tend to persist. Both economies increasingly appear to have priced in fairly significant recessions thus presenting us with attractive entry points for long term investors.

Chart 5. European equity valuations now, in aggregate, compare with previous recessions

Source; Janus Henderson, Bernstein. 14th September 2022. Note; valuations are an average of 12 previous European recessions since 1960 as per OECD data

Conclusion

There is an old adage amongst investors which states, “don’t fight the Fed (US Federal Reserve)” and the Fed Chair Jerome Powell has recently said that he thinks some economic pain is a price worth paying in order to tame inflation. So we are now of the belief that a severe slowdown in the US will occur and that inflationary expectations will be significantly lower within a year. Although this could cause some near-term equity pain as profit expectations are reduced, it sets financial markets up for a meaningful rebound in the medium term. Companies demonstrated during Covid how nimble they have become, and we are confident a rebound in corporate profits will occur by the 2nd half of next year at the latest. Markets will move to discount the rebound some time in advance.

Chart 6. Investors have continued to find refuge in more highly valued US equities, but appear to have given up on the UK and Europe

Source; EPFR, JP Morgan. 3rd October 2022.

There is much more value around now, in equities as well as bonds, so you can expect us to reduce cash further in the coming months. As Warren Buffett famously said, “…be fearful when others are greedy, and … be greedy only when others are fearful”[8]. Year to date non-US equities have suffered significant outflows, particularly from the UK and Europe (as shown in the chart above), whilst several bond markets have suffered their worst returns in living memory. So, some other investors are certainly fearful. Whilst not yet greedy, we are working up an appetite at the moment and on occasion starting to nibble.

Jack Byerley and Ian Brady

11th September 2022

[1] Source; Raymond James, October 2022

[2] Source; Barclays, October 2022

[3] Source: Macro Research Board, September 2022

[4] Source; ISM, October 2022. Note;

The US ISM Manufacturing index is a leading economic indicator of economic activity in the manufacturing sector in the US

[5] Note; meetings refers to scheduled FOMC meetings and BoE Monetary Policy Committee meetings

[6] Source; Bloomberg, September 2022

[7] Source; JP Morgan, October 2022

[8] Source; Chairman’s Letter – 1986 (berkshirehathaway.com)