Macro

Investors were given reasons during Q1 to believe in a Goldilocks scenario, one in which inflation and economic growth are neither ‘too hot’ (strong) or ‘too cold’ (weak). Overall, economic forecasts in Western markets were revised up as the period progressed whilst China forecasts fell a little, albeit not the government compiled ones. However, during the period, Chinese authorities enacted several supplementary measures to support both financial markets and consumption.

As growth held up better than feared in developed nations, investors have pared back the number of interest rate cuts expected in 2024 from five or six down to three in respect of both the US and UK (please see chart below).

Examples of better data include robust US jobs growth, much better US services data, encouraging industrial trends survey in the UK, improvement in the Royal Institution of Chartered Surveyors housing data, Eurozone Investor Confidence rising and Eurozone Manufacturing Confidence hitting a five-month high.

Inflation is clearly past its worst and for once, the US economy is the one giving investors concerns about potential difficulties in bringing it down further. Our view is that inflation in each of the US, UK and Europe will fall further and that by year-end the inflation number is likely to be below 3%.

The UK and European economies have both seen a return to the situation where there are more positive data releases than negative compared to market expectations. With policy in the process of becoming less restrictive and with households in both regions yet to run down their excess savings in the manner US households have, we anticipate that there will continue to a skew towards positive data. A troughing in manufacturing activity, as appears to be happening globally, will further bolster the outlook.

Markets

Equities enjoyed positive returns and new highs were reached in several European markets, as well as Japan (for the first time in 35 years) and the US, China and the UK lagged. However, both the UK and China rallied hard from lows early in the quarter and ended up with modestly positive returns. Outside of China, most major government bonds saw yields rise (prices fall) at both the 2-year duration and 10-year duration resulting from investors paring back interest rate expectations as noted above. Japan finally ended its long standing policy of negative interest rates but did so in a very circumspect way. This has meant the yen has not yet begun to appreciate despite it being at multi-decade lows against the US dollar on Purchasing Power Parity (how much the same goods will cost you in each country in constant currency).

Gold was another asset class which reached an all-time high in the quarter, whilst oil and copper also appreciated despite muted sentiment towards commodity-intensive China.

As per normal, markets have moved up in anticipation of a re-acceleration in profits growth and this has meant that the optics on valuations are not as attractive as they were twelve months ago. This is particularly true for large-cap equities and especially for US shares. The outlier, as it has been for a few years now, is the UK, with small-caps here being at extreme lows. However, as seen in the table below, FTSE 250 Earnings per Share growth is expected to be strong over the next two years on the back of the more positive economic outlook referred to above.

A peaking in interest rates, robust earnings growth and low starting valuations should be a profitable combination for investors as we move forward. The active merger and acquisition market implies valuations won’t stay this low indefinitely.

Positioning & Outlook

Given very strong recent momentum and generally ebullient investor confidence, there is considerable scope for at least consolidation and probably a pullback at some point in Q2, especially because, as of April excess US liquidity could be declining for the first time since 2022. The source of this liquidity, the Reverse Repo Facility (RRP), has fallen from circa $2.3 trillion in early 2023 to circa $500 billion now and so will soon be fully used up at current depletion rates. However, despite scope for a short-term wobble, we remain optimistic about 2024 overall as the combination of lower interest rates, rising real wages and a reversal of surging domestic power prices combine to fuel accelerating profit growth. This is particularly true in the UK so we retain our overweight position.

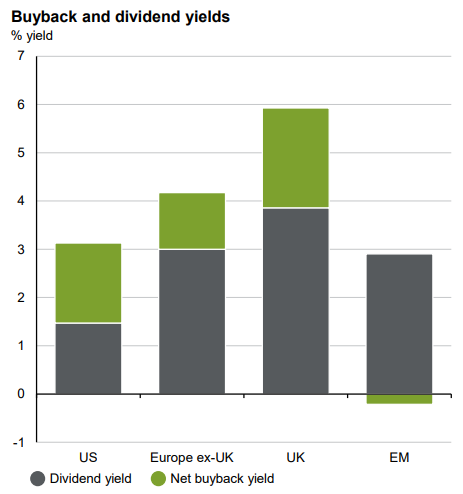

Whilst the exodus of institutional capital from the UK equity market has been going on for a while now, other buyers have recently entered the fray in the form of corporations. Not only are domestic companies buying back their own shares in large amounts (please see graph below), but merger and acquisition activity has accelerated too, with a larger-than-normal average premium being paid. The following table and chart highlight each of these points. In a recent development, retailer Curry’s and insurer Direct Line both rejected bids at significant premiums, indicating they did not think the bids properly reflected the long-term value inherent in their businesses. It also implies management feel they can realise these values as independent businesses within the UK market.

Returning to the issue of institutional capital outflow, UK pension funds have been at the forefront of the exodus. The table below shows how far away from the international average our pension funds currently are.

Not only do most developed countries have pension funds that act as secure long-term shareholders for domestic companies, but also hold high domestic weightings because the vast majority of pensioners have their liabilities (things they need to spend on when retired) denominated in their local currency. Political recognition of this low weighting and the issues it could cause have, at long last, led to some baby steps being taken to lend support to the UK equity market (e.g. UK ISA). Over time we expect more supportive legislation which further bolsters an improving fundamental story.

The UK is by far our biggest regional weighting and we anticipate robust returns over the next two to three years on the basis of the above factors.

More generally, the last two years could be characterised as a period where interest rates were rising whilst economic activity, particularly manufacturing (as measured by Purchasing Managers Indices) was low and/or falling. Barclays point out that such an environment is seldom ideal for smaller cap companies but that over the next several quarters, we are likely to be in an environment where the opposite is true, i.e. falling rates and accelerating activity, particularly outside the US. That is why we are optimistic on making positive returns on both equities and, in more modest amounts, bonds over the medium term.

Kind regards,

Ian Brady, Chief Investment Officer

Important Information:

For more industry terms and definitions, visit our glossary here.

All Index data figures are sourced by Morningstar and correct as at 31 March 2024, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.