Important notice: This information is of a general nature and is not an offer or a solicitation to buy or sell any financial instrument or provide any financial services. Any statements and opinions given herein are liable to change without notice and may not be held throughout the firm. The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance. No responsibility is taken for any losses, including, without limitation, any consequential loss, which may be incurred by acting upon any advice or recommendations contained in this document. For our mutual protection, telephone calls may be recorded and made available to you on request and such recordings may be used in the event of a dispute.

Summary

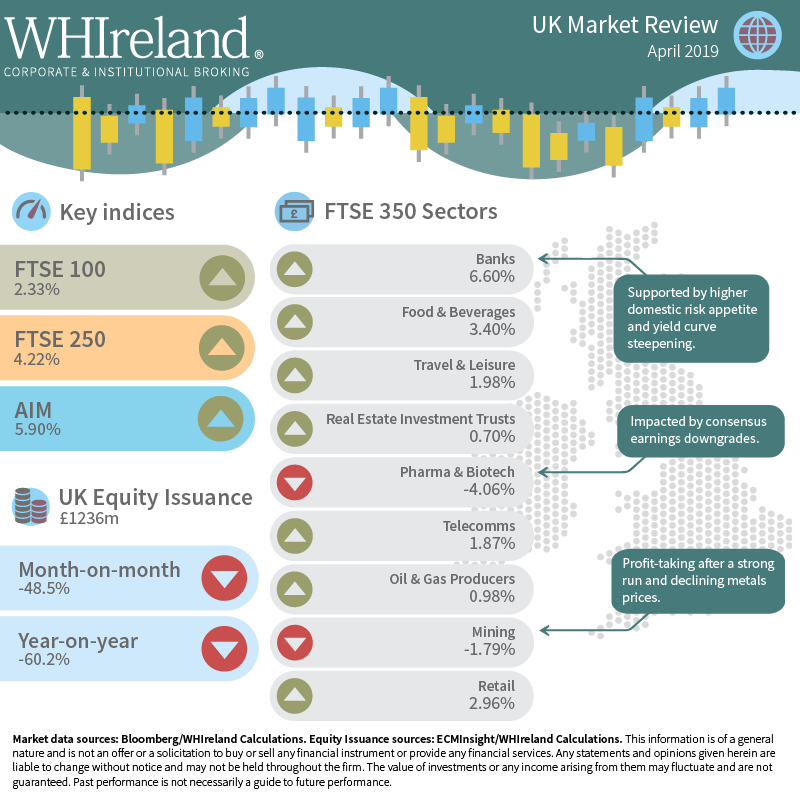

Global equities made further progress in April, buoyed by a solid start to the US earnings season, continued central bank dovishness and the perception of receding geopolitical risk. In the UK, further delays to Brexit also prompted investors to take a more constructive view on domestic risk assets. Sterling was volatile, though ultimately little changed on the month, while Gilts suffered significant losses. The Uk top 100, 250 mid-cap and AIM indices posted total returns of 2.33%, 4.22% and 5.90% in April.

Most UK equity sectors posted respectable gains in the month, with more domestically orientated exposures favoured. Banks notably outperformed while Mining stocks succumbed to profit-taking. Pharmaceuticals suffered notable declines.

Incoming UK economic data in April painted a mixed picture on growth and economists continue to cut their full-year forecasts. Broad inflationary pressure currently appears contained. However with the timetable for Brexit again delayed, market expectations of a prudential rise in UK rates from the Bank of England (BoE) are now building.

UK equity issue failed to build on the momentum evidenced in March and amounted to just £1236m in April. This represents a decline of 48.5% month on month and – crucially – a 60.2% fall year on year. Investors appear content to add to existing risk positions, but are still exercising caution towards new exposures. This perhaps goes some way to explaining the current disconnect between weak primary and strong secondary markets, though traded volumes in the latter also appear depressed.

UK Equity Markets

UK equities were supported by a number of factors over the course of April. Global central banks have continued to sound a more cautious outlook on interest rates, and markets now seem reasonably confident that we are at the peak of the US rate cycle. US/China trade talks also appear to be slowly moving towards a resolution. Meanwhile, the unfolding US earnings season, while revealing a few high-profile misses, has thus far exceeded analysts’ expectations overall.

In the UK itself, the deadline for Brexit was postponed – again – until 31 October. Despite considerable uncertainty around the eventual outcome, investors’ current working assumption is that the probability of a ‘hard’ Brexit is low.

Against this backdrop, UK equity indices posted healthy gains in April, with a preference for UK domestic exposure. Accordingly, the Uk top 100, 250 mid-cap and AIM indices posted gains of 2.33%, 4.22% and 5.90% respectively.

Unsurprisingly, UK banks led the charge in April, also aided by a steeper UK yield curve. Although the sector seems largely ex-growth, the prospects for the return of excess capital appear to be improving. The Uk top 350 banks ended the month up 6.60%.

The quoted UK Retail sector also performed well last month (+2.96%), continuing its strong year-to-date recovery from December’s plunge. This was however bettered by the performance of the Food & Beverages sector, which rose 3.40% on the month.

The Mining sector succumbed to profit-taking in April (-1.79%), after a stellar performance in March and perhaps prompted by a decline in industrial metal prices during the month. Pharmaceuticals also struggled (-4.06%), with the ‘defensive growth’ investment thesis coming under pressure from analysts’ forecast downgrades.

Real Estate Investment Trusts (REITs) also put in a relatively muted performance (+0.70%) with some uncertainty over net asset value underpinning. The Oil & Gas sector was also a relative underperformer (+0.98%).

UK Economy

Overall, incoming economic data in April was quite mixed and economists continue to cut consensus growth forecasts for 2019 as a whole. The most recent GDP data (for February) suggests that the UK economy remains on track to grow 0.2% quarter on quarter. PMIs painted a mixed picture with a stronger than expected pickup in Manufacturing, but unexpected weakness in the heavyweight Services sector. Overall the PMI data disappointed, perhaps impacted by last minute jitters over a ‘hard’ Brexit. Business and consumer surveys suggest that confidence levels remain fragile. Retail sales and car registration data received in April were both weak. The UK labour market appears to have lost some momentum, but overall net gains remain robust.

Both consumer and retail price inflation data received during the month came in lower than expected, while producer price inflation was broadly in-line. However, wage inflation confirmed an accelerating trend and remains a focus for the Bank of England (BoE). With the deadline for Brexit now notionally pushed out to 31 October, the BoE appears increasingly unwilling to be a hostage to fortune and the market is pricing in an increased probability of a rate hike by year end.

UK Equity Issuance

UK equity issue failed to build on the momentum evidenced in March and amounted to just £1236m in April. This represents a decline of 48.5% month on month and – crucially – a 60.2% fall year on year. Investors appear content to add to existing risk positions, but are still exercising caution towards new exposures.

Consistent with the reduced level of activity, market breadth also declined in April with the deal count falling to 19 from the 27 registered in March and down sharply from the 31 posted in April 2018. The number of sectors represented also declined to 13 from 18 in March and 16 in April 2018.

Sectoral concentration of activity was unsurprisingly high in April with Mining (24.0%) and Equity Investment Instruments (23.4%) leading issuance. Financial Services, Media, Technology Hardware & Equipment and General Retailer offerings also made significant contributions and the named sectors combined accounted for almost 87% of monthly issuance.