The most recent UK budget in March 2016 introduced a few surprises; below is an overview of some of the changes coming our way.

Personal Allowance and Higher Rate Tax Threshold

The personal allowance will increase to £11,000 for 2016/17 and to £11,500 for 2017/18. Higher rate taxpayers also receive a boost and many taxpayers will be taken out of higher rate tax, following confirmation of an increase in the higher rate threshold to £43,000 for 2016/17 and £45,000 for 2017/18.

These increase supports the UK Government’s pledge to increase the personal allowance to £12,500 and higher rate threshold to £50,000 by the end of the current parliament.

Dividend Tax

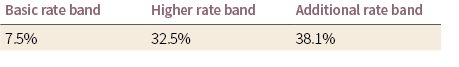

As already announced, the dividend tax credit will be replaced by a new £5,000 tax-free dividend allowance for all taxpayers from 6th April 2016. Dividends that exceed this allowance will be taxed as follows:

Capital Gains Tax

The higher rate of capital gains tax will be reduced from 28% to 20% and the basic rate from 18% to 10%. The reduced rates apply to relevant gains accruing on or after 6th April 2016.

The 28% and 18% rates will, however, continue to apply for carried interest and for chargeable gains on residential property (that do not qualify for private residence relief).

The government wants to develop ‘a strong investment culture’. Cutting the rates of CGT for most assets is intended to support companies to access the capital they need to expand and create jobs. Retaining the 28% and 18% rates for residential property is intended to provide an incentive for individuals to invest in companies over property.

ISA Limit

From 6th April 2017 the ISA limit will increase to £20,000. The ISA limit for 2016/17 is unchanged at £15,240.

Lifetime ISA

The Lifetime ISA will be available from 6th April 2017. Individuals will be able to save up to £4,000 each year, and receive a government bonus of 25% – that’s a bonus of up to £1,000 a year. The money can then be used to either buy a first home or kept until the age of 60 before being withdrawn. They can be opened by savers between the ages of 18 and 40, and any savings invested into it before the age of 50 will receive the added 25% bonus from the government. Contributions can continue after the saver’s 50th birthday but there will be no further government bonuses after the age of 50.

Contributions to the Lifetime ISA must be within the overall ISA limit  (£20,000 from 2017/18). Individuals can contribute into a Lifetime ISA alongside any other ISA in the same tax year up to the ISA limit.

(£20,000 from 2017/18). Individuals can contribute into a Lifetime ISA alongside any other ISA in the same tax year up to the ISA limit.

Savers can withdraw their funds at any time but will lose the government bonus and will incur a 5% charge if the withdrawal is not for the purchase of their first property or after they turn 60 (unless they are diagnosed with terminal ill health).