6 April 2016 marked the one year anniversary of pension freedoms, which transformed the landscape in terms of the options and flexibilities available on retirement. No longer were retiring individuals restricted to buying an annuity or dealing with the investment risk of a drawdown plan.

With this new found freedom came the ability to potentially withdraw all of your pension assets in one lump sum from the age of 55; 25% of which would be tax free and the remaining 75% would be taxed at the individuals highest marginal rate of tax. Other options could include just taking the tax free cash only and no (or any level of) pension income or taking Uncrystallised Funds Pension Lump Sum (UFPLS) where a portion of the pension will be taken, 25% tax free and 75% taxable. UFPLS can be taken as a series of withdrawals at any level or frequency until the pot has been extinguished.

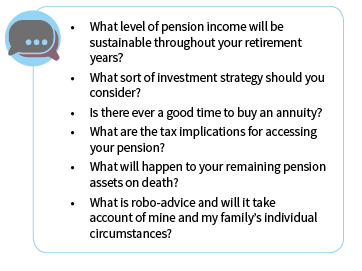

For an individual trying to work their way through the pensions maze and decide what is best for them, the implications of any choices made can be a nerve wrecking time. Especially as we are constantly bombarded with pension news and stories in the press.

Future changes to pension regulations will happen but to what degree is unknown, speculation ahead of the recent budget on the 16 March 2016 was all about changes to tax relief on pension contributions or the pension structure. Nothing fundamentally changed for pensions at this budget but the creation of the Lifetime ISA (LISA) could be an indication of future change. A LISA will provide a 25% government top-up on a maximum investment of £4,000 annually; the client will keep the top up only if used to purchase a first home or held until the age of 60.

Retirement options should be less about the financial product and more about the objectives and needs of the individual, and finding the right solution for them. It is not unreasonable to want income flexibility and income certainty in retirement. Retirement planning for many wealthy individuals should not be looked at in isolation either, but should be considered in conjunction with all other investments and estate planning issues in mind to ensure the most tax efficient solution is established.

Whether you are still saving towards your retirement, considering your options as you approach retirement or are retired and want to review your options; speak to an Independent Wealth Planner at WHIreland now who can help you plan to meet all your financial goals in the future.