![]()

26 September 2025

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in the United Kingdom pursuant to the European Union (Withdrawal) Act 2018. Upon the publication of this announcement via Regulatory Information Service (RIS), this inside information is now considered to be in the public domain.

WH Ireland Group Plc

(“WH Ireland” or the “Company” and with its subsidiaries the “Group”)

Financial Results for the Twelve Months ended 31 March 2025, Notice of GM and Publication of Annual Report

Financial Results for the Twelve Months ended 31 March 2025

WH Ireland announces its final audited results for the year ended 31 March 2025.

Financial & Operating Summary

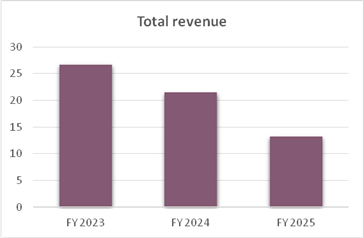

· Revenue of £13.2m (FY 2024: £21.5m) reflecting the sale of the Capital Markets division in July 2024

· Underlying* loss before tax of £1.9m (FY 2024: underlying loss before tax of £2.5m)

· Statutory loss before tax of £9.2m (FY 2024: statutory loss before tax £6.0m) reflecting impact of:

o Restructuring costs £0.9m (FY 2024: £2.9m)

o Impairment of £6.1m (FY 2024: nil)

· Loss per share of 3.97p (232,869,000 shares) (FY 2024: loss of 3.38p, 175,718,000 shares)

· Cash and cash equivalents as at 31 March 2025 of £3.5m (FY 2024: £4.9m)

o Cash and cash equivalents of £3.3m as at 31 August 2025

*A reconciliation from underlying profits to statutory profits is shown within the financial review.

The above results include the Capital Market Division which was sold on 15 July 2024

Pro-forma results of the continuing group comprising wealth management and head office

These pro-forma results consider what the continuing operations results would look like following the disposal of the Capital Markets division. Refer to note 5 of the Annual Report Accounts for further information.

· Revenue of £10.0m (FY 2024: £11.9m) reflecting market falls during the year

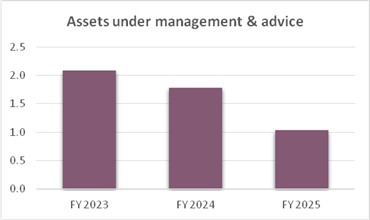

· Total AUM at £1.0bn (FY2024: £1.2bn)

· Underlying loss before tax of £1.9m (FY 2024: underlying loss before tax of £0.6m)

· Statutory loss before tax of £9.1m (FY 2024: loss before tax of £2.8m)

· Loss per share of 3.91p (232,869,000 shares)(FY 2024: loss of 1.57p, 175,718,000 shares)

Post period end events

· Subsequent to the balance sheet date, in September 2025 the Group announced a conditional disposal of its Wealth Management division

Outlook

· With the planned sale of the Wealth Management division, the Group now intends to delist from the AIM market and commence a process of winding down its operations

Commenting, Simon Moore, Non – Executive Chair said:

“Market conditions during the period have had a significant impact on our financial performance leading to a fall in AUM and Wealth Management revenues and losses for the year at both the statutory and underlying levels. With the successful divestment of the Capital Markets division and the planned sale of the Wealth Management division, the Group now intends to delist from the AIM market and commence a process of winding down its operations and returning cash to shareholders.”

Publication of Accounts and Notice of General Meeting

WH Ireland (AIM: WHI), announces that it has published its Annual Report and Accounts for the year ended 31 March 2025 (“Annual Report and Accounts“).

A Notice of General Meeting (“GM“) for WH Ireland’s 2025 GM is being made by the Company today. The GM will be held at the Company’s offices at 24 Martin Lane, London EC4R 0DR on 20 October 2025 at 11.00 a.m. for the purposes of approving the Accounts.

A copy of the Annual Report and Accounts along with a copy of the Notice of GM are available on the Company’s website at www.whirelandplc.com –(in the Annual Reports Section and Circulars and Votes Section respectively). Printed copies are being posted to shareholders who have requested hard copies. All shareholders will be sent a hard copy Form of Proxy for use in connection with the GM.

-END-

For further information please contact:

|

WH Ireland Group plc |

|

|

Simon Jackson, Chief Finance Officer |

+44(0) 20 7220 1666 |

|

Zeus Capital Limited |

|

|

Katy Mitchell |

+44(0) 161 831 1512 |

|

MHP Communications |

|

|

Reg Hoare / Hugo Harris |

+44 (0) 20 7831 406117 |

Notes to Editors:

About WH Ireland Group plc

WH Ireland Group plc is the holding company for WH Ireland Limited (WHI). WHI delivers a high quality service in Wealth Management (WM) providing investment solutions for individuals, families and charities. Previously, WHI had a Capital Markets (CM) division which was a leading firm for public and private companies seeking corporate advice and investment capital.

Classification and Disclosure within Financial Statements

During the year, the Group completed a sale of the CM division and pursued a sale of the WM division. The WM sale was judged to be highly probable at year end and so has been classified as ‘held for sale’ within the Statement of Financial Position with the associated loss for the year being shown within Discontinued Operations within the Statement of Comprehensive Income. A breakdown of these disclosures is shown within note 6 of the Annual Report.

Post year end, the sale of the WM division is still judged to be highly likely. The sale of the CM division completed during the year in July 2024.

Wealth Management

WHI provides financial planning advice and discretionary investment management. Our goal is to build long-term, mutually beneficial, working relationships with our clients so that they can make informed and effective choices about their money and how it can support their lifestyle ambitions. We help clients to build a long-term financial plan and investment strategy for them and their families.

Capital Markets (sold July 2024)

The CM division had been specifically focused on the public and private growth company marketplace. The team’s significant experience in this dynamic segment means that they have been able to provide a specialist service to each of its respective participants. For companies, we have raised public and private growth capital, as well as provided both day-to-day and strategic corporate advice including M&A advisory. The division’s tailored approach means that the team engages with all of the key investor groups active in its market – High Net Worth individuals, Family Offices, Wealth Managers and Funds. The broking, trading and research teams provide the link between growth companies and this broad investor base.

Chair and Chief Executive’s statement

Market backdrop

The market conditions during the period have had a significant impact on our financial performance. While the FTSE 100 has shown signs of recovery, the AIM All-Share Index experienced a decline of 8%. In light of the strategic challenges faced by the company in recent years, as well as public perception concerns, our Assets Under Management (AUM) were similarly affected.

Operating review

Early in the financial year in July 2024, the Group successfully completed the sale of its Capital Markets (CM) division, which was structured on a contingent consideration basis. Following this divestment, the Group shifted its focus to the continued operation and development of its Wealth Management (WM) division, while also exploring potential strategic opportunities as they arise.

Given the ongoing challenges posed by market conditions and persistent inflationary pressures, the Board has pursued a strategy of actively evaluating opportunities to optimise the Group’s portfolio, with a primary focus on the potential sale of all or part of its assets. During the year, we received multiple inquiries from potential buyers interested in acquiring the WM division. Where appropriate, these discussions were actively pursued.

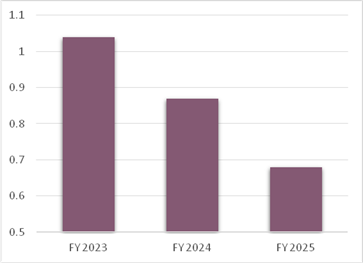

Additionally, following the resignation of key Investment Managers in our Henley office, an agreement was made to transfer our Henley clients to the firm these managers joined. As part of this, the Group also decided to surrender its Henley office lease in order to reduce operational costs and consolidate Wealth Management operations in its remaining London, Manchester, and Poole offices.

Subsequent to the balance sheet date, in September 2025 the Group advanced the sale process for its WM division. Negotiations for this sale had been taking place for much of the financial year, with the sale judged to be highly likely by 31 March 2025. Given the likelihood of a sale in the near term, the WM division was classified as an asset held for sale and a discontinued operation in the subsequent Financial Statements.

Looking forward

With the successful divestment of the CM division and the planned sale of the WM division, the Group now intends to delist from the AIM market and commence a process of winding down its operations. We extend our sincere gratitude to our shareholders for their ongoing support throughout this challenging period, and we appreciate their understanding as we move forward with the wind-down strategy.

The Financial Year 2025

For the financial year 2025, the Group reported a 39% decline in total revenue, from £21.5 million to £13.2 million, largely due to the sale of the CM business in July 2024. Administrative expenses were reduced from £26.7 million to £22.8 million (15%), but excluding impairment charges by 38% to £16.7 million.

The Group also incurred redundancy and project costs totalling £0.9 million, related to the Board’s efforts in exploring strategic opportunities. A profit of £100k was recognised on the sale of the CM division, resulting in an overall pre-tax loss of £9.23 million. An additional £150k of profit was recognised on the previous sale of the Isle of Man business.

Revenue from the WM division was impacted by market declines, leading to a reduction in total assets under management from £1.2 billion to £1.0 billion. This contributed to a 16% drop in WM revenue, from £11.9 million to £10.0 million. Despite a reduction in operating costs, including staff redundancies, the WM division recorded an underlying loss of £1.85 million.

Revenue from the CM division was recognised until the completion of its sale on 12 July 2024. Contingent consideration of £1.1 million has been recorded in relation to the successful disposal of the CM division as of March 31, 2025, based on projected revenue to be generated by the buyer within the 12 months following the acquisition. For further details, see note 1. This contingent consideration has resulted in a gain on disposal of £100k, which is reflected in the result from discontinued operations (see note 6).

Net cash at year-end was £3.5m (FY24: £4.9m).

Summary

On behalf of the Board, we wish to express our sincere gratitude to all employees for their continued dedication and hard work during this challenging period. Although this has been an unsettling time for all stakeholders, we deeply appreciate the efforts of our employees, clients, and partners in successfully completing the sale of the CM division and for their collaboration in stabilising the business.

As the company moves towards delisting and the winding-down process, the Board’s primary objective will be to ensure an orderly and efficient dissolution of operations. This includes the sale of remaining assets, settlement of liabilities, and management of ongoing contractual obligations. We will focus on minimising costs and protecting the interests of all stakeholders. Throughout this process, the Board will closely assess the strategic value of key business units, identifying assets that can be liquidated or have potential for future strategic opportunities.

While the company is in the process of winding down, we are committed to maintaining a strong focus on optimising cash flow and ensuring transparency to all parties involved. The Board aims to manage the wind-down with discipline and foresight, striving to maximise value for shareholders while ensuring an ethical and responsible closure of operations.

Overview

The WH Ireland Group consists of a principal operating subsidiary, WH Ireland Limited.

WH Ireland Limited is a Wealth Management (WM) company, providing investment solutions for individuals, families and charities. On the 12th July 2024 the Capital Markets (CM) division was disposed. This division provided corporate finance advice and investment banking services.

Total assets managed by the Group are £1.03bn (FY24: £1.78bn). Of this total, all (FY24: £1.2bn) is held in WM.

The Group’s income is derived from activities conducted in the UK although a number of clients are situated worldwide.

The average Group headcount for the year was 84 (FY24: 133) all based in the UK.

Strategy summary

During the year, the Group successfully completed the sale of the CM division on 12 July 2024 to Zeus Capital Limited. The gain on sale of the division is shown within the Statement of Comprehensive Income.

Following the sale of the CM business the strategy for the continuing business of the WM division was initially to drive growth in the assets under management and provide a wider level of service to develop further revenue streams. However, the Group received offers for the division during the year. As a result of which, the Board revised the strategy to pursuing a successful sale of the WM business. This was judged to be highly probable at year end and so the business has been classified as ‘held for sale’ assets within the Statement of Financial with the associated loss for the year being shown within Discontinued Operations.

Group financial results summary

|

|

Year to 31 Mar 2025 £’000 |

Year to 31 Mar 2024 £’000 |

|

Revenue |

13,227 |

21,465 |

|

Operational costs |

(16,655) |

(26,665) |

|

Expected credit loss |

(37) |

(328) |

|

Operating loss |

(3,465) |

(5,528) |

|

|

|

|

|

Net gain (loss) on investments |

99 |

(583) |

|

Gains on fixed assets |

250 |

– |

|

Finance income |

12 |

– |

|

Finance expense |

(12) |

– |

|

Release of deferred consideration |

– |

160 |

|

Other income |

1 |

– |

|

Impairment |

(6,113) |

– |

|

Loss before tax |

(9,228) |

(5,951) |

|

Taxation |

– |

12 |

|

Loss and total comprehensive income for the year |

(9,228) |

(5,939) |

The format of these tables do not follow that in the Statement of Comprehensive Income which is required to show effect of discontinued operations on the business.

Reconciliation between underlying and statutory profits

Underlying profit before tax is considered by the Board to be an accurate reflection of the Group’s performance when compared to the statutory results, as this excludes income and expense categories which are deemed of a non-recurring nature or non-cash operating item. Reporting at an underlying level is also considered appropriate for peer group benchmarking. A reconciliation between underlying and statutory profit before tax for the year ended 31 March 2025 with comparative is shown below:

|

|

Year to 31 Mar 2025 £’000 |

Year to 31 Mar 2024 £’000 |

|

|

Underlying loss before tax |

(1,927) |

(2,468) |

|

|

Amortisation of acquired brand and client relationships |

(664) |

(273) |

|

|

Changes in fair value and finance cost or release of deferred consideration |

– |

160 |

|

|

Restructuring costs |

(872) |

(2,909) |

|

|

Client Settlement |

– |

(152) |

|

|

Other income |

1 |

– |

|

|

Finance income |

12 |

– |

|

|

Finance expense |

(12) |

– |

|

|

Gains on fixed asset |

250 |

– |

|

|

Net changes in the value of non-current investments |

97 |

(309) |

|

|

Impairment |

(6,113) |

– |

|

|

Total underlying adjustments |

(7,301) |

(3,483) |

|

|

|

|

|

|

|

Statutory loss before tax |

(9,228) |

(5,951) |

|

|

Tax |

– |

12 |

|

|

Loss and total comprehensive income for the year |

(9,228) |

(5,939) |

|

|

Underlying earnings per share |

|

|

|

|

Weighted average number of shares (‘000) in issue during the period (note 11) |

232,869 |

175,718 |

|

|

Basic underlying earnings per share |

(0.83p) |

(1.40p) |

|

Amortisation of acquired brand and client relationships

These intangible assets are created in the course of acquiring funds under management and are amortised over their useful life which have been assessed between two to 12 years. This charge has been excluded from underlying profit as it is a significant non-cash item. Amortisation ceased from the date the WM division was reclassified to assets held for sale. The intangible assets have now been allocated to the disposal group at their recoverable value, refer to note 6.

Impairment

An impairment has been recorded to reflect the fair value of the WM division. As the WM division is held for sale, this is the consideration less costs to sell. The impairment is the amount required to reduce the carrying value to this amount, refer to note 4.

Changes in fair value and finance cost of deferred consideration

This comprises the fair value measurement arising on the deferred consideration payments from acquisitions together with the associated finance costs from the unwinding of the present value discount relating to the Harpsden acquisition in previous years.

Restructuring costs

These costs relate to the restructuring costs in WM the resultant costs of redundancies of staff arising from the cost savings measures taken during the year. These costs also include transaction fees paid in relation to the exploration of the potential sale of the WM division and the resultant sale of the CM division.

Client Settlement

This item relates to an issue with our outsourced platform provider, cited in our interim results, which resulted in incorrect amounts of interest being paid to clients. The provider and the Group have settled these amounts with clients.

Gains on fixed asset

This gain relates to two items: the sale of the CM division to Zeus Capital Limited, which settled in September 2025 with a net gain of £100k. During the year we received £150k relating to the sale of IOM business which relates to previous years.

Net changes in value of investments

As part of the fee arrangement with corporate clients in CM, there was often a grant of warrants over shares or the issue of actual shares in addition to the cash element of the fee. The value of such warrants and shares are credited to revenue on the date of the fee note and then any changes in the valuation are recorded as net gains or losses. In view of the nature of these gains or losses, including non-cash, these gains or losses have been excluded from underlying profit. The total change in value of investments was £99k, a corresponding commission payable of £2k on the gain or loss of these warrants is included in the net changes above. The net change in investment value is £97k.

The Financial Year 2025

Overall revenue fell from £21.5m to £13.2m from the previous year (39%), whilst operational costs were reduced by 38% from £26.7m to £16.7m before impairment. The reduction in the revenue is a result of the CM division being sold in July and the market falls affecting WM. Administrative expenses were reduced in line with this.

Although our loss on investments reduced from a £0.6m loss in the previous year to a £0.1m profit, we incurred restructuring costs of £0.9m. These were principally redundancies, and transaction costs in relation to the Board exploring strategic opportunities for parts of the business. This led to a loss overall for the business of £9.23m before tax.

WM income was affected by market falls and uncertainty created by the sale of the CM division which led to a reduction of assets under management from £1.2bn to £1.0bn. This was the principal reason for a fall in WM revenue of 16% (from £11.9m to £10.0m).

Expenses

Total operational costs decreased by 38%, mainly due to sale of CM division. This excludes the one-off impairment charge of £6.1m. As part of cost of sales, third party commission decreased by 56.2%, due to agreements that are revenue contingent. Variable people costs, mainly related to retention bonus payments have increased by 56.4%.

|

|

2025 £’000 |

2024 £’000 |

|

Cost of sales – non-salaried staff costs (note 7) |

697 |

1,592 |

|

Fixed non-people costs |

7,462 |

11,235 |

|

Fixed people costs |

7,012 |

12,881 |

|

Variable people costs |

1,495 |

956 |

|

Impairment |

6,113 |

– |

|

Total |

22,779 |

26,664 |

Financial position and regulatory capital

Net assets reduced to £5.6m at 31 March 2025 (FY24: £14.3m).

The Investment Firms Prudential Regime (IFPR) applies to all solo-regulated MiFID investment firms and WH Ireland is a non-SNI (small and non-interconnected) MIFIDPRU investment firm.

Accordingly, the Group’s regulatory capital requirement is from its harm assessment as defined by the Financial Conduct Authority (FCA). In the prior year the Group carried out a placing to raise £5m by way of the issue of ordinary shares, to ensure that the Group’s own funds are in excess of its regulatory capital requirement. During the year, the sale of the CM division took place. This has had the effect of fixed overhead requirements and wind-down costs for the business falling.

Cost reduction exercises have been implemented during the year, including certain members of senior management agreeing to sacrifice a proportion of their salary in return for share options, alongside a collective consultation regarding headcount reduction.

In light of the likely sale of the WM business, the directors have assessed the going concern of the business and modelled the likely scenario. The Group would initiate a wind down in order to satisfy creditors and shareholders. In this scenario the Group would remain liquid and would retain sufficient cash to distribute to shareholders. As the intention is now complete an orderly wind down, the going concern basis of preparation is no longer appropriate. These financial statements are prepared on a non-going concern basis. Refer to note 1 for further details.

Future developments

Following the likely sale of the WM business the Group plans to initiate delisting and wind down proceedings. The decision to wind down the business is a strategic and voluntary one, and does not arise from financial distress or insolvency concerns. The wind-down is expected to be executed in a controlled and solvent manner, with full consideration for the interests of creditors and shareholders.

Accordingly, the Group has prepared the financial statements on a non-going concern basis.

Key Performance Indicators

The following financial and strategic measures have been identified as the key performance indicators (KPIs) of the Group’s overall performance for the financial year. The sale of the CM division had a significant effect on the following KPI’s.

|

1. GROUP ASSETS UNDER MANAGEMENT The total value of funds under management has a direct impact on the Group’s revenue.

-42%

|

|

|

2. TOTAL REVENUE The amount of revenue generated by WM and CM together is one of the key growth indicators.

|

|

|

3. DISCRETIONARY AND ADVISORY ASSETS UNDER MANAGEMENT (WM)

-22%

|

|

Dividends

The Board does not propose to pay a dividend in respect of the financial year (FY24: £nil).

Statement of Financial Position and Capital Structure

We have been in consultation with the FCA around the sale of the WM business. As the Group will no longer be running a financially regulated business, there will be no regulatory capital requirements that are to be met. At no time going forward in the period under consideration does WH Ireland Group Plc have a cash deficit or a regulatory capital deficit. It is concluded therefore that sufficient funds will be in place to continue the forecasted business model as envisaged and agreed with the Board and shareholders and that the firm is a non-going concern due to the expected wind down. As at 31 March 2025, total net assets were £5.6m (FY24: £14.3m) and net current assets £5.6m (FY24: £14.3m). Net cash at year-end was £3.5m (FY24: £4.9m).

Risks and Uncertainties

Risk appetite is established, reviewed and monitored by the Board. The Group, through the operation of its Committee structure, considers all relevant risks and advises the Board as necessary. The Group maintains a comprehensive risk register as part of its risk management framework encouraging a risk-based approach to the internal controls and management of the Group. The risk register covers all categories including human capital risk, regulatory risk, conduct (client) risk, competition, financial risk, IT and operational resilience risk and legal risk. Each risk is ranked on impact and likelihood and mitigating strategies are identified. In addition, the Executive Committee which is formed of the Executive Directors, the Heads of the business divisions, a representative from HR and Chief Risk and Compliance Officer meet to assess and monitor these. An Executive Risk Committee has recently been established to manage and monitor risks and report into the Board.

The Group outsources its internal audit function to BDO. The internal auditors formally report to Garry Stran, Chair of the Audit Committee with Richard Swain, Chief Risk and Compliance Officer, being the principal day to day contact.

Liquidity and capital risk

During the year the Group focused on managing the costs of its business and returning to growth and sustainable profitability whilst increasing its discretionary fee paying client base in WM to better fit the regulatory environment in which it operates.

To mitigate risk, the Group focused on ensuring that the financial position remains robust and suitably liquid with sufficient regulatory capital being maintained over the minimum common equity tier 1 capital requirements. Regulatory capital and liquid assets are monitored on a daily basis. Once the WM business is sold, the capital risks will no longer be relevant. The planned wind down scenario states that liquidity will be sufficient to fulfil obligations.

Operational risk

Operational risk is the risk of loss to the Group resulting from inadequate or failed internal processes, people and systems, or from external events.

Business continuity risk is the risk that serious damage or disruption may be caused as a result of a breakdown or interruption, from either internal or external sources, of the business of the Group. This risk is mitigated in part by the number of branches across the UK and the Group having business continuity and disaster recovery arrangements including business interruption insurance.

The Group seeks to ensure that its risk management framework and control environment is continuously evolving which Compliance and Risk monitor on an ongoing basis.

Credit risk

The Board takes active steps to minimise credit losses including formal new business approval, and the close supervision of credit limits and exposures, and the proactive management of any overdue accounts. Additionally, risk assessments are performed on an ongoing basis on all deposit taking banks and custodians and our outsourced relationships.

Regulatory risk

The Company operates in a highly regulated environment in the UK. The Directors monitor changes and developments in the regulatory environment and ensure that sufficient resources are available for the Group to implement any required changes. The impact of the regulatory environment on the Group’s management of its capital is discussed in note 25 of the financial statements.

Section 172 Statement

Broader Stakeholder Interests

Directors of the Group must consider Section 172 of the Companies Act 2006 which requires them to act in the way that would most likely promote the success of the Group for the benefit of all its stakeholders. The Board and its committees consider who its key stakeholders are, the potential impact of decisions made on them taking into account a wider range of factors, including the impact on the Company’s operations and the likely consequences of decisions made in the long-term. The Group’s key stakeholders and how the Board and the Group have engaged with them during the year is set out below.

Employees

The CEO and his management team on behalf of the Board engage with employees through a variety of methods including periodic ‘all staff’ updates, information and points of interest, staff forums, group meetings and Town Hall meetings. Further details can be found in the corporate social responsibility section on page 25 of the Annual Report.

Shareholders

Our shareholders have been pivotal in supporting the Group and its management team and Board. The Board recognise and frequently discuss the importance of good, open and constructive relationships with both potential new shareholders as well as existing shareholders and is committed to this communication. The way in which this has been achieved during the year has been by our Chief Executive Officer, supported by the management team, maintaining regular contact and meetings with individual and institutional shareholders, both existing and potential, and communicating and discussing shareholders’ views with the Board. A number of Board members and employees also hold the Group’s shares and regular communications are provided. Having one class of share capital ensures all shareholders are treated equally.

The Group’s strategy and results are presented to shareholders through meetings following announcements of the final and interim results. Shareholders are also invited to meet the Board and management team, who attend the Annual General Meeting. The annual report and accounts for the year ended 31 March 2025 along with all past accounts, regulatory communications and other material is set out on the Group’s website at https://www.whirelandplc.com/investor-relations.

Regulators

The Board maintains continuous and open communication with our regulators at the FCA as well as with the London Stock Exchange. Regular ongoing dialogue has continued through the CEO and CFO with the FCA who receive regular Management information. The FCA have approved the appointments of each member of the Management team and the Board members as required.

Clients

Our clients are fundamental to the business of the Group and the Board recognise that their interests are of paramount importance. Management of WM closely engage with clients to understand their objectives so that the service provided by the business is appropriate. The client’s profile and the suitability of the investment strategy provided is frequently assessed by our professional investment managers and this is supplemented by a second line of review from management and our compliance team. It is recognised that the status of our clients can and does change in line with the environment and vulnerable clients in particular are identified and discussed at management and at Committee level to ensure that they are provided with the best possible advice.

Suppliers, Community and Environment

The Board through its Executive Directors is keenly focused on its key supplier relationships and regularly challenges and reviews its arrangements. The Group openly encourages its offices and employees to engage in local charitable, community groups and other causes. Further detail can be found on page 26 of the Annual Report.

The Board recognises the firm’s duty to act in the best long-term interests of our clients which includes having investment practices that contribute to the preservation of our planet. The Board has had an active effort to continue on our path towards carbon neutrality by consuming less as an organisation, providing recycling points in our offices and planting a new tree for every new investment account opened. Further detail can be found on pages 27-28 of the Annual Report.

Each of the Board members consider that they have acted together, in good faith in a way most likely to promote the success of the Group for the benefit of its broader range of stakeholders as a whole taking into account section 172 (1) (a-f) of the Companies Act 2006.

Maintaining a reputation for high standards of business conduct

The Board supports a culture that encourages the group’s high standards which helps the Group deliver on its strategic objectives. The Board ensures adherence to policies that encourage high performance of employees and regularly receives updates on the group’s culture through engagement surveys and in the business updates.

Considering the Long Term

The Board outlines the Group’s strategy and oversees the framework of governance, risk management and internal controls to with the long-term success of the business in mind. The strategy is focused on developing the Group’s ability to service the long-term needs of its clients. Further detail can be found within the Strategic Report on pages 5 – 11 of the Annual Report. The group operates in a highly regulated environment. The identification, management and mitigation of risks to the group’s business is key to ensuring the delivery of its strategy over the longer term, and the consideration of risk plays an important part in decision-making.

Significant decisions have had to be made in the past year including the decision to sell the CM division last year and the likely sale of the WM business post year end. Following the successful sale of the WM business, an orderly wind down will take place. The Board has taken these decisions in consultation with stakeholders and believes this is the best strategy for the Group in the long term.

The Strategic Report on pages 5 – 11 of the Annual Report has been approved by the Board and signed on its behalf by:

S Jackson

Chief Finance Officer

26 September 2025

Consolidated statement of comprehensive income

|

|

|

Year ended |

|

Year ended |

|||

|

|

|

31 March 2025 |

|

31 March 2024 |

|||

|

|

Note |

£’000 |

|

£’000 |

|||

|

Net profit/(loss) on investments |

16 |

99 |

|

(583) |

|||

|

Release of deferred consideration |

23 |

– |

|

160 |

|||

|

Finance income |

8 |

12 |

|

– |

|||

|

Finance expense |

8 |

(12) |

|

– |

|||

|

Pre-tax profit/(loss) from continuing operations |

|

99 |

|

(423) |

|||

|

Taxation |

9 |

– |

|

12 |

|||

|

Post-tax profit/(loss) from continuing operations |

|

99 |

|

(411) |

|||

|

Loss from discontinued operations inc. tax |

6 |

(9,327) |

|

(5,528) |

|||

|

Loss and total comprehensive income for the year |

|

(9,228) |

|

(5,939) |

|||

|

Earnings per share |

11 |

|

|

|

|

||

|

From continuing operations |

|

|

|

|

|

||

|

Basic and diluted |

|

0.04p |

|

(0.23p) |

|

||

|

From discontinuing operations |

|

|

|

|

|

||

|

Basic and diluted |

|

(4.01p) |

|

(3.15p) |

|

||

|

Total |

|

|

|

|

|

||

|

Basic and diluted |

|

(3.97p) |

|

(3.38p) |

|

||

|

|

|

||||||

Notes on pages 47 to 82 of the Annual Report (and extracted below) are an integral part of these financial statements.

There were no items of other comprehensive income for the current year or prior years. The loss and total comprehensive income is 100% attributable to owners of the parent.

Consolidated and Company statement of financial position

|

|

|

|

|

|

|

|

31 March |

31 March |

|

|

|

2025 |

2024 |

|

|

Note |

£’000 |

£’000 |

|

ASSETS |

|

|

|

|

Non-current assets |

|

|

|

|

Intangible assets |

14 |

– |

– |

|

Goodwill |

13 |

– |

– |

|

Property, plant and equipment |

12 |

– |

– |

|

Investments |

16 |

– |

– |

|

Right of use asset |

17 |

– |

– |

|

Deferred tax asset |

18 |

|

|

|

|

|

– |

– |

|

Current assets |

|

|

|

|

Trade and other receivables |

19 |

3,777 |

5,098 |

|

Other investments |

20 |

84 |

1,544 |

|

Cash and cash equivalents |

21 |

3,459 |

4,902 |

|

Assets held for sale |

6 |

748 |

7,994 |

|

Total current assets |

|

8,068 |

19,538 |

|

Total assets |

|

8,068 |

19,538 |

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Trade and other payables |

22 |

(1,964) |

(3,232) |

|

Provisions |

23 |

(368) |

(1,676) |

|

Liabilities classified as held for sale |

6 |

(186) |

(293) |

|

Total current liabilities |

|

(2,518) |

(5,201) |

|

Non-current liabilities |

|

– |

– |

|

Total liabilities |

|

(2,518) |

(5,201) |

|

Total net assets |

|

5,550 |

14,337 |

|

|

|

|

|

|

Capital and reserves |

|

|

|

|

Share capital |

26 |

4,965 |

4,965 |

|

Share premium |

26 |

22,817 |

22,817 |

|

Other reserves |

|

981 |

981 |

|

Retained earnings |

|

(22,099) |

(13,312) |

|

Treasury shares |

27 |

(1,114) |

(1,114) |

|

Shareholders’ funds |

|

5,550 |

14,337 |

These financial statements were approved by the Board of Directors on 26 September 2025 and were signed on its behalf by:

S Jackson

Director

|

|

|

Company |

|

|

|

|

31 March |

31 March |

|

|

|

2025 |

2024 |

|

|

Note |

£’000 |

£’000 |

|

ASSETS |

|

|

|

|

Non-current assets |

|

|

|

|

Investment in subsidiaries |

15 |

532 |

19,848 |

|

Loan receivable |

27 |

79 |

1,114 |

|

Amounts owed from Group companies |

19 |

4,050 |

4,676 |

|

|

|

4,661 |

25,638 |

|

Current assets |

|

|

|

|

Trade and other receivables |

19 |

15 |

44 |

|

|

|

15 |

44 |

|

Total assets |

|

4,676 |

25,682 |

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Trade and other payables |

22 |

(529) |

(750) |

|

Provisions |

23 |

(354) |

(1,229) |

|

Total liabilities |

|

(883) |

(1,979) |

|

Total net assets |

|

3,793 |

23,703 |

|

|

|

|

|

|

Capital and reserves |

|

|

|

|

Share capital |

26 |

4,965 |

4,965 |

|

Share premium |

26 |

22,817 |

22,817 |

|

Other reserves |

|

228 |

228 |

|

Retained earnings |

|

(24,217) |

(4,307) |

|

Shareholders’ funds |

|

3,793 |

23,703 |

The notes on pages 47 to 82 of the Annual Report (and extracted below) are an integral part of these financial statements.

The Company has elected to take the exemption under Section 408 of the Companies Act 2006 not to present the Company statement of comprehensive income. The loss after tax of the Company for the year was £20.4m (FY24: £6.6m).

These financial statements were approved by the Board of Directors on 26 September 2025 and were signed on its behalf by:

S Jackson

Director

Consolidated and Company statement of cash flows

|

|

|

Group |

Company |

||||||

|

|

|

Year ended |

Year ended |

Year ended |

Year ended |

||||

|

|

|

31 Mar 2025 |

31 Mar 2024 |

31 Mar 2025 |

31 Mar 2024 |

||||

|

|

Notes |

£’000 |

£’000 |

£’000 |

£’000 |

||||

|

Operating activities: |

|

|

|

|

|

||||

|

Loss for the year |

|

(9,228) |

(5,939) |

(20,351) |

(6,600) |

||||

|

|

|

(9,228) |

(5,939) |

(20,351) |

(6,600) |

||||

|

Adjustments for non-cash items: |

|

|

|

|

|

||||

|

Depreciation and amortisation |

12, 14, 17 |

947 |

624 |

– |

– |

||||

|

Loss on disposal of property, plant and equipment |

12 |

111 |

– |

– |

– |

||||

|

Finance income |

8 |

(12) |

– |

– |

– |

||||

|

Movement in deferred consideration |

23 |

– |

(160) |

– |

(160) |

||||

|

Finance expense |

8 |

12 |

21 |

– |

– |

||||

|

Tax |

9 |

– |

(12) |

– |

– |

||||

|

Non-cash adjustment for share option charge |

7 |

441 |

338 |

441 |

338 |

||||

|

Non-cash adjustment for investment gains |

16, 20 |

(99) |

583 |

– |

– |

||||

|

Non-cash consideration for revenue |

|

(132) |

(761) |

– |

– |

||||

|

Non-cash adjustment for right of use assets |

17 |

20 |

– |

– |

– |

||||

|

Impairment |

13 |

6,113 |

– |

20,351 |

6,600 |

||||

|

Working capital changes: |

|

|

|

|

|

||||

|

Decrease / (increase) in trade and other receivables |

|

1,436 |

346 |

655 |

(4,851) |

||||

|

Decrease in trade and other payables and provisions* |

|

(2,575) |

(336) |

(1,096) |

(228) |

||||

|

Net cash (used in) / generated from operations |

|

(2,966) |

(5,296) |

– |

(4,901) |

||||

|

Income taxes received/(paid) |

9 |

– |

– |

– |

– |

||||

|

Net cash outflows from operating activities |

|

(2,966) |

(5,296) |

– |

(4,901) |

||||

|

Investing activities: |

|

|

|

|

|

||||

|

Acquisition of property, plant and equipment |

12 |

(10) |

(16) |

– |

– |

||||

|

Increase in loan receivables |

27 |

– |

– |

– |

(21) |

||||

|

Interest received |

8 |

12 |

12 |

– |

– |

||||

|

Cash received on disposal of investments and warrants |

16, 20 |

1,640 |

1,408 |

– |

– |

||||

|

Deferred consideration paid |

23 |

– |

(78) |

– |

(78) |

||||

|

Net cash generated from / (used in) investing activities |

|

1,642 |

1,326 |

– |

(99) |

||||

|

Financing activities: |

|

|

|

|

|

||||

|

Proceeds from issue of share capital |

26 |

– |

5,000 |

– |

5,000 |

||||

|

Purchase of own shares by Employee Benefit Trust |

|

– |

(21) |

– |

– |

||||

|

Lease liability payments |

17 |

(119) |

(340) |

– |

– |

||||

|

Net cash (used in) / generated from financing activities |

|

(119) |

4,639 |

– |

5,000 |

||||

|

Net (decrease) / increase in cash and cash equivalents |

|

(1,443) |

668 |

– |

– |

||||

|

Cash and cash equivalents at beginning of year |

|

4,902 |

4,234 |

– |

– |

||||

|

Cash and cash equivalents at end of year |

|

3,459 |

4,902 |

– |

– |

||||

Non-cash transaction:

* Prior year outstanding deferred consideration of £654k was settled via issue of shares (refer to note 23)

|

|

As at |

Cash flows |

Non-cash |

As at |

|

|

1 April 2024 |

|

changes |

31 March 2025 |

|

Group |

£’000 |

£’000 |

£’000 |

£’000 |

|

Lease liability |

293 |

(119) |

12 |

186 |

|

|

293 |

(119) |

12 |

186 |

Reconciliation of Group and Company liabilities arising from financing activities in the prior year:

|

|

As at |

Cash flows |

Non-cash |

As at |

|

|

1 April 2023 |

|

changes |

31 March 2024 |

|

Group |

£’000 |

£’000 |

£’000 |

£’000 |

|

Lease liability |

612 |

(340) |

21 |

293 |

|

|

612 |

(340) |

21 |

293 |

There are no Company liabilities arising from financing activities.

The notes on pages 47 to 82 of the Annual Report (and extracted below) are an integral part of these financial statements

Consolidated and Company statement of changes in equity

|

|

Share |

Share |

Other |

Retained |

Treasury |

Total |

|

|

capital |

premium |

reserves |

earnings |

shares |

equity |

|

Group |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Balance at 1 April 2023 |

3,116 |

19,014 |

981 |

(7,711) |

(1,093) |

14,307 |

|

Loss and total comprehensive income for the year |

– |

– |

– |

(5,939) |

– |

(5,939) |

|

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

Employee share option scheme |

– |

– |

– |

338 |

– |

338 |

|

New share capital issued* |

1,849 |

3,928 |

– |

– |

– |

5,777 |

|

Share issue costs |

– |

(125) |

– |

– |

– |

(125) |

|

Purchase of own shares by Employee Benefit Trust |

– |

– |

– |

– |

(21) |

(21) |

|

Balance at 31 March 2024 |

4,965 |

22,817 |

981 |

(13,312) |

(1,114) |

14,337 |

|

|

|

|

|

|

|

|

|

Loss and total comprehensive income for the year |

– |

– |

– |

(9,228) |

– |

(9,228) |

|

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

Employee share option scheme |

– |

– |

– |

441 |

– |

441 |

|

Balance at 31 March 2025 |

4,965 |

22,817 |

981 |

(22,099) |

(1,114) |

5,550 |

*See further details in note 26.

The notes on pages 47 to 82 of the Annual Report (and extracted below) are an integral part of these financial statements.

Retained earnings include £10k (2024: £10k) ESOT reserve.

|

|

Share |

Share |

Other |

Retained |

Treasury |

Total |

|

|

capital |

premium |

reserves |

earnings |

shares |

equity |

|

Company |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Balance at 1 April 2023 |

3,116 |

19,014 |

228 |

1,955 |

– |

24,313 |

|

Loss and total comprehensive income for the year |

– |

– |

– |

(6,600) |

– |

(6,600) |

|

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

Employee share option scheme |

– |

– |

– |

338 |

– |

338 |

|

New share capital issued (note 26) |

1,849 |

3,928 |

– |

– |

– |

5,777 |

|

Share issue costs |

– |

(125) |

– |

– |

– |

(125) |

|

Balance at 31 March 2024 |

4,965 |

22,817 |

228 |

(4,307) |

– |

23,703 |

|

|

|

|

|

|

|

|

|

Loss and total comprehensive income for the year |

– |

– |

– |

(20,351) |

– |

(20,351) |

|

Transactions with owners in their capacity as owners: |

|

|

|

|

|

|

|

Employee share option scheme |

– |

– |

– |

441 |

– |

441 |

|

Balance at 31 March 2025 |

4,965 |

22,817 |

228 |

(24,217) |

– |

3,793 |

The notes on pages 47 to 82 of the Annual Report (and extracted below) are an integral part of these financial statements.

The nature and purpose of each reserve, whether consolidated or Company only, is summarised below:

Share premium

The share premium is the amount raised on the issue of shares that is in excess of the nominal value of those shares and is recorded less any direct costs of issue.

Other reserves

Other reserves comprise a (consolidated) merger reserve of £753k (FY24: £753k) and a (consolidated and company) capital redemption reserve of £228k (FY24: £228k).

Retained earnings

Retained earnings reflect accumulated income, expenses, gains and losses, recognised in the statement of comprehensive income and the statement of recognised income and expense and is net of dividends paid to shareholders. It includes £10k (FY24: £10k) of ESOT reserve.

Treasury shares

Purchases of the Company’s own shares in the market are presented as a deduction from equity, at the amount paid, including transaction costs. That is, shares are shown as a separate class of shareholders’ equity with a debit balance. This includes shares in the Company held by the EBT or ESOT, both of which are consolidated within the consolidated figures.

Notes to the financial statements

1. General information

WH Ireland Group plc is a public company incorporated in the United Kingdom. The shares of the Company are traded on the AIM, a market of the London Stock Exchange Group plc. The address of its registered office is 24 Martin Lane, London, EC4R 0DR.

Basis of preparation

The consolidated and Parent Company financial statements have been prepared in accordance with International Accounting Standards as adopted by the UK and in accordance with the Companies Act 2006. The principal accounting policies adopted in the preparation of the consolidated financial statements are set out in note 3. The policies have been consistently applied to all the years presented, unless otherwise stated.

The consolidated financial statements are presented in British Pounds (GBP), which is also the Group’s functional currency. Amounts are rounded to the nearest thousand, unless otherwise stated.

Non-going concern basis of preparation

The financial statements of the Group have been prepared on a non-going concern basis. In making this assessment, the Directors have prepared detailed financial forecasts for the expected wind down period to June 2026 which consider the funding and capital position of the Group and Company. As the sale of the Wealth Management (WM) business is due to complete by the end of September 2025, the Group has resolved to initiate an orderly wind-down of its operations and pursue a voluntary delisting from the start of October 2025. As a result of these intentions, the basis of preparation as a going concern is no longer appropriate.

However, an orderly wind down will be achieved because:

– The Group has no outstanding external borrowings or material obligations that would compromise its ability to settle liabilities as they fall due.

– Forecast cash flows indicate that the Group will retain sufficient liquidity throughout the wind-down period.

– It is anticipated that, following the satisfaction of all known and expected liabilities, surplus funds will be available for distribution to shareholders.

The decision to wind down the business is a strategic and voluntary one, and does not arise from financial distress or insolvency concerns. The wind-down is expected to be executed in a controlled and solvent manner, with full consideration for the interests of creditors and shareholders. Accordingly, the Directors have a reasonable expectation that the Group has adequate resources to facilitate the orderly wind down. The wind down is expected to be completed by June 2026.

Management have been in consultation with the FCA around the sale of the WM business. As the Group will no longer be running a financially regulated business, there will be no regulatory capital requirements that are to be met. At no time going forward in the period under consideration, based on the analysis in this assessment, does WH Ireland Group Plc have a cash deficit or a regulatory capital deficit.

It is concluded therefore that sufficient funds will be in place to continue the forecasted business model as envisaged and agreed with the Board and shareholders and that the firm is able to complete an orderly wind down. No adjustments have been required to the amounts presented at 31 March 2025 as a result of the non-going concern basis. This is because the closing balance sheet is currently based on the recoverable amount for current assets and the amounts held for disposal groups for the WM disposal have already been written down to their recoverable amount. The wind down model takes these balance sheet values into account.

2. Adoption of new and revised standards

New and amended standards that are effective for the current year

The group has applied amended standards effective for the current period including changes to IAS 1 ‘Presentation of Finance Statements’ (effective 1 January 2024). None of the changes applied have had a material impact on the financial statements. The Directors do not expect any material impact on the financial statements in future periods from the adoption of new or revised accounting standards.

3. Significant accounting policies

Non-current assets (or disposal groups) held for sale and discontinued operations

Non-current assets (or disposal groups) are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use and a sale is considered highly probable. They are measured at the lower of their carrying amount and fair value less costs to sell.

An impairment loss is recognised for any initial or subsequent write-down of the asset (or disposal group) to fair value less costs to sell. A gain is recognised for any subsequent increases in fair value less costs to sell of an asset (or disposal group), but not in excess of any cumulative impairment loss previously recognised. A gain or loss not previously recognised by the date of the sale of the non-current asset (or disposal group) is recognised at the date of derecognition.

Non-current assets (including those that are part of a disposal group) are not depreciated or amortised while they are classified as held for sale. Interest and other expenses attributable to the liabilities of a disposal group classified as held for sale continue to be recognised.

Non-current assets classified as held for sale and the assets of a disposal group classified as held for sale are presented separately from the other assets in the statement of financial position. The liabilities of a disposal group classified as held for sale are presented separately from other liabilities in the statement of financial position.

A discontinued operation is a component of the entity that has been disposed of or is classified as held for sale and that represents a separate major line of business or geographical area of operations, is part of a single co-ordinated plan to dispose of such a line of business or area of operations, or is a subsidiary acquired exclusively with a view to resale. The results of discontinued operations are presented separately in the statement of profit or loss.

Basis of consolidation

Where the company has control over an investee, it is classified as a subsidiary. The company controls an investee if all three of the following elements are present: power over the investee, exposure to variable returns from the investee and the ability of the investor to use its power to affect those variable returns. Control is reassessed whenever facts and circumstances indicate that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the Company and its subsidiaries (“the Group”) as if they formed a single entity. Intercompany transactions and balances between group companies are therefore eliminated in full. The consolidated financial statements incorporate the results of business combinations using the acquisition method. In the statement of financial position, the acquiree’s identifiable assets, liabilities and contingent liabilities are initially recognised at their fair values at the acquisition date. The results of acquired operations are included in the consolidated statement of comprehensive income from the date on which control is obtained until the date on which control ceased.

In the Company’s accounts, investments in subsidiary undertakings are stated at cost less any provision for impairment.

Business combinations

All business combinations are accounted for by applying the purchase method. The purchase method involves recognition, at fair value, of all identifiable assets and liabilities, including contingent liabilities, of the subsidiary at the acquisition date, regardless of whether or not they were recorded in the financial statements of the subsidiary prior to acquisition. The cost of business combinations is measured based on the fair value of the equity or debt instruments issued and cash or other consideration paid, plus any directly attributable costs. Any directly attributable costs relating to business combinations before or after the acquisition date are charged to the statement of comprehensive income in the period in which they are incurred.

Goodwill arising on a business combination represents the excess of cost over the fair value of the Group’s share of the identifiable net assets acquired and is stated at cost less any accumulated impairment losses. The cash generating units to which goodwill is allocated are tested annually for impairment. Any impairment is recognised immediately in administrative expenses in the statement of comprehensive income and is not subsequently reversed. On disposal of a subsidiary the attributable amount of goodwill that has not been subject to impairment is included in the determination of the profit or loss on disposal.

Revenue

Wealth Management (WM)

Management and custody fees

Investment management fees are recognised in the period in which the related service is provided. It is a variable fee based on the average daily market value of assets under management and is invoiced on a calendar quarter basis in arrears. The performance obligation is satisfied over time as the contractual obligations are on ongoing throughout the period under contract. The revenue accrued but not yet invoiced is recognised as a contract asset.

Initial and ongoing advisory fees

Initial advisory fees are charged to clients on a fixed one-off fee agreement. The performance obligation is satisfied as the initial advice is provided. Ongoing advisory fees are variable fees based on the average daily market value of assets under management and invoiced on a calendar quarter basis in arrears. Both initial and ongoing advisory fees are recognised in the period in which the related service is provided. The performance obligation of ongoing advice is satisfied over time as the contractual obligations are ongoing throughout the period under contract. The revenue accrued but not yet invoiced is recognised as a contract asset.

Commission and transaction charges

Commission is recognised when receivable in accordance with the date of settlement. It is a variable fee based on a percentage of the transaction and therefore the performance obligation is satisfied at the date of the underlying transaction. The transaction price is calculated based on the agreed percentage of the underlying consideration of the trade. The underlying consideration being the number of shares multiplied by the share price at the time of the underlying transaction.

Capital Markets (CM)

Commission

Brokerage commission is recognised when receivable in accordance with the date of settlement. It is a variable fee based on a percentage of the transaction and therefore performance obligation is satisfied at the date of the underlying transaction. The transaction price is calculated based on the agreed percentage of the underlying consideration of the trade. The underlying consideration being the number of shares multiplied by the share price at the time of the underlying transaction.

Corporate finance advisory fees

Corporate finance advisory fees are fixed fees agreed on a deal by deal basis and might include non-cash consideration received in the form of shares, loan notes, warrants or other financial instruments recognised at the fair value on the date of receipt and therefore the performance obligation is satisfied over time when the Group has met the performance obligations per the contract.

Retainer fees

Retainer fees are recognised over the length of time of the agreement. Fees are fixed and invoiced quarterly in advance based on the agreed engagement letter. The performance obligation is satisfied over time as the contractual obligations are on ongoing throughout the period under contract. The deferred revenue is recognised as a contract liability.

Corporate placing commissions

Corporate placing commissions are variable fees agreed on a deal-by-deal basis based on a percentage of the funds raised as part of a transaction. This includes non-cash consideration received in the form of shares, loan notes, warrants or other financial instruments recognised at the fair value on the date of receipt. Given that fees related to this work are success based, there is a significant risk of reversal of the variable revenue and therefore the performance obligation is satisfied at a point in time when the transaction is completed. The combination of corporate placing commissions and corporate finance advisory fees are referred to as corporate success fees.

Employee benefits

The Group contributes to employees’ individual money purchase personal pension schemes. The assets of the schemes are held separately from those of the Group in independently administered funds. The amount charged to the statement of comprehensive income represents the contributions payable to the schemes in respect of the period to which they relate.

Short-term employee benefits are those that fall due for payment within 12 months of the end of the period in which employees render the related service. The cost of short-term benefits is not discounted and is recognised in the period in which the related service is rendered. Short-term employee benefits include cash-based incentive schemes and annual bonuses.

Share-based payments

The share option programmes allow Group employees to receive remuneration in the form of equity-settled share-based payments granted by the Company.

The cost of equity-settled transactions with employees is measured by reference to the fair value at the date at which they are granted. The fair value of the options granted is measured using an option valuation model. The cost of equity-settled transactions is recognised, together with a corresponding increase in equity, over the period in which the performance or service conditions are fulfilled (the vesting period), ending on the date on which the relevant employees become fully entitled to the award (the vesting date). The cumulative expense recognised for equity settled transactions, at each reporting date until the vesting date, reflects the extent to which the vesting period has expired and the Group’s best estimate of the number of equity instruments that will ultimately vest. The statement of comprehensive income charge or credit for a period represents the movement in cumulative expense recognised at the beginning and end of that period.

Where the terms of an equity-settled award are modified, an incremental value is calculated as the difference between the fair value of the repriced option and the fair value of the original option at the date of re-pricing. This incremental value is then recognised as an expense over the remaining vesting period in addition to the amount recognised in respect of the original option grant.

Where an equity-settled award is cancelled or settled (that is, cancelled with some form of compensation) it is treated as if it had vested on the date of cancellation and any expense not yet recognised for the award is recognised immediately.

However, if a new award is substituted for the cancelled award and is designated as a replacement award on the date that it is granted, the cancelled and new awards are treated as if they were a modification of the original award, as described in the previous paragraph. Any compensation paid up to the fair value of the award is accounted for as a deduction from equity. Where an award is cancelled by forfeiture, when the vesting conditions are not satisfied, any costs already recognised are reversed (subject to exceptions for market conditions).

In all instances, the charge/credit is taken to the statement of comprehensive income of the Group or Company by which the individual concerned is employed.

Employee Share Ownership Trust (ESOT)

The Company has established an ESOT. The assets and liabilities of this trust comprise shares in the Company and loan balances due to the Company. The Group includes the ESOT within these consolidated Financial Statements and therefore recognises a Treasury shares reserve in respect of the amounts loaned to the ESOT and used to purchase shares in the Company. Any cash received by the ESOT on disposal of the shares it holds, will be used to repay the loan to the Company.

The costs of purchasing Treasury shares are shown as a deduction against equity. The proceeds from the sale of own shares held increase equity. Neither the purchase nor sale of treasury shares leads to a gain or loss being recognised in the consolidated statement of comprehensive income.

Income taxes

Income tax on the profit or loss for the years presented, comprising current tax and deferred tax, is recognised in the statement of comprehensive income except to the extent that it relates to items recognised directly in equity, in which case it is recognised in equity.

Current tax is the expected tax payable on the taxable income for the year, using rates enacted or substantively enacted at the reporting year-end date and any adjustment to tax payable in respect of previous years.

Deferred tax is provided for temporary differences, at the reporting year-end date, between the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes. The following temporary differences are not provided for;

· goodwill which is not deductible for tax purposes;

· the initial recognition of assets or liabilities that affect neither accounting nor taxable profit; and

· temporary differences relating to investments in subsidiaries to the extent that they will probably not reverse in the foreseeable future.

The amount of deferred tax provided is based on the expected manner of realisation or settlement of the carrying amount of assets and liabilities, using tax rates enacted or substantively enacted at the reporting period end date (note 19).

A deferred tax asset is recognised for all deductible temporary differences and unused tax losses only to the extent that it is probable that future taxable profits will be available against which the assets can be utilised.

Plant and equipment

Plant and equipment is stated at cost less accumulated depreciation and impairment. Depreciation is calculated, using the straight-line method, to write down the cost or revalued amount of plant and equipment over the assets’ expected useful lives, to their residual values, as follows:

Computers, fixtures and fittings – 4 to 7 years

Intangible assets

Measurement

Intangible assets with finite useful lives that are acquired separately are measured, on initial recognition at cost. Following initial recognition, they are carried at cost less accumulated amortisation and any accumulated impairment. The cost of intangible assets acquired in a business combination is their fair value at the date of acquisition.

Intangible assets other than goodwill are amortised over the expected pattern of their consumption of future economic benefits, to write down the cost of the intangible assets to their residual values as follows:

Client relationships – 10 to 12 years

Brand – 2 years

The amortisation period and method for an intangible asset are reviewed at least at each financial year end. Changes in the expected useful life or the expected pattern of consumption of future economic benefits embodied in the asset or its residual value are accounted for by changing the amortisation period or method.

Impairment

The carrying amounts of the Group’s intangible assets, excluding goodwill, are reviewed when there is an indicator of impairment and the asset’s recoverable amount is estimated.

The recoverable amount is the higher of the asset’s fair value less costs to sell (or net selling price) and its value-in-use. Value-in-use is the discounted present value of estimated future cash inflows expected to arise from the continuing use of the asset and from its disposal at the end of its useful life. Where the recoverable amount of an individual asset cannot be identified, it is calculated for the smallest cash-generating unit (CGU) to which the asset belongs. A CGU is the smallest identifiable group of assets that generates cash inflows independently.

When the carrying amount of an asset (or CGU) exceeds its recoverable amount, the asset (or CGU) is considered to be impaired and is written down to its recoverable amount. An impairment loss is immediately recognised as an expense. Any subsequent reversal of impairment credited to the statement of comprehensive income shall not cause the carrying amount of the intangible asset to exceed the carrying amount that would have been determined had no impairment been recognised.

Impairment of assets

Goodwill and other intangible assets that have an indefinite life are not subject to amortisation, they are tested annually for impairment. Other assets are tested for impairment when any changes in circumstance indicate the carrying amount is possibly not recoverable. An impairment loss is recognised when the asset’s carrying amount exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and the value in use. Goodwill is allocated to cash generating units for the purpose of assessing impairment, assets (excluding goodwill) are grouped together based on the assets that independently generates cash flow whose cash flow is largely independent of the cash flows generated by other assets (cash generating units).

Leased assets

Measurement and recognition of leases as a lessee

For any new lease contracts entered into on or after 1 April 2019, as permitted under IFRS 16, the Group recognises a right of use asset and a lease liability except for:

· Leases with a term of 12 months or less from the lease commencement date

· Leases of low value assets

Lease liabilities are measured at the present value of the unpaid lease payments discounted using an incremental borrowing rate.

Right of use assets are initially measured at the amount of the lease liabilities plus initial direct costs, costs associated with removal and restoration and payments previously made. Right of use assets are amortised on a straight-line basis over the term of the lease.

Lease liabilities are subsequently increased by the interest charge using the incremental borrowing rate and reduced by the principal lease.

Financial instruments

Financial assets and financial liabilities are recognised in the Group’s balance sheet when the Group becomes a party to the contractual provisions of the instrument.

Financial assets and liabilities

Investments are recognised and derecognised on the trade date where the purchase or sale of an investment is under a contract whose terms require delivery of the investment within the timeframe established by the market concerned, and are initially measured at fair value, plus transaction costs, except for those financial assets classified as at fair value through profit or loss, which are initially measured at fair value.

Assets and liabilities are presented net where there is a legal right to offset and an intention to settle in that way.

The three principal classification categories for financial assets are: measured at amortised cost, fair value through other comprehensive income (FVOCI) and fair value through profit or loss (FVTPL). The classification of financial assets under IFRS 9 is generally based on the business model in which a financial asset is managed and its contractual cash flow characteristics.

Financial assets are not reclassified after their initial recognition unless the Group changes its business model for managing financial assets, in which case all affected financial assets are reclassified on the first day of the first reporting period following the change in the business model.

A financial asset is measured at amortised cost if it meets both of the following conditions and is not designated as at FVTPL:

· it is held within a business model whose objective is to hold assets to collect contractual cash flows; and

· its contractual terms give rise on specified dates to cash flows that are solely payments of principal and interest on the principal amount outstanding.

On initial recognition of an equity investment that is not held for trading, the Group may irrevocably elect to present subsequent changes in the investment’s fair value in OCI. This election is made on an investment-by-investment basis.

All financial assets not classified as measured at amortised cost or FVOCI as described above are measured at FVTPL. On initial recognition, the Group may irrevocably designate a financial asset that otherwise meets the requirements to be measured at amortised cost or at FVOCI as at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise.

Assets held at FVTPL are subsequently measured at fair value. Net gains and losses, including any interest or dividend income, are recognised in profit or loss.