Macro

As in the previous quarter, economic data was mixed in Q4, and the picture was made murkier by the longest US government shutdown in history, which limited data availability. Despite the shutdown, the Federal Reserve had sufficient conviction that inflation is contained and the labour market weakness required another interest rate cut. This interest rate cut, alongside a much stronger-than-anticipated Gross Domestic Product (GDP) print, helped prop up the market. The 4.3% economic growth registered for Q3 was the strongest figure in two years and easily beat forecasts of 3.3%. However, AI capital expenditure remains a large part of this growth, and the rising unemployment rate, combined with low consumer sentiment, reinforces the Federal Reserve’s view that the economy is softening.

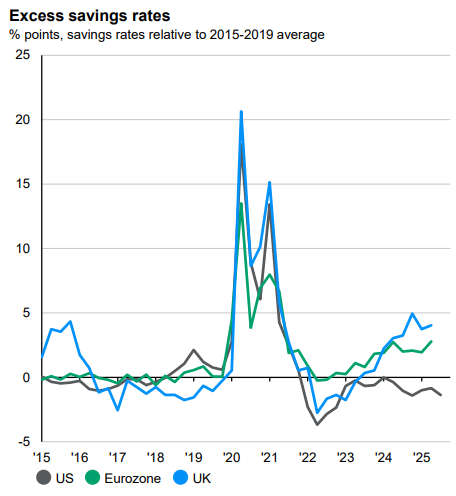

Here in the UK, data was particularly weak, largely due to the uncertainty surrounding the Budget. However, in a number of cases, this weakness can be attributed to a temporary deterioration associated with Budget uncertainty and should improve going forward now that this uncertainty has been removed. Labour market weakness appears deeper rooted, with unemployment hitting the highest level since 2021. The silver lining is that with a well-entrenched disinflationary trend, the Bank of England (BoE) should be able to continue supporting the economy with interest rate cuts. The savings rate is still elevated relative to Europe, and especially the US, and as the return on cash depletes, there will be a greater propensity to consume, which will be very supportive for the UK economy.

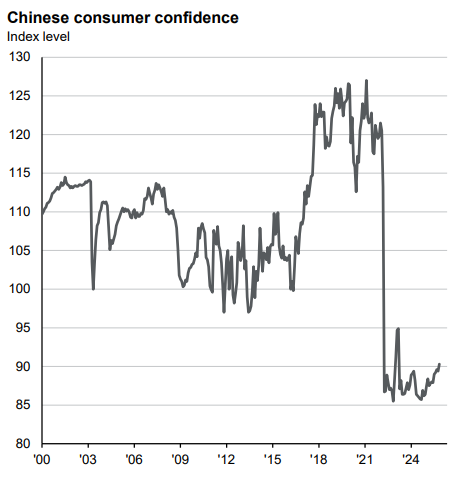

In Asia, China’s data remains weak, with retail sales, industrial production and fixed asset investment coming in weaker than expected for November. GDP growth consequently dipped slightly below the 5% target, but consumer confidence is starting to pick up from very low levels, and the period of deflation might be in the back mirror as November’s inflation data reached the highest level since February 2024.

The Indian economy continues to perform strongly, with Q3 GDP growth of 8.2% making the US’s impressive figure for the same period look ordinary. Meanwhile, Japan’s GDP growth eased to a fairly muted 1.1%.

Markets

Equity markets registered another solid quarter of performance despite numerous pullbacks and the absence of a Santa Rally. For the year as a whole, the S&P 500 registered a third successive year of double-digit returns. Incredibly, the 17.88% returns for the S&P 500 paled in comparison to many other markets. Back home, the FTSE 100 registered a very impressive 25.82%, whilst South Korea returned a meteoric 75.60% and Spain surged 60.90%. The commodity-focused Brazil also gained a very respectable 33.95% as gold, silver and copper surged.

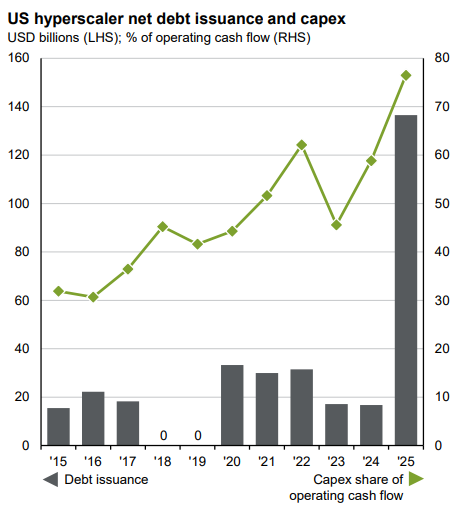

Similar to last quarter, equity market volatility remains well below average, and bond market volatility is sitting at 2021 lows. However, volatility did spike at times over the quarter as equity markets corrected. The corrections came from fears of history repeating itself in the form of the Great Financial Crisis in 2008 or the Dot Com Bubble in 2000. For the former, the bankruptcy of two US regional banks sparked concerns of financial contagion, and in the case of the latter, the elevated valuations of AI stocks and the initiation of financing capital expenditure with debt instead of solely cash flow provided the red flags. As the majority of free cash flow from AI stocks or hyperscalers is now being directed to AI capex, they will increasingly have to turn to debt markets if they want to direct incremental dollars to AI capex.

Impressively, markets shook off these fears and investors continued to reap the benefits from a ‘buy the dip’ strategy. AI chip-maker Nvidia consequently pressed on to become the first company in history to hit a market capitalisation of $5 trillion.

The UK’s outperformance over the US for the year as a whole was helped by the outperformance achieved in the final quarter. This came courtesy of improved clarity after the Autumn Budget, an interest rate cut and strong performance from mining stocks as commodity prices moved higher. Gold continued to reap the benefit of central banks diversifying away from the dollar, which saw its largest annual slump since 2017. Silver and copper were also shining brightly, benefiting from accelerating demand linked to AI and the energy transition, as well as supply issues in copper’s case.

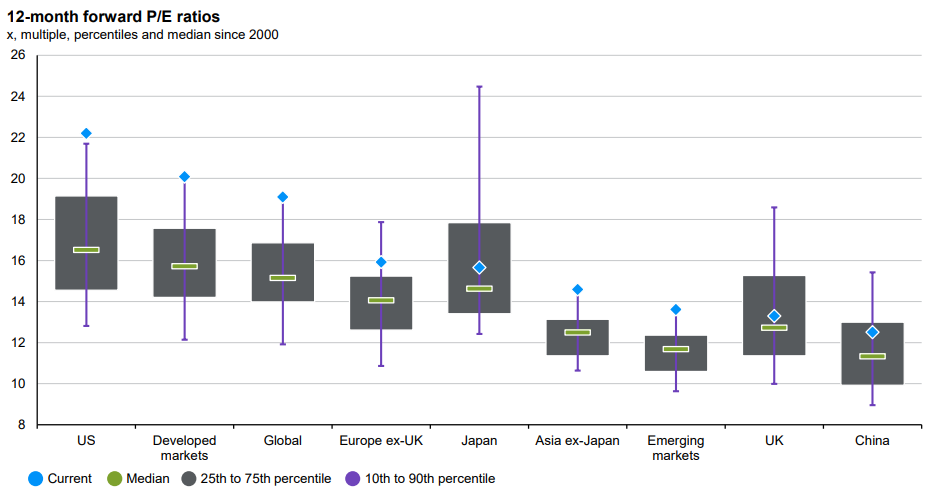

In Asia, Japan elected their first female prime minister, who implemented a ¥21.3 trillion fiscal package, which, alongside another interest rate hike from the Bank of Japan, led to the 10-year government bond yield surging above 2% for the first time this century as debt concerns mount. The equity market reaction was more mixed, but Japanese equities had a strong year as a whole. Despite weak economic performance, China’s market performed strongly as investors anticipated a recovery and shifted to the more palatable valuations in Chinese tech compared to the US. India showed the reverse trend, with strong economic performance still resulting in India being one of the weakest markets in 2025 as elevated valuations limited further upside.

Positioning and Outlook

Global markets have had a stellar year, which has resulted in valuations looking stretched across the board, and spreads are similarly very tight in fixed income. This is where diversification is key, and our exposure to alternatives, including commodities and hedge funds, is key to managing risk. Alternatives offer low correlation to equities and fixed income, which limits portfolio losses in an equity market downturn. Within our equity and fixed income exposure, we are also positioned in areas where valuations and spreads are more palatable. For example, we maintain our overweight position in UK stocks, which is one of the few regions that still trades in line with its historical median valuation.

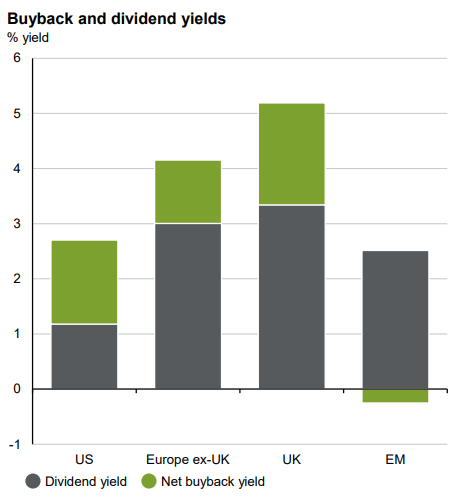

The UK also still offers a very attractive all-in yield, with an impressive combination of buybacks and dividends.

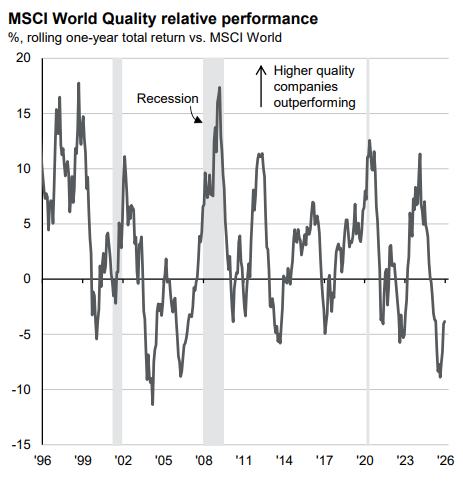

Turning to portfolio activity, we exited our yen position as we lost conviction in the prospect for the yen to mean-revert to its historical average, given heightened debt concerns after the stimulus package announced by the recently appointed prime minister of Japan. We also saw better prospects elsewhere. Notably, high-quality stocks, which have been very much out of favour, registered their second-worst year of relative performance on record in 2025. This is starting to reverse, and we expect quality stocks to continue to outperform over the long run, as has historically occurred.

In the sustainable portfolios, we added hedge fund exposure to provide greater resilience to the portfolio in market sell-offs. We also added exposure to two exciting regional growth stories in the shape of India and Vietnam.

Markets have been relatively sanguine in 2025, and volatility will likely be more elevated in 2026, but as long-term investors, we welcome periods of volatility and will use it to add to areas where we have the most conviction.

Kind Regards,

Robert Matthews, Head of Research and Chartered Wealth Manager

Important Information:

For more industry terms and definitions, visit our glossary here.

All Index data figures are sourced by Morningstar and correct as at 31 December 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.