Macro

Global economic data was mixed in Q3, with strength in August waning as we moved into September, and the majority of Purchasing Managers Indices (PMI) weakened. Gross Domestic Product (GDP) data, however, was revised higher in the US, Japan and the UK. Data in China was very weak, but as with the US jobs data, the market was able to look past this. The Federal Reserve (Fed) helped market strength by cutting interest rates, but the market may be a little too optimistic on the number of interest rate cuts still to come, given that the economy is still holding up relatively well.

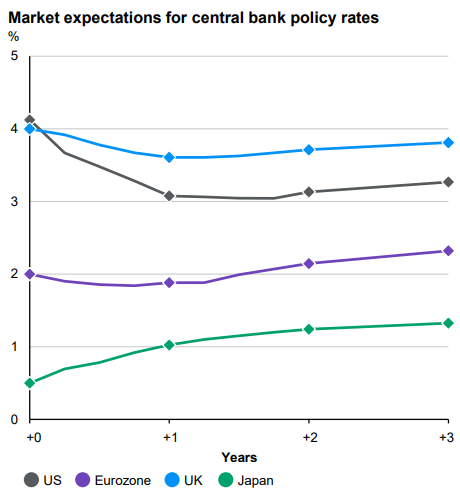

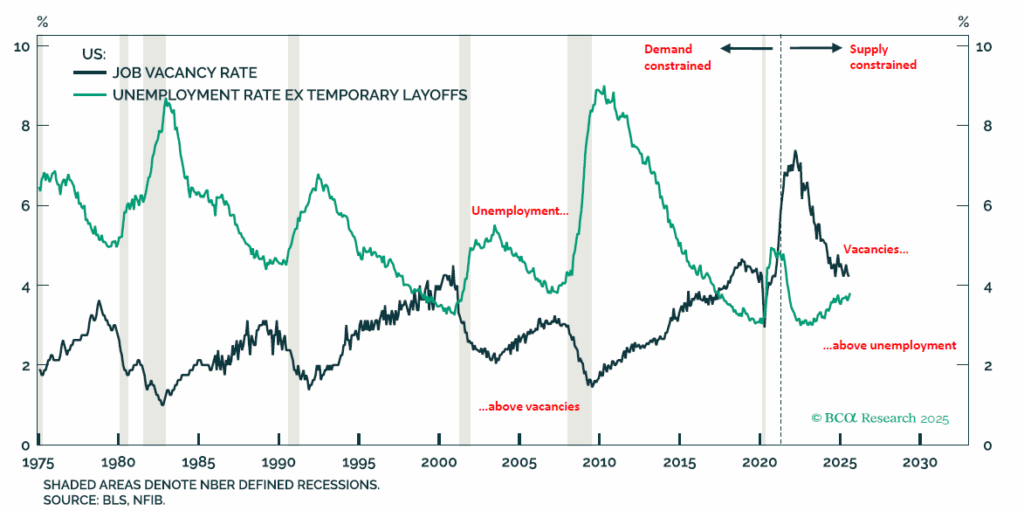

The US consumer represents 70% of the economy, and the high-income consumer is in particularly good shape, given their greater exposure to stocks. The S&P 500 is now up 86% since the start of the current bull market in October 2022, and the strength since Liberation Day helped consumer spending growth in Q2 to rise to a healthy 2.5%. This, in turn, played its part in GDP growth approaching its fastest pace in nearly two years. Encouragingly, whilst government debt is elevated, household debt is at its lowest in over 60 years as a proportion of net worth. With growth accelerating and earnings inflecting higher, there appears to be limited reasons for the Fed to cut interest rates four times in the next 12 months. The market believes that the sharp drop-off in job vacancies provides enough impetus, but as the chart below demonstrates, there has so far been limited translation into an increase in unemployment thus far.

We believe this will remain the case, given the drop-off in labour supply associated with the clamp-down in immigration and more senior personnel dropping out of the labour force. As unemployment rather than job vacancies is half of the Fed’s mandate, without a sharp increase in unemployment, there should be minimal interest rate cuts for now. This is especially the case when looking at the stickiness of inflation, which is the other half of their mandate.

Markets

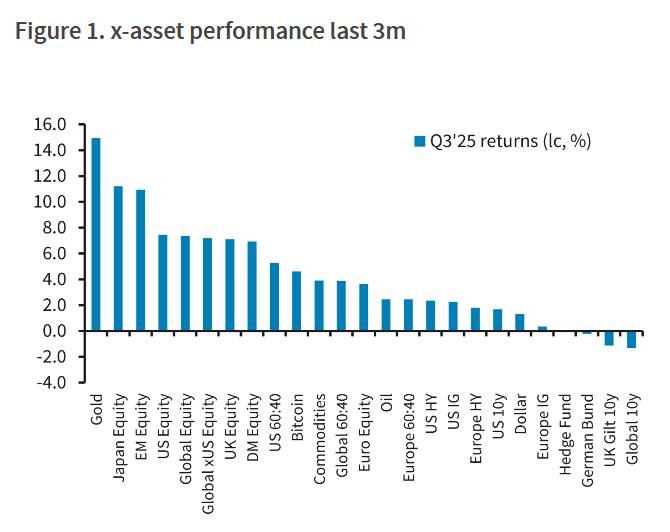

Q3 exhibited a mere fraction of the volatility that we witnessed at the start of Q2, when the ‘Liberation Day’ tariffs were announced. The start of Q3 instead saw Japan and Europe striking a tariff deal with the US, providing certainty to the market that was far from present at the start of Q2. Equity market volatility remains well below average, and bond market volatility is sitting at 2022 lows. This is truly remarkable, given the weak seasonality present in the summer months. September has historically been the worst month of the year, but this rally continues to defy historical norms. The quarter’s only sell-off was brief and shallow, with fears that the AI ‘bubble’ was bursting, but the Federal Reserve’s speech in Jackson Hole removed any market pessimism. AI optimism was soon further entrenched by software giant Oracle, which forecasted that its cloud business revenues would exceed half a trillion dollars in the next few months. This announcement was rewarded by a mouth-watering $250bn market cap move in one day, which propelled Oracle’s CEO, Larry Ellison, past Elon Musk to become the world’s richest person. US markets, therefore, continued their strength over the quarter as the AI rally, and prospect of interest rate cuts outweighed labour market weakness. China also benefited from strength in the tech sector as e-commerce giant, Alibaba, announced a partnership with chip-maker, Nvidia. The government’s anti-involution strategy, which focuses on putting an end to deflation, also led the market higher, providing hope for the future and drawing focus away from the current bleak economic data.

Gold shone brightest over the quarter as fiscal concerns and threats to the Fed’s independence continued. The precious metal has risen close to 50% so far in 2025 and is on track for its best year since 1979. Still, copper’s quarter was more eventful, with a price decline in excess of 20% in a single hour after Trump excluded the refined metal from tariffs. September then saw the metal have its strongest month in a year after an Indonesian mine took 3.5% of the global copper supply offline following a mudslide.

The fiscal concerns that propped up gold were particularly present in France, Japan and the UK, and long-end bond yields drifted higher as a result. Japan’s equity market performed well despite this, courtesy of the associated weakening of the yen and continued progress on corporate reforms. The UK also saw its best quarter since 2022 despite a drop in confidence ahead of November’s Budget in the UK, which could see the Labour government ignore their manifesto and raise income taxes in an effort to allay the fiscal concerns. Meanwhile, France lagged due to Bayrou’s government toppling.

Positioning and Outlook

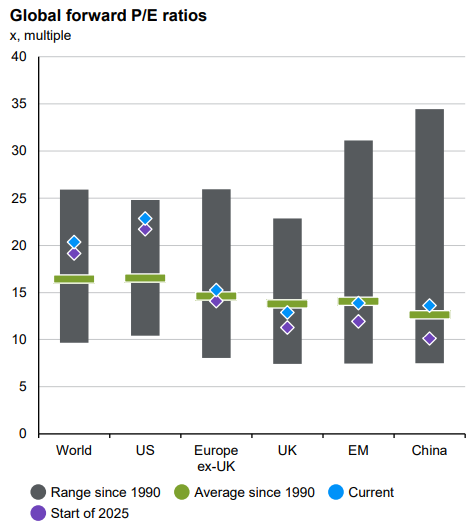

The bull market shows no signs of slowing for now, but the performance this year hasn’t been all earnings driven and valuations have therefore continued to drift higher. There are consequently few undervalued areas and the UK is now the only major region trading below its historical average.

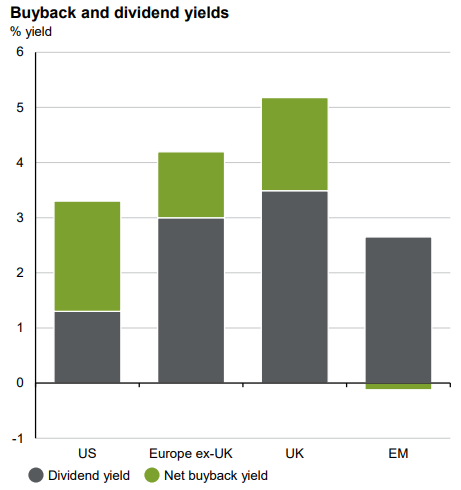

The UK also offers the most attractive all-in yield, with an impressive combination of buybacks and dividends. Valuations aren’t a problem until they are, and the bull market could continue for the foreseeable future. However, it is our job to manage this risk, and the risk return on offer in the UK is very attractive and offers good diversification away from the elevated valuations of the broader markets. Commodities have also offered strong returns and crucial diversification in this environment. This diversification has by no means compromised return, with gold generating close to 50% returns this year and continuing to climb higher. Despite the strong returns witnessed in commodities and the UK, the prospects for both look very attractive going forward.

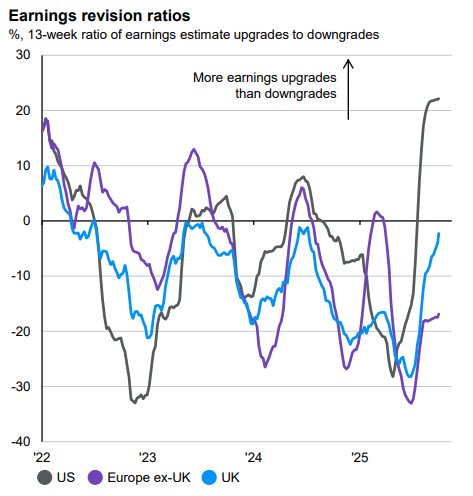

We also remain cautiously optimistic about performance in the US, given the accelerating economic growth and earnings revisions inflecting higher. However, there could be a short-term pullback as the market adjusts to the prospect of fewer interest rate cuts or the government shutdown, which looks likely to occur on 1 October, drags on for a number of weeks, and the market has to work with a depleted amount of data on the US economy and, importantly, jobs data.

We reduced our yen exposure and increased our commodities exposure, given the continued waning of supply in commodities, like copper, whilst demand accelerates courtesy of AI and the energy transition. We also added to an instrument that provides inflation-protection through index-linked bonds and gold, which is increasingly important given the incentive for governments to inflate away their bloated debt piles.

In the sustainable portfolios, we enacted two fund switches after a period of lacklustre performance and a management change.

As ever, and as long-term investors, we welcome periods of volatility and will use them to add to areas where we have the most conviction.

Kind Regards,

Robert Matthews, Head of Research and Chartered Wealth Manager

Important Information:

For more industry terms and definitions, visit our glossary here.

All Index data figures are sourced by Morningstar and correct as at 30 September 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.