Summary

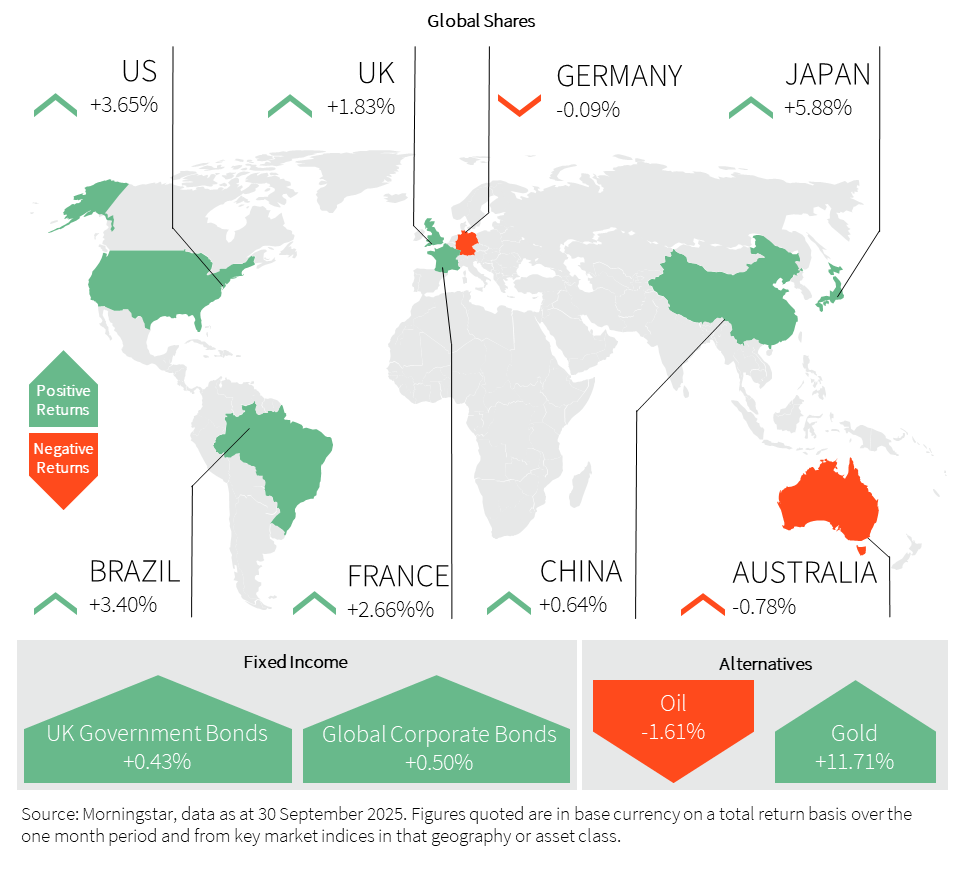

Global markets gained nearly 4% in the month, led by strong performances from the US and Emerging Markets. The lack of retaliation to US tariffs and ongoing trade diversion have, so far, preserved global growth prospects since “Liberation Day” in April. A key pivot came with the Fed’s 0.25% interest rate cut after a nine-month pause, with markets pricing in further easing over the next two meetings. The combination of easing financial conditions, a weaker dollar, and resilient global growth created an ideal backdrop for equities.

Emerging Markets outperformed developed markets, rising 7% over the month. US small and mid-cap stocks also responded positively. However, earnings growth remains concentrated. Mega-cap tech names linked to the AI boom continue to drive earnings upgrades for the cap-weighted S&P 500, while the equal-weighted index faces downward revisions. The $100bn “circular” deal between Oracle, Nvidia, and OpenAI reignited exuberance around AI and temporarily eased concerns over capital returns.

European markets posted more modest gains of over 2%. The Eurozone fared slightly better, supported by a balanced macro backdrop and ongoing fiscal expansion, particularly in Germany. Strong performance in September helped the UK register its best quarter since 2022 despite the upcoming November Budget and looming tax rises weighing on consumer confidence and business sentiment.

Meanwhile, gold recorded another month of double-digit gains, driven by falling US interest rates, dollar weakness, and rising geopolitical tensions. Russian incursions into NATO airspace and the coordinated recognition of Palestinian statehood by three G7 nations have sharpened global focus on defence spending.

Looking ahead, market volatility is expected to rise as the US government shutdown unfolds, alongside renewed tariff threats on targeted sectors and rising cost pressures starting to ripple through earnings and consumer demand.

United Kingdom (UK)

September presented the UK economy with persistent challenges stemming from elevated inflation, which in turn restricted further monetary easing. Against this backdrop, the FTSE 100 index posted a resilient month of performance.

The primary economic focus in September was the Bank of England’s (BoE) interest rate decision. The Monetary Policy Committee (MPC) voted by a majority of 7–2 to maintain interest rates at 4.0%. This hold came after a series of cuts in the preceding months, reflecting the MPC’s renewed caution over persistent inflationary pressures.

Although underlying disinflation continued, the 12-month Consumer Price Index (CPI) inflation remained elevated, holding steady at 3.8% in August (the last reported figure for the month prior to the MPC meeting). Forecasters, including the BoE, widely anticipated a slight rise in the September CPI figure, potentially peaking at 4.0%, before beginning a steadier decline towards the 2% target in 2026. This “hump” in price pressures, driven partly by global factors like rising food prices, was a central reason for the interest rate decision.

Underlying UK GDP growth was still considered subdued. While the better-than-expected first half of 2025 led to modest upward revisions in full-year GDP forecasts, the second half is expected to be slower. The labour market continued to weaken, with the unemployment rate ticking up.

The FTSE 100’s performance demonstrated the market’s resilience, even as interest rate cuts paused and domestic economic uncertainty lingered. The index benefited from a mix of defensive and commodity stocks. A weaker pound, a theme that re-emerged in September, provided a tailwind for the index’s internationally focused constituents, which earn a significant portion of their revenue in dollars. Mining and commodity companies generally performed well, supported by commodity price movements. A surge in the price of gold to another record high above $3,800 per ounce and silver to a 14-year peak propelled precious metal miners to the top of the performance charts. Gold and silver miner, Fresnillo, was the top performer, with its stock price rising by a staggering 32.0% in September. Meanwhile, copper miner, Antofagasta, also performed exceptionally well, rising by 28.3%. Pharmaceutical giant, AstraZeneca, was a major gainer, leading the index after promising developments in their clinical trials. Conversely, some domestically focused stocks faced pressure. Food ingredients provider, Tate & Lyle, saw its shares slump following a warning of slowing market demand, highlighting the fragility in parts of the consumer sector. The FTSE 250 and AIM Indices also ended the month in positive territory.

United States (US)

The month of September presented a complex and often counter-intuitive picture for the US economy and financial markets. While economic indicators pointed toward a continued slowdown, the major stock indices, notably the S&P 500 and the NASDAQ Composite, posted a rare and uncharacteristically strong performance for a month historically known for volatility and weakness.

The most significant economic event was the Federal Reserve’s (Fed) decision to cut its benchmark interest rate by 0.25%. This marked the first interest rate cut in a long cycle of tightening and signalled a pivotal shift in the Fed’s focus toward mitigating risks to the labour market, despite the persistent inflation. This easing signal was a major factor in market performance.

The labour market continued its gradual cooling trend. While the official unemployment rate remained relatively low, job creation has slowed significantly. The upcoming September jobs report (scheduled for release in early October) is widely anticipated to show a modest gain, following disappointing figures in the preceding months. Inflation remained a persistent concern. Compounding the economic backdrop was the looming threat of a US government shutdown. While historically, short-lived shutdowns have had a muted long-term market impact, the political rhetoric and proposed permanent federal job cuts add a layer of uncertainty.

The Trump administration’s trade policy remained a dominant geopolitical theme. New tariffs were announced in September on select categories, including pharmaceuticals, household furnishings, and heavy trucks. These actions sustained the high level of trade protectionism that began early in the year.

Europe

The region rose 2.6% this month, trailing the broader world, index which was lifted primarily by gains in Emerging Markets and the US. Unlike other major central banks, the European Central Bank (ECB) remains in a relatively comfortable position. Inflation has returned to target levels and is well anchored, and the economy has shown greater resilience than previously anticipated. Year-to-date, the euro has strengthened by mid-double against the US dollar, leaving room for further gains. The ECB kept rates unchanged, but the door to additional cut is not entirely closed. Any downside shock, such as a surge in the euro pushing down on inflation, could prompt a more accommodative stance.

While US tariffs disrupted growth patterns in the first half of the year, underlying demand in the economy has remained resilient. Business activity hit a 16-month high, led by the fastest growth in services this year. While manufacturing slowed, industrial production came in ahead of expectations. Peripheral nations continue to outperform, with Spain’s GDP growth forecast revised upward to 2.7% for the year.

German consumer confidence improved as households grew more optimistic about their incomes, while fiscal stimulus is accelerating. Germany plans to ramp up spending significantly, with a budget deficit projected at €143bn in 2025, nearly three times the current deficit of €50 billion as of September. Meanwhile, recent Russian incursions into NATO airspace have sharpened focus on boosting Europe’s defence capabilities.

Fixed income

Bond market volatility remained incredibly subdued, sitting at levels not seen since the start of 2022. Credit spreads compressed further, with US investment-grade spreads tightening to multi-decade lows as investors poured into corporate paper and issuance surged, leaving little compensation for credit risk in many parts of the market.

The Fed enacted its first interest rate cut since 2024, lowering the federal-funds target to 4.00–4.25% on 17 September, but the central bank signalled a gradual path of easing rather than an aggressive pivot. Markets still price additional cuts through year-end, but Fed rhetoric emphasised data-dependence and lingering upside inflation risk.

Nominal long-end US yields finished the month below the peaks seen in August but remain elevated versus multi-year averages. The yield curve globally experienced bouts of steepening and flattening as the market balanced interest rate cut expectations with inflation and supply worries.

Following stickier than expected price data and prolonged fiscal concerns, the UK 30-year gilt hit highest level since 1998 reaching 6%. This can also be somewhat attributed to the sell-off in US Treasury yields, indicating a temporary loss of safe haven status for US assets. The UK’s long term gilt yields are now among the highest in the G7, reflecting investor caution and domestic fiscal stress.

French government bonds weakened materially amid ongoing political instability, the France-Germany 10-year spread widened to a level last seen in earlier bouts of euro-area stress and approaching extremes not seen since 2012. In Japan, Prime Minister Shigeru Ishiba resigned early in the month, increasing political uncertainty. The yen weakened in response, as markets fretted over possible looser fiscal policy and lack of clear direction in economic governance. Japan’s long end continued to trade nervously, with super-long Japanese Government Bond yields lingering at record highs.

Asia and Emerging Markets

Emerging markets (EM) had another strong month, climbing 6.8%, supported by a Goldilocks macro backdrop. With the Fed cutting rates into a soft but still resilient US economy, the dollar looks set to weaken further, opening the door for EM central banks to begin easing more decisively.

In China, domestic indices treaded water, but the Hang Seng rallied nearly 5%, driven by a wave of optimism surrounding home-grown AI start-ups. However, Beijing’s tightening grip on excessive price competition cast a temporary shadow over growth and earnings momentum.

Korea surged 9%, lifted by a sweeping $200bn relief package to cushion tariff shocks. Taiwan followed closely, rising nearly 8%, shrugging off mounting concerns over potential US tariffs reportedly as high as 100%, targeting chipmakers that fail to produce an equal volume of semiconductors on US soil.

India underperformed this month, but the underlying economy remains solid. The Organisation for Economic Co-operation and Development (OECD+) upgraded its growth forecast to 6.7%, citing resilient domestic demand and tax reforms. To drive consumption and support investment, the government is considering boosting capital expenditure beyond the $126bn budgeted for FY26.

Elsewhere in EM, Brazil and Mexico performed in line. Mexico imposed tariffs on Chinese imports, while softer inflation and a robust Brazilian Real point toward the possibility of interest rate cuts starting as early as 2026.

Shifting focus to Japan, the Nikkei 225 rose 5.6% helped by softer-than-expected Tokyo inflation of 2.5%, reducing near-term Bank of Japan (BoJ) tightening expectations. However, underlying price pressures remain, and while the BoJ kept rates steady, it signalled the possibility of further hikes this year. As part of gradual policy normalisation, the central bank also announced plans to unwind its Exchange Traded Funds (ETF) holdings of over $500bn.

Alternatives

The impressive rally in gold and silver continued in September, with both metals reaching record highs in multiple currencies.

Having passed $3000 per ounce for the first time this year, gold has pushed on to a new high of over $3800 buoyed by concerns over a looming US Government shutdown, whilst soft jobs data bolstered expectations of Fed rate cuts. Traders are now pricing in a 97% chance of an interest rate cut at the Fed’s October meeting. Inflation and employment figures will remain key to interest rate cut expectations. Anything that further solidifies the case for an interest rate cut could prompt additional dollar weakness and gains for gold and silver. Whilst the pace of gains could cause some selling pressure, thus far gold’s rally seems well supported with any dips proving to be short-lived. China has discussed with allied nations about the prospect of becoming a custodian for their gold reserves, which would be a major step towards moving away from the reliance on the US dollar and western nations.

Silver climbed by 17% in September, reaching 14-year highs of over $45 per ounce and may well continue to challenge the 1980 high of $49. Much like gold, silver’s rally seems well supported and surpassing $50 would represent a major new milestone for the metal.

Oil prices steadied towards the end of the month with Brent settling at $66 a barrel, as investors weighed potential OPEC+ plans for a larger output hike next month against the prospect of shrinking inventories in the US.

Property

The UK Nationwide House Price Index rose 2.2% year-on-year in September, compared with a 2.1% increase in August and above market expectations of 1.8%.

On a monthly basis, prices grew 0.5%, beating forecasts of a 0.2% gain. The stability in house price growth in the last few months illustrates ongoing steady purchase activity. Mortgage approvals averaged around 65,000 per month, close to pre-pandemic levels despite elevated interest rates. The conditions for house buyers remain fairly supportive, underpinned by low unemployment, strong household balance sheets, healthy earnings growth and the prospect of lower borrowing costs if the Bank of England eases interest rates in the coming months. Chief economist Robert Gardner noted that he expects housing market activity to strengthen gradually, provided the broader economic recovery is sustained. This is corroborated by data from the Halifax House Price Index, which rose 2.2% year on year above forecasts, with the average property value climbing to just below £300,000. Easing mortgage rates, wage growth and many fixed-rate deals now below 4% are all indicative of steady improvement.

The S&P Global UK Construction PMI rose in August, from an over five-year low in July and slightly above market forecasts. A slower contraction in commercial building helped offset sharper falls in residential and civil engineering work, with housing activity posting its steepest drop since February and civil engineering its worst since October 2020. New orders fell for the eighth month, but at the slowest pace since January. However, this ongoing weakness led to hiring freezes and non-replacement of departing staff, with employment levels falling at the fastest rate since May.

Learn more…

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 30 September 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.