Overview

August was characterised by slowing momentum, with markets fearing that the AI ‘bubble’ is bursting, but Federal Reserve Chair Powell’s speech in Jackson Hole helped markets to shake it off and mount a swift recovery.

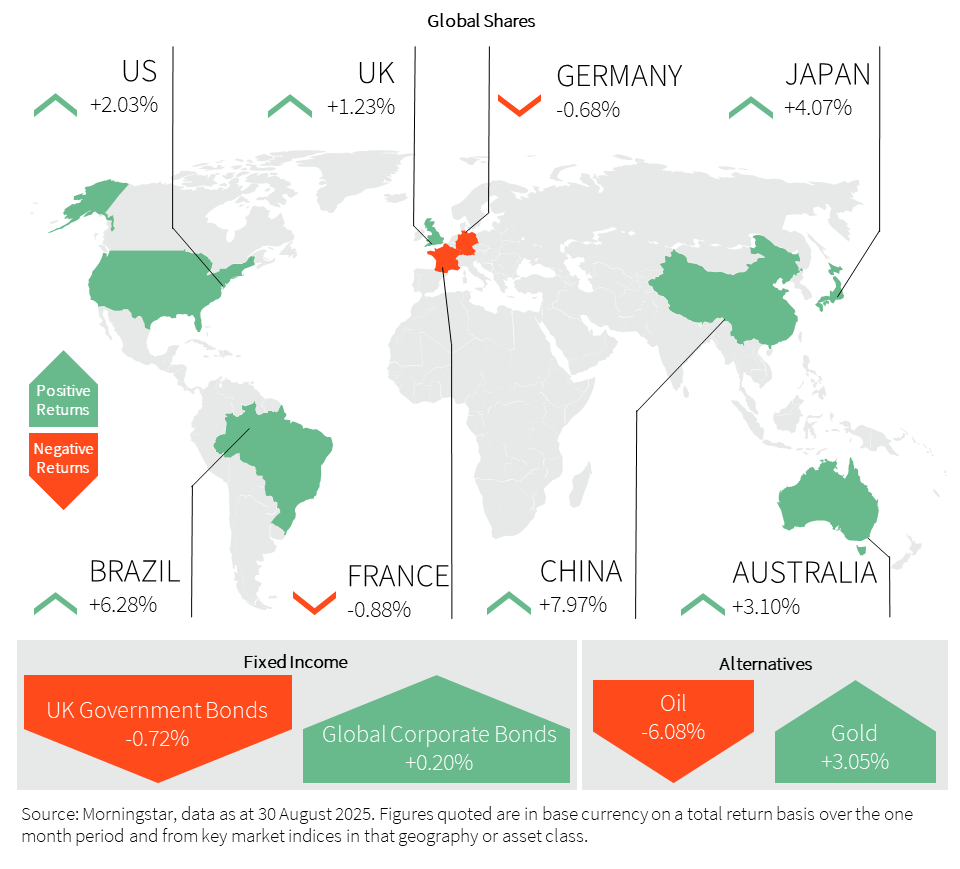

For the month as a whole, the S&P 500 was up 2.03% whilst the tech-focused Nasdaq gained a more muted 0.92%. China was the strongest performer amongst major markets, gaining 7.97%.

The AI-related jitters stemmed from Meta freezing AI hiring, Open AI CEO Sam Altman suggesting that AI ‘may be in a bubble,’ and an MIT study concluding that 95% of organisations are seeing no business return. However, the world’s largest company, Nvidia, released results towards the end of the month, which demonstrated that AI demand remains very strong.

Meanwhile, economic data presented a mixed picture, with very strong private sector activity across the globe, but challenging labour market and inflation data in the US. This concoction of a slowing economy and rising inflation provides a challenging backdrop for the Federal Reserve (Fed).

Simultaneously, the central bank is having to contest with a threat to its independence. This was most recently highlighted by Trump firing the head of the Bureau of Labour Statistics after the unfavourable labour market data and attempting to fire a member of the Federal Reserve Committee as he attempts to influence monetary policy. This is therefore one of the toughest periods in the Federal Reserve’s history, and elevated the importance of Fed Chair Powell’s speech in Jackson Hole. Powell made a well telegraphed speech, which appeared to reassure markets of its independence, whilst also aligning with Trump by teeing up an interest rate cut in September. This was welcomed by markets with the Russell 2000 gaining close to 4% and the VIX shedding close to 10%.

Whilst US 10-year government bonds rallied, the picture was very different in other developed markets. UK inflation hit an 18-month high, and fiscal concerns also present in France and Japan resulted in long-duration bonds selling off.

United Kingdom (UK)

It was another positive month overall for UK equities, with the FTSE 100 hitting another record high before momentum slowed into month end. The more domestically focussed FTSE 250 suffered from more volatility, ending the month slightly negative. At a sector level, companies with a mining and hard commodity focus led the way, supported by telecoms companies, which continued to rebound. Those companies more aligned to the consumer struggled over the month as spending was reigned in. All this was set against a mixed economic backdrop and continuing political infighting.

The Bank of England’s (BoE) Monetary Policy Committee voted to cut interest rates by 0.25% to 4% in early August, the lowest since March 2023. This marked the fifth rate cut in the last 12 months, signalling the central bank’s confidence in easing inflationary pressures. However, the vote was divided in its first-ever two-round vote, highlighting internal divisions on how to manage persistent inflation and a weakening economy. Five members supported the cut, while four preferred a hold. Governor Andrew Bailey described the decision as ‘finely balanced’ and signalled a gradual pace of easing. Despite the rate cut, inflation remains a concern, with the Consumer Price Index (CPI) rising to 3.8% in the 12 months to July, up from 3.6% in June and remaining above the central bank’s 2% target. The BoE also flagged possible changes to its bond-selling strategy amid long-dated gilt market stress. Growth forecasts for 2025 were revised up to 1.25%, while inflation is expected to peak at 4% in September.

UK Gross Domestic Product (GDP) grew by 0.3% in the second quarter of 2025, a slower pace than the 0.7% growth in the first quarter, but still better than many forecasts. The services and construction sectors were the main drivers of this growth, while the production sector contracted. The labour market showed signs of loosening, with the unemployment rate rising to 4.7% in the April-to-June period. Businesses, however, saw a slight improvement in confidence in August, though concerns over taxes and the broader economic climate persist.

United States (US)

US equity markets enjoyed a strong August with all three major indices posting positive returns. Fed Chair Jerome Powell’s Jackson Hole speech hinted at the resumption of interest rate cuts, which helped ignite US markets. This was magnified at the more rate-sensitive small-cap level with the Russell 2000 surging over 7% in August. Not even Trump threatening to sack Fed governor Lisa Cook and the muted response to Nvidia’s stellar earnings could derail the S&P 500 and Dow Jones from notching record closing highs towards the end of the month.

Growth for the economy was revised upwards for the second quarter to 3.3% ahead of the 3.1% forecast, and rebounding strongly from the 0.5% contraction in the first quarter. Growth was driven by business investment in AI and an upward revision for consumer spending. The latest Purchasing Managers Index (PMI) data for August was also positive, showing business activity picking up pace with the uptick in manufacturing being of particular note. Analysts continue to caution that growth may slow in the second half of the year as the effects of tariffs and policy uncertainty become reflected in the data.

Consumer Price Inflation increased 0.2% on the month in July, in line with expectations and down from June’s reading of 0.3%. Core inflation, which strips out more volatile food and energy prices, saw its biggest increase since January, rising 0.3%. The Fed’s preferred inflation gauge showed inflation rising to 2.9% in July, in line with forecasts. With US employers adding fewer jobs than forecast in July and unemployment ticking up slightly, the Fed are poised to cut rates at their upcoming meeting in September.

As the Q2 earnings season ended, investors can reflect on what was a strong showing. 81% of S&P 500 companies beat with earnings and revenue growth accelerating at its strongest pace since late 2022. Nearly 60% of companies raised guidance, with the Magnificent 7 stocks posting particularly impressive earnings growth again.

Europe

Eurozone equities managed to end the month in positive territory despite a backdrop of renewed tariff uncertainty, ongoing geopolitical tensions, and rising political risk in France. While the DAX and CAC dragged regional indices, strength in Italy and Spain helped offset losses.

The European Central Bank (ECB) held its key rate steady at 2% in July, though policymakers remain divided over the inflation outlook. On one hand, softer growth prospects, US trade tensions, and a stronger euro point to downside risks. On the other, volatility in energy prices and currency markets complicates the outlook. Preliminary inflation data across core economies support the view that the ECB will likely stay on hold again next month.

Encouragingly, business activity expanded for the third consecutive month in August, with the Composite PMI climbing to 51.1. This growth was fuelled by a rebound in new orders and a strong uptick in manufacturing. Germany’s manufacturing sector posted its fastest output growth in over three years, marking a potential turnaround from its prior weakness. Activity in France contracted at a slower pace and showed signs of stabilising, but political uncertainty remains a key concern. Prime Minister François Bayrou faces a pivotal no-confidence vote on 8 September 2025 over a controversial €44bn austerity package.

Looking ahead, Germany may transform from the Eurozone’s laggard to its growth engine. The government’s ambitious infrastructure and defence spending plans are expected to boost GDP in the second half of 2025 onward.

Fixed Income

In line with equity markets, bond market volatility remained remarkably subdued, sitting at levels not seen since the start of 2022. Meanwhile, credit spreads are extremely tight with global corporate bond spreads hitting 18-year lows, offering investors minimal compensation to invest in corporate rather than government bonds.

Jackson Hole marked an important milestone for markets in August, as the Fed attempted to make a stand against the President’s threat to its independence and Fed Chair Powell discussed the challenges of inflation risks skewed to the upside and labour market risks to the downside. The largely dovish tone that Chair Powell struck during the speech led markets to price in a 90% chance of an interest rate cut in September. This caused a steepening of the yield curve, with short-term yields declining, whilst the potential for a rate cut to amplify inflation lifted longer-term yields higher, with the 30-year government bond yield approaching 5%.

UK yields exhibited a diverging trend from the US, with yields rising across the curve, following hotter-than-expected inflation data and ongoing fiscal concerns.

Japan’s 30-year government bond yield climbed to a fresh record, as concerns over sticky inflation and rising fiscal risks continue to weigh on sentiment. Fiscal concerns also mounted in France with the Prime Minister facing a no confidence vote. The spread or differential between the French 10-year government bonds and the equivalent in Germany headed towards one percentage point, a concerning landmark that hasn’t been reached since 2012.

Asia and Emerging Markets (EM)

The region delivered another positive month, led by a strong 8% surge in China’s domestic market. Japan, Brazil, and Mexico also contributed robustly, while India lagged due to recent geopolitical and trade tensions.

China’s liquidity-driven rally was largely a bet on future policy actions and economic recovery rather than strong current economic fundamentals. The impact of trade tensions has been measured, as Chinese companies managed to offset lost US sales with increased exports elsewhere, and a recent 90-day pause on higher US tariffs provided additional support. The government’s ‘anti-involution’ campaign is introducing short-term economic drag but may ultimately improve profitability by addressing mal-investment. Retail sales, factory activity, and fixed asset investment came below expectations, and industrial profits fell 1.5% in July despite support from a strong tech sector. CPI and Producer Price Inflation (PPI) data continue to signal deflationary pressures. On a positive note, regulators plan to mobilise state-owned enterprises to purchase unsold homes, which may help stabilise the property market.

In Japan, conditions are aligning for a potential rate hike, with the Bank of Japan Governor signalling that tightening labour markets could push wages higher. Tokyo’s core consumer prices rose 2.5% year-over-year in August, while the unemployment rate fell to 2.3%, the lowest since December 2019.

Elsewhere, Mexico’s central bank cut rates by 0.25% to 7.75%, returning to pre-pandemic levels, though trade tensions and uncertainty pose ongoing risks to inflation and growth. Brazil’s July inflation slowed to 5.2%, giving room for gradual monetary easing. Meanwhile, India faces rising US tariffs on exports, set to hit 50% due in part to oil purchases from Russia. This escalation has prompted closer ties between India and China, along with fast-tracked business-friendly reforms in India.

Alternatives

Following a period of much-needed consolidation, gold looks to be closing in on another record high, a consequence of growing optimism that the Fed will cut rates. The precious metal looks set to surpass $3,500 in the near future.

Silver surged above $40 per ounce at the end of the month for the first time since 2011. The weakening dollar and increasing industrial demand for silver will likely only add to the 40% price gain so far in 2025. Whilst it is still some way off 2011 highs, it looks to be steadily building towards those levels.

After an appeals court upheld the finding that Trump’s global tariffs are illegal, we are likely to see a further appeal at the Supreme Court. Publicly traded companies continue to build up their cryptocurrency-based treasuries. Midway through the month, BlackRock’s crypto portfolio exceeded $100 billion, an indicator of institutional commitment to digital assets.

Lastly, oil prices declined in August as a result of weaker demand in the US, combined with an expected boost in supply from The Organization of the Petroleum Exporting Countries (OPEC+) and its allies in the autumn. Brent crude oil futures settled at around $68 per barrel. Supply uncertainty continues following Ukrainian attacks on Russian oil export terminals, and investors await India’s response to pressure from the US to stop buying Russian oil.

Property

The Nationwide House Price Index fell marginally month over month in August. Year over year, the index rose 2.1%, slightly less than the gain last month. House price growth remains subdued as affordability is stretched, with prices high relative to incomes and mortgage costs now more than three times pre-pandemic levels. A typical first-time buyer with a 20% deposit now spends about 35% of take-home pay on repayments above the long-run average of 30%. Nationwide’s chief economist noted that affordability should improve gradually as income growth outpaces house prices and borrowing costs ease. The Halifax Price Index rose 2.4% year on year, marking the softest annual increase since July 2024. The average property value increased month, over month evidencing that the property market is showing some resilience.

The S&P Global UK construction PMI fell in July, marking the steepest contraction in activity since May 2020, driven by sharp drops across all key sectors, particularly in residential building and civil engineering. New orders declined for the seventh consecutive month, with firms noting weaker client confidence. Expectations for the year ahead improved marginally but remain muted. Construction orders plunged around 12% in the second quarter, driven again by weakness across all segments. Notably, new housing orders declined at a much faster rate, dropping 25%.

Learn more…

Commodities: Commodities include basic goods. ‘Hard’ commodities are natural resources that must be mined or extracted, such as gold, rubber, and oil. ‘Soft’ commodities are agricultural products or livestock, such as corn, wheat, coffee, sugar, soybeans, and pork.

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 30 August 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.