World Market Summary

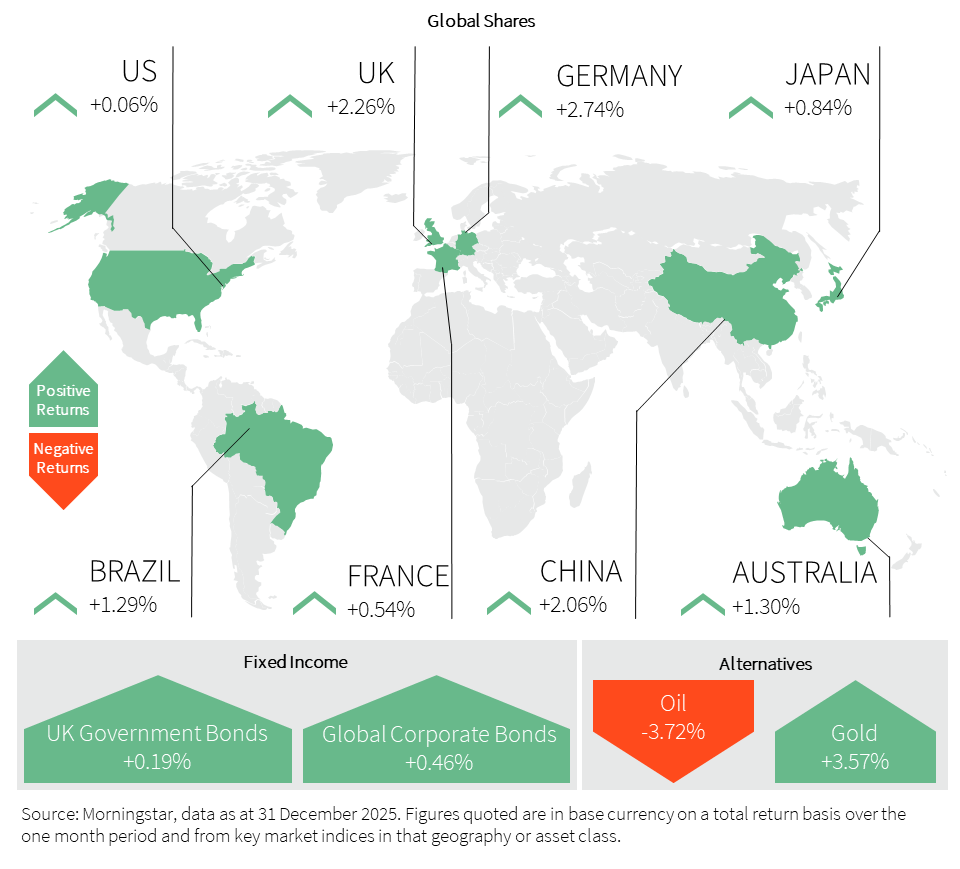

December was characterised by growing geopolitical tensions alongside regional divergence in economic growth trends and market performance. Europe led with a 2.7% gain, while the FTSE 100 rose 2.3%. Emerging markets (EM) gained 1.6%, with China up 2.0%. By contrast, the US was broadly flat, while Japan was down -4.3%. The drivers for each region were mixed. In the US, the AI rally crept higher following November’s market correction which left risk appetite fragile. In Japan, currency weakness and policy uncertainty weighed on sentiment. Europe’s stronger performance was more consistent with improving domestic-demand sentiment and a growing focus on defence and infrastructure priorities, while China’s rise within EM reflected resilient export momentum even as domestic economic indicators remained soft.

Several developments raised the temperature on global risk. The Trump administration announced an $11bn arms package for Taiwan, drawing strong condemnation from China and raising cross-strait tension risks. The EU approved joint borrowing for Ukraine to be raised in capital markets, while President Putin warned Russia could accelerate offensive operations if peace terms are rejected. The US also imposed a naval-backed blockade on Venezuelan oil flows, tightening the link between politics and energy pricing.

Macro conditions remained uneven, with policy signals diverging across regions. In the US, the Federal Reserve (Fed) cut interest rates, but signalled a cautious approach to further easing, keeping attention on the 2026 policy path and the balance between cooling labour conditions and tariff-driven inflation uncertainty. The European Central Bank (ECB) held interest rates steady and highlighted domestic demand resilience alongside expected defence and infrastructure investment, even as consumer confidence softened marginally. The UK delivered a hawkish interest rate cut, but inflation decelerated more than expected, supporting the disinflation narrative into 2026. Meanwhile, Japan remained the most complex case. Despite an interest rate hike, the yen stayed weak, and markets remained sensitive to how monetary policy interacts with a more expansionary fiscal stance under Prime Minister Takeichi.

Our in-depth views on:

Our weightings are based on sterling as a base currency.

United Kingdom (UK)

The UK stock market closed 2025 on a triumphant note, with the FTSE 100 surging through December to finish the year with an annual gain of over 25%. This represented the index’s strongest annual performance since 2009, notably outperforming the S&P 500.

Throughout December, the market benefited from a sustained “Santa Rally.” After starting the month around 9,700 points, the FTSE 100 hit a new intraday record high on 30 December, fuelled by optimism over falling inflation and easing interest rates.

The defining economic event of the month was the Bank of England’s (BoE) decision on 17 December. The Monetary Policy Committee (MPC) voted 5 to 4 to cut interest rates by 0.25% to 3.75%. This move was supported by data showing inflation holding steady at 3.2%, with the BoE signalling that disinflation is becoming more entrenched.

While the stock market rallied, retailers faced a mixed Christmas. Office for National Statistics (ONS) data showed a surprising slump in retail sales volumes for the run-up to December as consumers remained cautious following the November Budget. However, the month ended on a high with a bumper Boxing Day, which saw footfall rise by 4.4%, the strongest increase in over a decade.

The “old economy” sectors, in this case mining, banking, and defence stocks, were the most notable contributors. Fresnillo was the standout performer of the year and the month, with its shares soaring as gold and silver prices hit record highs. High-street lenders like Lloyds, Barclays, and NatWest saw strong December activity, benefiting from the lack of any new windfall taxes in the late-year Budget.

December also saw the demerger of The Magnum Ice Cream Company from Unilever, with the new entity listing on the London Stock Exchange’s Main Market on December 8th. Conversely, Diageo remained a laggard, struggling within a weak global spirits market.

The month concluded with the market just shy of the “magic” 10,000-point milestone, leaving investors with a high degree of “cautious optimism” heading into 2026.

United States (US)

US markets ended December balancing three cross-currents: a cooling labour narrative, uneven inflation signals, and an AI trade reset that extended from November. The S&P 500 was broadly flat, while the Nasdaq fell -0.67%, reflecting continued unease around the AI theme. Risk appetite remained fragile after disappointing guidance from several key technology names.

On policy, the Fed cut interest rates by 0.25%. The meeting minutes pointed to rising downside risks to the labour market, while noting that upside inflation risks have diminished somewhat. The Fed also announced $40bn per month of Treasury bill purchases to support bank reserves and reduce the risk of short-term funding market stress. Separately, the earlier-than-expected reappointments of regional Fed presidents were seen as supporting perceptions of Fed independence, which is an important anchor for confidence in US capital markets and the dollar.

Inflation was softer in November, but the data was distorted by delayed and incomplete data collection during the US government shutdown. The Zillow Observed Rent Index has cooled and has historically tended to lead CPI shelter inflation by around a year, suggesting some scope for housing-related disinflation into 2026. Tariffs remain a key two-way risk for 2026, with both the timing and extent of pass-through to consumer prices still uncertain.

The labour market remains central to the easing pace in 2026, and December data sent increasingly cautious signals. Delayed payroll releases showed stronger-than-expected job growth in November, but a sharp slump in October, with unemployment jumping to 4.6%, the highest in four years. While initial jobless claims fell well below expectations, Job Openings and Labor Turnover Survey (JOLTS) data were softer overall: job openings held up, but hiring and quits weakened further, and layoffs edged up. Looking into 2026, tariff-related cost pressures working through supply chains could squeeze margins, increasing the risk of slower hiring and headcount reductions.

Europe

European equity markets mirrored the UK’s bullish year-end; the month was characterised by a rotation into value, allowing European indices to outpace many of their global peers as the year drew to a close.

While the broader European market rose, performance varied across the major continental bourses. The German DAX 40 finished the month on a strong note, gaining some 22% plus over the full year, supported by Germany’s commitment to fiscal expansion and outpacing the FTSE 100. The Italian FTSE MIB was one of the region’s top performers as banking stocks, a sizeable weighting in the Italian index, surged. France, however, faced more volatility due to domestic political uncertainty; despite a softer December, it managed to gain more than 10% through 2025.

The ECB held its final meeting of the year on December 18, choosing to keep interest rates steady at 2.00%. This “hawkish hold” came as a surprise to some, as the ECB revised its 2026 inflation projections slightly upward to 1.9%. President Christine Lagarde emphasised a “data-dependent” approach, signalling that while the interest rate cutting cycle that began in 2024 is paused, the central bank remains comfortable with current levels to ensure a soft landing for the Eurozone economy.

The Banking sector was the undisputed star of December, with Banco Santander, Société Générale, and Commerzbank all seeing heavy buying. German defence manufacturer Rheinmetall appreciated by more than 2% in the final week of December alone, driven by expectations of increased European military spending, as the Russia-Ukraine conflict showed no signs of abating despite numerous peace talks.

On the flip side, the luxury and pharmaceutical sectors struggled. Novo Nordisk faced its worst year on record, falling 48% due to increased competition in the weight-loss drug market, while Puma slumped 50% following profit warnings.

Asia and Emerging Markets (EM)

Emerging markets have had a strong year, with the MSCI Asia excluding Japan up over 30% and the outlook remains positive as global investors increasingly shift away from US assets and highlight improving fiscal and monetary metrics in developing nations. Looking ahead, the key factors dominating the New Year will be China’s economic trajectory, Fed policy, US dollar moves, and concerns around AI valuations. President Trump’s trade and geopolitical decisions will form the sentiment backdrop, whilst prospects for interest rate cuts by local central banks drive selective bets.

Japanese stocks finished a strong year in 2025, with the Nikkei up over 24%, lifted to new heights by the artificial intelligence boom, Prime Minister Sanae Takaichi’s plans to bolster manufacturing, and a reassessment of the financial sector amid rising interest rates. In relative terms, India had quite a poor year when compared with the strong rallies elsewhere in Asia. The Nifty 50 posted a record tenth straight year of gains, defying expectations, up approximately 10.5% thanks to a strong surge in the final quarter of the year. The year was volatile as investors grappled with multiple challenges, including the 50% tariff rate imposed by the US, the decline in the Indian rupee and a sell-off amidst lofty valuations.

The Hang Seng Index was up around 28% over the year, extending its rally in the final month on the back of fading geopolitical risks, a return of investor interest in Chinese technology stocks, and domestic household savings returning to equities as interest rates trend lower. Many analysts believe there is a good chance that this bull market will persist into 2026, marking a transition from a ‘hope’ to ‘growth’ phase, where consistent earnings realisation and moderate valuation expansion typically supersede the volatile sentiment-driven re-ratings of early cycles. Further, attractive dividend yields and a positive outlook for the Chinese yuan are expected to bolster the appeal of Chinese onshore assets.

Broader Asian markets have also had very positive momentum year to date, with Korea up 76%, Vietnam up 36% over the year, and Taiwan up 24%. A weakening US dollar has increased the attractiveness of Asian assets, while the region’s deep integration into transformative global technology supply chains has further enhanced its long-term investment value. This shift is not merely a cyclical rebound; rather it is a powerful convergence of global growth and supportive policy momentum, establishing a solid growth trajectory for the region heading into 2026.

Fixed Income

Government bond markets ended December with clearer policy divergence. The ECB held interest rates steady, and investors increasingly debated whether the euro area is nearing the end of its easing cycle. Germany’s larger 2026 funding plans and the EU’s €90bn joint borrowing package for Ukraine (2026–27) highlighted rising bond supply, which can limit how far yields fall even as inflation cools.

In the US, the Federal Reserve cut interest rates by 0.25%, but Chair Powell signalled that investors should not expect rapid further easing. Markets reflected that caution: the 2-year Treasury yield was broadly unchanged, while longer-dated yields rose (10-year +0.11%; 30-year +0.14%). The Fed’s next move remains pivotal for both short-term growth and longer-term investment trends. Near-term easing supports demand in an economy still reliant on affordable funding. At the medium-term growth narrative increasingly rests on an AI-driven investment cycle that is highly sensitive to interest rates and market confidence.

In the UK, the BoE also cut interest rates by 0.25% in a narrow 5–4 vote and reiterated that further easing will likely be gradual. The 2-year gilt yield fell about 0.09%, while the 10-year was flat, reflecting caution amid persistent wage and services inflation.

Japan remains a key source of global bond volatility. The Bank of Japan (BoJ) raised rates as expected, yet the yen weakened sharply to nearly 160 per dollar. Prime Minister Takeichi’s ¥21.3 trillion stimulus plan marked a clear shift towards fiscal expansion. Bond and currency markets reacted nervously to the prospect of heavier borrowing and firmer inflation, keeping the yen under pressure amid rising concerns over longer-term debt sustainability. The BoJ now faces a sharper bind as it needs to tighten monetary policy to support the currency and contain inflation, yet looser fiscal policy and high debt may limit how far it can go.

Alternatives

Gold finished the month testing all-time highs, trading above $4,200 per ounce once again. Silver jumped to fresh highs as the final month of 2025 got underway, a year that has seen an explosive rally for the metal after lagging behind gold for years. The gold-silver ratio, which is the metric that indicates how many ounces of silver can be exchanged for one ounce of gold, is now around 74, an impressive drop from April’s high of 105. Some analysts believe we may see further gains in silver, bringing the ratio back towards its historical average of around 50, which at current gold prices would see silver above $80 per ounce.

Brent Crude finished the month of December 2025 at approximately $61.55 per barrel, down nearly 4%, as investors weighed oversupply concerns against geopolitical risks, including the war in Ukraine and Venezuelan exports. 2026 will be an important year in assessing The Organisation of the Petroleum Exporting Countries (OPEC+) decisions for balancing supply; the expectation at the time of writing is that it could be a fairly benign year for oil prices, range-bound around $60-65 a barrel.

Property

In the final month of the year, the Nationwide House Price Index rose 0.6% year on year, below market forecasts of 1.2% and easing from November’s 1.8% gain, marking the softest annual growth since April 2024. The slowdown in the price growth rate partly reflected strong price gains in December 2024 and the December 2025 price fall, with the number of mortgages approved remaining at similar levels to those seen before the COVID-19 pandemic. Nationwide chief economist Robert Gardner has stated that with price growth well below the rate of earnings growth and a steady decline in mortgage rates, affordability constraints eased somewhat, helping to underpin buyer demand. He added that he expects house price growth to increase at an annual rate of 2-4% in 2026.

The S&P Global UK construction Purchasing Managers Index (PMI) fell to 39.4 in November 2025 from 44.1 in October, pointing to the steepest downturn in UK construction output for over five years amid challenging market conditions. New orders decreased by the greatest extent since May 2020. Many construction companies commented on weak client confidence alongside delayed spending decisions linked to uncertainty prior to the budget. Survey respondents reported fragile confidence, delays with the release of new projects and a general lack of incoming new work. Employment also declined at the steepest rate since August 2020, and business optimism was the weakest since December 2022.

Learn more…

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 31 December 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.