Summary

Although historically the best month for equity markets, this November saw global stocks sell off amidst a spike in volatility driven by fears of an AI bubble. The sell-off continued despite blow-out earnings from chip-maker Nvidia and was most pronounced in AI stocks and other speculative areas, exemplified by Bitcoin’s near 20% slump over the month. Elsewhere, US shoppers blew their budgets on Black Friday deals, but Rachel Reeves managed to keep the UK’s Budget in check as far as the bond market was concerned.

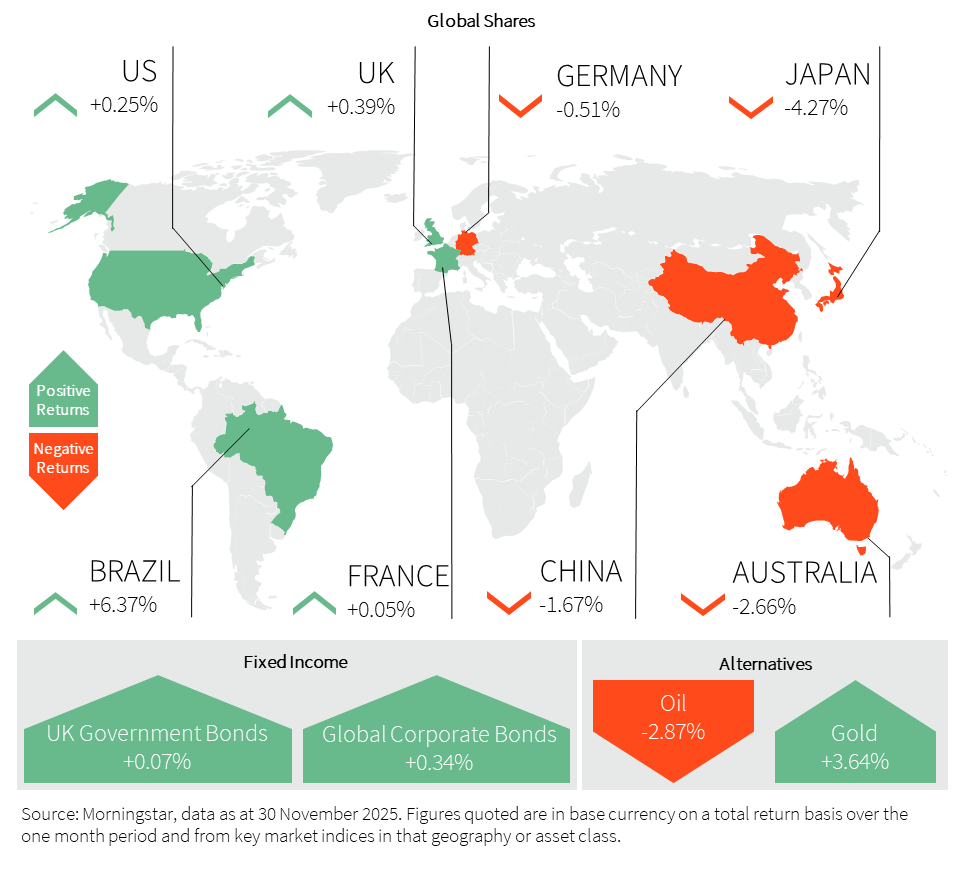

The ‘buy the dip’ strategy once again worked for investors, as the S&P 500 managed to recover losses to finish the month with a minor gain of 0.25%. Japan’s market was the weakest in November, shedding -4.27%, as investors took profits following weak economic growth data. Meanwhile, Brazil defied the global trend, gaining 6.37%. This was helped by strong commodity prices and lower-than-anticipated inflation data, which improves the prospects for interest rate cuts in the future.

Turning to economic data, where the picture remains murky in the US, courtesy of the longest government shutdown on record. Although the shutdown has now ended, market participants are still working with delayed or secondary data sources. Encouragingly, September’s payrolls data suggested the labour market is holding up better than expected, but substantial downward revisions remain a theme. Hence, the Federal Reserve (Fed) looks increasingly likely to cut interest rates in December. In the UK, economic data was weak across the board due to the uncertainty surrounding the Autumn Budget, and this too tees up an interest rate cut from the Bank of England (BoE) in December. Elsewhere, India’s Q2 GDP growth came in at a massive 8.2%, the strongest growth in six quarters.

Whilst questions remain about the valuations of AI stocks and the sustainability of the rally, this appears to have been just a healthy correction, and earnings continue to be very strong at 15.2% for the S&P 500 in Q3. November may not have been as strong as usual for markets, but we are well set up for positive returns to the end of the year, also known as the ‘Santa Rally’. Thanksgiving, Black Friday and Christmas shopping will support consumption and oil prices sitting at near 4.5-year lows will help facilitate this spending.

United Kingdom (UK)

After the FTSE 100 index hit a record high of 9,930 points on 12 November, and with 10,000 points in sight, global markets wobbled as AI euphoria was quickly replaced by ‘bubble’ fears, and the FTSE 100 eased back nearly 500 points. However, an end-of-month rally left both main UK markets in marginally positive territory for November, with the FTSE 100 up 0.39% and the FTSE 250 up 0.31%.

The highlight of the month was the UK Budget, widely leaked in the lead-up and then calamitously published online by the Office for Budget Responsibility (OBR) before Rachel Reeves had a chance to deliver it. As expected, taxes were raised again, most notably through the further freezing of personal tax thresholds alongside increased tax on electric car travel, investment income and high-value properties. Combined, this should raise £26 billion by the end of parliament and takes the tax burden up to 38% of GDP by 2030-2031. The tax hikes will increase her fiscal headroom and did the job of reassuring the bond market with yields on the 30-year moving down nicely and domestic equity markets reacting positively through the afternoon post-budget. Rachel Reeves remains in post for now, although she faces intense scrutiny over the data used to justify her tax rises.

The Bank of England left rates unchanged this month, but the vote was tight with chair Andrew Bailey casting the decisive vote after four members called for a 0.25% cut. A cocktail of data points through the month put a high probability on a further interest rate reduction in December. Unemployment edged higher to 5% over the three months ahead of forecast, wage growth also eased over the period, and inflation moved back to 3.6%. Whilst the OBR budget forecasts upgraded growth for this year, they slashed forecasts for 2026, likely providing enough ammunition to justify moving rates lower.

Other economic indicators were mixed throughout the month. In retail, sentiment fell at its sharpest pace for 17 years, with firms expected to pull back on hiring and investment. Retail sales slumped in October, falling 1.1%, but many analysts attribute this to consumers waiting for November’s Black Friday sales. There was better news for manufacturers as domestic demand improved and exports softened, leading to the first expansion since September 2024. Finally, house prices rose at a faster pace than expected in November, pointing to a robust backdrop despite the uncertainty in the lead-up to the budget.

Global Market Insights – October 2025United States (US)

“If we delivered a bad quarter, it is evidence there’s an AI bubble. If we delivered a great quarter, we are fuelling the AI bubble,” Jenson Huang, CEO of Nvidia, told employees following an incredible quarter and upgraded guidance. After months of exceptional gains for AI winners, questions remain over whether returns will justify the vast sums being spent on the likes of Nvidia’s chips and ‘Bubble’ fear gripped the market in November, with famed ‘shorter’ Michael Burry calling out the various similarities between now and the ‘dot-com bubble’. Time will tell if he is correct or if this was just the removal of excess risk, but for the month, defensive sectors outperformed, leading the DOW Jones up 0.48% and the technology-related Nasdaq down 1.57%.

Positively for US corporates, the 3rd quarter earnings season was again excellent, marking the fourth consecutive quarter of double-digit earnings growth. Originally forecast to deliver annual EPS growth of 8%, companies defied this by growing earnings 13%, with 82% of S&P 500 constituents coming in ahead of forecast. Growth was again led by the big AI players but financials also put in a good showing.

November finally saw the longest government shutdown in US history, ending after 43 days, and as such, data pertaining to the economy has been delayed in its release and pushed back into December. However, we did learn that job openings increased in September, but at the same time, the unemployment rate climbed to 4.4%. In more worrying news, US consumer sentiment fell in November to one of the lowest levels on record due to high shop prices and wealthier Americans becoming less optimistic on the stock market.

Europe

In November, European indices took a breather from the strong gains of the preceding months, but, with the exception of the German DAX, they generally posted modest positive returns.

In terms of major data releases over the month, the European Central Bank (ECB) maintained its key deposit rate at 2.00%, continuing to hold for the third consecutive meeting. Minutes from the October meeting (released in November) confirmed the Governing Council’s view that inflation was “under control,” hovering around the 2% target. Officials left the door open for interest rate cuts in 2026, which was generally supportive of market valuations.

The European Commission’s Autumn 2025 Economic Forecast, released in mid-November, projected Euro Area GDP growth of 1.3% for 2025, a slight upward revision from earlier forecasts, exemplifying the economy’s resilience. Added to this, Germany’s historic €500 billion infrastructure fund and increased defence spending (projected to reach 2.4% of GDP) were seen as a major long-term positive. Continued declines in European natural gas prices provided relief to Germany’s energy-intensive industries, reducing a major headwind for the region’s industrial core.

At the sector level, financials benefited from strong third-quarter earnings and a steepening yield curve, as lower-for-longer interest rate expectations in the Eurozone provided clearer forward visibility. Healthcare and consumer staples (defensives), along with certain industrials (cyclicals), significantly outperformed growth/technology, suggesting an investor rotation towards relative value and stability. Defence companies such as Rheinmetall, which has been a standout performer this year, stabilised after a brief decline driven by “peace speculation”. Elsewhere, French luxury stocks, key components of the CAC 40, saw renewed interest. Hermès and Kering posted gains towards the end of the month, supported by the expectation of an improving China outlook.

Asia and Emerging Markets (EM)

Markets turned more cautious over the month. Excitement around Artificial Intelligence cooled, Chinese tech shares slipped, and expectations of a December Fed interest rate cut eased. The risk-off tone resulted in Asia down -2.8%, while Latin America still managed a 6.1% gain.

The Bank of Japan sent a clear hint that a December interest rate hike is possible, pushing the yen higher and driving two-year government bond yields to their highest level since 2008. Tensions with China also flared after comments on Taiwan by Japan’s prime minister, prompting Beijing to advise its citizens against travelling to Japan. That sparked a significant sell-off as almost one in five foreign visitors last year came from China.

China remains on track to meet its 5% GDP growth target without major new stimulus, but stresses in the property sector are broadening, with flagship developer Vanke asking to delay repayment on a local bond for the first time. Exports saw their first decline in eight months as a rise in exports to the rest of the world failed to offset a 25% decline in US exports. Looking ahead, plans to double down on manufacturing and a warmer Trump-Xi tone suggest exports could outperform expectations next year.

Elsewhere, India’s GDP growth accelerated to 8.2% year-on-year, helped by stronger production and lower inflation, leaving room for future interest rate cuts. In Latin America, falling inflation in Brazil and the removal of the additional 40% US tariff on some farm exports support the case for interest rate cuts and a more durable equity rally. Mexico is in a soft patch, but expected interest rate cuts and a successful review of the US-Mexico-Canada Agreement trade deal could set up a broader recovery in 2026.

Fixed Income

Bond volatility briefly spiked at the start of the month before returning to the remarkably subdued levels it started with. US yields initially rose as fewer interest rate cuts were priced in for December. Rhetoric from Fed members later caused a steep drop in bond yields, with markets pricing in a 93% chance of an interest rate cut. Here in the UK, the Budget was the key focus for the bond markets. Gilt yields finished relatively flat despite a brief spike following the leaked announcement that Rachel Reeves would not be implementing any income tax hikes. Nevertheless, the Budget was net negative for economic growth, and the weak economic data has left the market pricing in an 89% chance of an interest rate cut from the BoE in December.

Credit spreads also picked up at the start of the month, as the bond market grew hungry for economic data, which was absent until the US government shutdown ended on 13 November. Subsequently, the better-than-expected payroll data for September helped rein in concerns about the health of the economy and helped spreads move tighter once more.

The dollar consolidated in November after a period of recovering the losses from earlier in the year. Meanwhile, fellow ‘safe haven’, gold, resumed its rally. The yen weakened further, and the Japanese 10-year rose 0.15%, as Japan’s new prime minister announced a $135 billion fiscal package aimed at easing public discontent over rising living costs.

Alternatives

Gold is testing all-time highs, trading above $4,200 per ounce once again. Markets still expect the Fed to cut interest rates at the December meeting, and gold therefore remains well positioned heading in to 2026. Notably, silver has jumped to fresh new highs with an incredible 15% gain towards the end of November, adding to its already stellar performance in 2025. The industrial metal is now up by a massive 98% so far this year. The gold-silver ratio (a measurement indicating how many ounces of silver are required to buy one ounce of gold) is now around 74, an impressive drop from April’s high of 105. Some analysts believe silver could still make further gains and bring the ratio back towards the historical average around 50. At current gold prices, that would see silver above $80 per ounce.

Once again, it was a different story for ‘black gold’ and ‘digital gold’. For the former, signs that a peace deal between Ukraine and Russia might be on the horizon pushed oil prices down sharply towards the end of the month. West Texas Intermediate crude settled around $58.55 a barrel, whilst Brent crude finished around $63.20. This was the fourth consecutive month of price declines, marking the longest losing streak since 2023 as expectations of higher supply weighed on prices. For the latter, Bitcoin was down as much as 30% from its recent high as investors took risk off the table amidst the increased market volatility.

Property

The UK Nationwide House Price Index rose 1.8% year-on-year in November, above the expected 1.4% but slowing from October’s 2.4% gain, marking the softest annual growth since June 2024. Nationwide Chief Economist, Robert Gardner, noted resilience despite subdued consumer confidence, early signs of labour market weakness, and mortgage rates more than double pre-Covid levels, with house prices near all-time highs. He added that steady mortgage approvals and ongoing demand, particularly from first-time buyers, support market stability. Gardner expects modest affordability improvements if income growth outpaces house prices, aided by potential interest rate cuts and strong household balance sheets. Housing activity is likely to remain steady, with limited impact from upcoming property tax changes and continued upward pressure on rental growth due to constrained supply.

The Halifax House Price Index rose 1.9% year on year, accelerating from September and coming in ahead of the expected 1.45% gain. The average property value is now at a record of £299,862. Buyer demand appears to remain strong despite market uncertainty. Affordability challenges persist with an average fixed mortgage rate near 4%, but many buyers are using smaller deposits and longer terms. Construction PMI weakened more than anticipated in October, reflecting a tenth consecutive month of contraction in UK construction activity. Construction firms continued to report poor market conditions and fewer tender opportunities.

Learn more…

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 30 November 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.