Summary

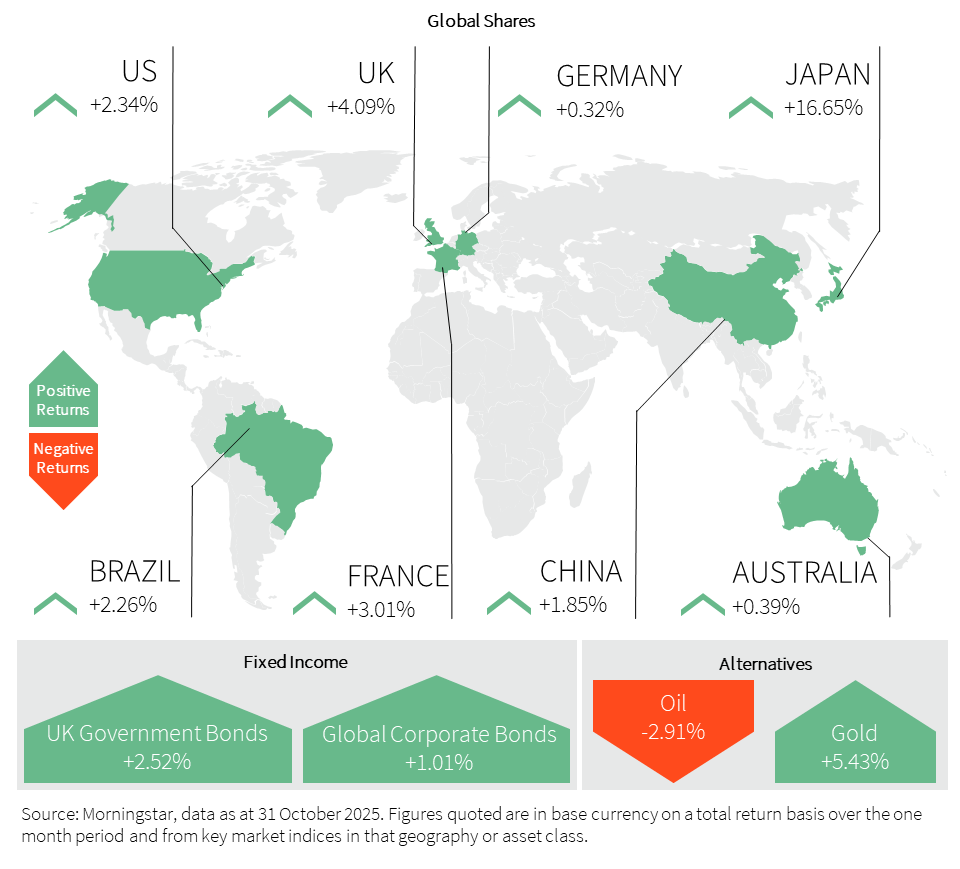

October proved to be another lucrative month for market participants. Despite gold registering its largest intra-day decline in over a decade, the precious metal is yet to lose its shine, with the price finishing the month close to $4,000 per ounce. Equity markets continued to be heavily influenced by the ‘Magnificent 7’ whose constituents bobbed up and down after the reporting earnings. Apple and Amazon’s results were taken positively, while Meta and Microsoft’s strong results were clouded by concerns over an increase in AI capital expenditure. Despite not reporting, Nvidia became the first company to reach a $5 trillion market capitalisation as the prospects for its revenues from the second largest economy were boosted by easing tensions between the US and China.

Japan’s standout performance in October prevented gold from receiving another medal of its own making. The election of the first female Prime Minister, Sanae Takaichi, proved to be the key catalyst for the strong performance, with expectations of market-friendly policies.

The bankruptcy of two US regional banks led to fears of financial contagion, similar to that witnessed in 2008. However, the resulting increase in credit spreads and equity market volatility proved brief, and the status quo soon resumed with very tight spreads and below-average volatility.

The US government entered its fifth week in shutdown, which appears no closer to a resolution and is already the second-largest on record. Any concerns about the resulting absence of data were allayed by the issuance of a delayed inflation report which gave the Federal Reserve (Fed) enough confidence to cut interest rates by another 0.25%. However, Fed Chair Powell warned that another interest rate cut in December was by no means guaranteed. This stems from the fact that the US economy remains very resilient, with Gross Domestic Product (GDP) for Q3 trending at 3.9% according to the Atlanta Fed, earnings continuing to beat expectations and unemployment remaining relatively stable.

Elsewhere, UK economic data was also resilient despite the uncertainty ahead of the upcoming Budget in November. In Asia, China’s GDP growth dipped below the government’s 5% target, and India’s inflation came in below the central bank’s target, providing plenty of room for monetary support going forward.

With the global economy holding up and November historically being the best month for markets, there is every chance that the current market strength has room to run.

United Kingdom (UK)

October was a strong month for markets in general, and the FTSE 100 index posted a solid gain for the month. The index’s overall upward trajectory was heavily reliant on its global heavyweights. The Pharmaceuticals and Basic Resources sectors were the primary drivers, benefiting from favourable commodity pricing and the boost in valuation from a slight weakening of the pound against the US dollar. Conversely, domestically focused sectors such as house-builders and retail lagged behind, reflecting the persistent pressure of borrowing costs on consumer credit and the housing market.

As a result, this was most starkly reflected in the mid-cap space as the more domestically focussed FTSE 250 trailed the return of the large-cap benchmark. In general, across both large and mid-caps, Consumer Discretionary stocks faced headwinds from persistent domestic inflation and cautious consumer spending forecasts, whilst utilities also struggled with regulatory uncertainty.

Mid-cap house-builders, construction and materials companies saw a significant recovery as mortgage rate increases eased slightly, suggesting a potential bottoming out of the housing downturn. The smaller AIM market, while positive, also trailed the main indices, indicating continued investor caution towards higher-risk, smaller-cap stocks.

Inflation data remained in focus, holding steady at an annual figure of 3.8%, which was below expectations. With no Bank of England (BoE) meeting this month, the focus is firmly on November’s meeting, where attention will be on the interest rate decision and the forward guidance.

GDP growth figures remained sluggish, with the economy growing at a three-month average of 0.3%, confirming that high interest rates continued to constrain corporate investment and household spending.

United States (US)

October was a strong but volatile month for the main US stock indices, with the continuation of a relentless rally driven largely by enthusiasm surrounding Artificial Intelligence (AI). The rally continues to defy narrow market leadership and significant domestic and global economic headwinds, including a prolonged government shutdown, which remains unresolved.

The S&P 500 posted eight new closing highs, and in tandem with observations from other global developed markets, smaller-cap stocks underperformed their larger counterparts, reinforcing the lack of real breadth in market leadership.

Aside from technology-related stocks, second derivatives of the AI theme, such as energy stocks, performed strongly. Gold miners appreciated strongly as the gold price continued to rally throughout most of October, before falling back as the month came to a close.

Across the S&P 500, reported earnings came in 6% above estimates, suggesting strong fundamentals within US large-caps.

Turning to the macro, the Fed cut its benchmark interest rate by a quarter point to a range of 3.75% to 4.00%, the second cut of the year. This action, driven by concerns over a cooling labour market, provided support for stock valuations. The inflation report for September showed prices rising 3.0% over the last year, the highest since January. However, the Fed appeared more concerned with the labour market than rising inflation as payroll solutions provider ADP reported a cut of 32,000 jobs in September, indicating a slowing job market.

The much-anticipated Non-Farm Payrolls data was not released as the prolonged federal government shutdown, on track to be one of the longest in US history, persisted throughout the month, complicating the Fed’s job further.

Europe

The Eurozone underperformed the UK over the month. The European Central Bank (ECB) kept interest rates unchanged for a third consecutive meeting, as core inflation remained stubborn. Headline inflation slowed to 2.1% in October, while core inflation held steady at 2.4%, driven by services inflation climbing to its highest level in six months. Looking ahead, more ECB participants believe that inflation risks are skewed to the downside rather than the upside. Interest rate markets are currently pricing in around a 50% chance of one further rate cut by Q3 2026.

In Germany, economic data disappointed and consumer confidence has fallen to its lowest level since April. The earlier boost from front-loaded exports, ahead of the US tariff deadline in April, faded, while auto production and exports declined sharply, reigniting recession concerns. The government has introduced austerity measures and adjusted electric vehicle subsidies.

At the same time, Q3 GDP growth for the Eurozone came in slightly above expectations, supported mainly by domestic demand, with strength in France offsetting weakness in Italy and Germany. Looking ahead, Eurozone GDP is expected to accelerate modestly into 2026 as higher spending on defence and infrastructure lifts manufacturing activity and, in turn, the broader economy. Lower energy prices and resilient labour markets should also help strengthen consumer confidence as real incomes continue to improve.

Asia and Emerging Markets

Emerging market equities within Asia rose for a tenth consecutive month in October, driven by an artificial intelligence boom, a weaker dollar and attractive valuations. South Korea and Taiwan led regional performance, supported by the ongoing AI-driven capital expenditure cycle and strong demand for semiconductors. Notably, Nvidia announced plans to AI chips to South Korea, enough to increase the country’s AI computing capacity fivefold.

China’s equity market experienced a volatile month. The national holiday period saw weaker-than-expected consumption, and soon after, Beijing introduced export controls on rare earth materials, which triggered a brief sell-off. Tensions escalated as the US threatened additional tariffs of up to 100% on Chinese goods. However, once again, both sides quickly reached a truce, agreeing on a preliminary trade framework.

On the data front, China’s industrial profits rebounded sharply in September, rising by 21.6% year-on-year, mostly as a result of base effects. Fixed asset investment growth turned negative on a year-to-date basis, suggesting the recovery remains fragile. China reaffirmed technology and innovation as key strategic priorities in the new Five-Year Plan, which also outlines measures to boost household consumption and strengthen social welfare. The approach indicates a gradual shift towards rebalancing the economy rather than a large-scale fiscal stimulus.

In Japan, the Nikkei surged by double digits in October following the appointment of new Prime Minister Sanae Takaichi, who is expected to deliver substantial stimulus. The Bank of Japan delayed rate hike despite persistent inflation, driven by rising energy costs and higher wages.

Elsewhere in the region, India plans to accelerate financial sector reforms by easing capital requirements, improving access to borrowing, and simplifying foreign investment rules, in an effort to restore confidence and attract long-term investment.

In Latin America, Argentina’s ruling La Libertad Avanza Party secured a decisive midterm election victory, while Mexico’s president stated that negotiations with President Trump were close to finalising a non-tariff trade agreement.

Fixed Income

Bond market volatility remains exceptionally subdued, sitting at multi-year lows. Government bonds rallied strongly in both the UK and the US, after weaker-than-expected inflation increased expectations for central bank interest rate cuts. However, comments following the Federal Reserve’s decision to cut interest rates reined in the optimism over interest rate cuts in the US, and the yield decline witnessed earlier in the month was largely offset. In the UK, the optimism over lower interest rates remained largely intact, with 10-year yields close to 0.3% lower than at the start of the month.

Credit spreads remain very tight, but they did briefly spike after two US regional banks defaulted and raised concerns that this could be part of a larger issue. JP Morgan Chase CEO, Jamie Dimon, exacerbated these concerns by stating, ‘when you see one cockroach, there are probably more.’ However, corporates and households remain in good shape, exhibiting strong balance sheets with minimal leverage.

The dollar saw a reprieve in October, amidst continued resilience of the US economy, and the Fed’s comments at the end of the month added further strength. Meanwhile, the yen weakened considerably after Sanae Takaichi took office as Japan’s new Prime Minister. Her loose fiscal policies raise concerns over the fiscal trajectory in Japan.

Alternatives

The dollar remains resilient at over three-month highs, supported by reduced expectations of another US interest rate cut in December. Alongside easing tensions between the US and China, weakened demand for gold. As a result, we have seen some slowdown in the recent rally. Nonetheless, the precious metal still sits close to the $4,000 mark. Given that non-yielding gold thrives in a low-interest-rate environment, investors are looking ahead to the ADP employment print in early November. It is likely that if we see further weakness in labour market data, gold will have another foothold to start tracking higher again.

Despite dips, analysts remain confident that gold will push higher in 2026. A survey from the recent precious metals conference resulted in a forecast price of $4,980 per ounce by this time next year, which would represent a further 25% rally from current levels.

Silver finished the month near $49, coming off its recent high of $55.50 weeks before. As usual, silver’s losses have been greater than gold’s, but the recovery has also outpaced gold so far. Losses have been exaggerated following reports of increased liquidity in the London Silver market.

Oil prices remained steady toward the end of October as the market balanced the latest Organization of the Petroleum Exporting Countries (OPEC+) supply increase with the group’s plans to pause output increases in the first quarter of 2026 along with fears of an oil supply glut and weak factory data in Asia. Furthermore, a strong US dollar also weighed on the price, with Brent finishing the month down -2.91% and just over $61 per barrel.

Property

The Nationwide House Price Index rose 2.4% year-on-year in October, which was above the expected 2.3% and better than the month prior. The market remains broadly resilient despite weak consumer confidence, early signs of labour market softening and mortgage rates more than double pre-COVID levels. Nationwide’s chief economist has noted that steady mortgage approvals and ongoing demand from first-time buyers have been a key factor in maintaining market stability. Looking to the months ahead, we can expect modest improvement in affordability if income growth outpaces house prices, aided by low unemployment, potential bank rate cuts and strong household balance sheets.

Meanwhile, the Halifax House price index highlighted the weakest annual growth since April 2024, a reflection of challenges related to affordability, with the typical first-time buyer’s new home costing more than £235,000 on average.

The S&P Global UK construction PMI rose in September, the highest in three months, but still in contractionary territory. The moderation was driven by a slower drop in new work and the slowest drop in order books for some time. Firms cited weak demand, client caution and uncertainty ahead of the autumn budget. Employment also fell for the ninth consecutive month amid hiring freezes. Business confidence remained near record lows with optimism hinging on potential infrastructure spending, future rate cuts and energy projects.

Learn more…

For more industry terms and definitions, visit our glossary here.

Important Information

All Index data figures are sourced by Morningstar and correct as at 31 October 2025, unless otherwise stated.

The value of investments or any income arising from them may fluctuate and are not guaranteed. Past performance is not necessarily a guide to future performance.